Tether’s USDT and Tron DAO’s USDD are both stablecoins pegged to USD, but they have important differences.

In this USDT vs USDD review, we’ll discuss their similarities and differences and explain the risks and benefits associated with each coin.

The History of Tether (USDT) and USD Digital (USDD)

USDD was launched in May 2022 by Tron blockchain founder and Poloniex owner Justin Sun as an algorithmic stablecoin that functions similarly to Terra USD. However, shortly after its launch, Terra USD crashed, creating widespread mistrust in algorithmic stablecoins and forcing the developer team to alter the project.

Eventually, developers announced USDD became an over-collateralized and algorithmic stablecoin, similar to DAI.

Within the first seven months of its launch, USDD de-pegged from its 1-to-1 peg to USD at least thrice, forcing Sun to inject considerable capital into the coin in order to protect its price stability. USDD consistently trades below its promised $1 value.

As a relatively recent entry to the market, USDD doesn’t have a long history, but its trajectory is tightly intertwined with Justin Sun’s other businesses, including the Poloniex exchange, HTX exchange, and TRON (TRX) coin.

Tether Holdings Ltd. launched USDT in 2014 on Tether’s sister company, the Bitfinex exchange. USDT is the first stablecoin in the market and remains the largest stablecoin by market cap.

despite its undeniable market dominance, Tether’s history is full of controversies that are starting to catch up with its digital asset. Bitfinex and Tether’s ties, first disclosed by Paradise Papers leaks, triggered an investigation that unraveled Tether’s mysterious reserves, revealing that USDT had not been backed by external reserves as the company promised.

Investigations led by the New York State Attorney General’s (NYAG) office revealed that USDT hadn’t been sufficiently backed by reserves from 2019 to early 2021. IFinex, the parent company for Bitfinex and Tether, paid around 60 million in fines to settle with the Attorney General’s office and the CTFC.

USDT’s popularity rose in tandem with Bitcoin prices, especially during the 2017 bull run. On the subject of the asset’s popularity, financial fraud experts argued that Tether had used USDT to increase the value of Bitcoin. The researchers claim Tether minted USDT was used to buy BTC when the asset prices were crashing, essentially manipulating the market at a large scale. In fact, researchers suspect a similar market manipulation might be taking place as of late 2022.

If you want to learn more, check out our articles on USDD, Bitfinex, and Poloniex.

How Do Tether and USDD Work?

USDT and USDD are both stablecoins pegged to USD, which means that the value of a single USDD or USDT should always be equal to 1 USD.

However, in practice, these stablecoins can de-peg from their supposed price points at times and could even enter a downward spiral that crashes the coin. The stablecoin issuers, in this case, Tether and Tron DAO, are tasked with coming up with ways to manage the stablecoin and prevent price volatility.

Tether, the first stablecoin issuer, came up with a solid way of ensuring price stability for USDT back in 2014: the company claimed it put 1 USD into reserves for every USDT ever minted. This way, whenever someone needs to redeem their USDT, they could get their assets worth from Tether.

However, Tether’s promise to lock up cash to back their asset was soon broken: The company started claiming that reserves are made up of cash and cash equivalents, including short-term commercial paper and bonds. These assets can’t be immediately liquidated and can be vulnerable to market swings, so they are considered weak reserves.

USDD, on the other hand, was created with a different pegging mechanism. Initially designed as an algorithmic stablecoin with no reserves, it would protect its value thanks to a set of complex algorithms that would mint USDD in exchange for burning TRX, depending on the market demand to balance the asset value.

The plan was abandoned shortly after its launch when a similar stablecoin, Terra UST, crashed and wiped 60 million USD from the market. The developers announced the asset would also be backed by collateralized assets to ensure price stability.

However, unlike Tether, the collateralized assets that back USDD aren’t cash equivalents. Instead, USDD is over-collateralized with other cryptocurrencies like BTC, USDT, and TRX. According to the projects whitepaper, USDD is at least over-collateralized at 120 percent to protect its peg to the USD.

What Are the Main Use Cases of USDT and USDD?

USDT has several use cases as it has become the dominant stablecoin in the market. It can be traded on almost all exchanges and against any other cryptocurrency. This is particularly useful when you want to sell your assets during a downward price swing without necessarily cashing out altogether.

Another benefit is that you can easily trade on multiple exchanges by moving around USDT. Traders who want to take advantage of arbitrage opportunities often depend on stablecoins like USDT and USDC. You can also trade on decentralized exchanges or platforms that don’t accept fiat currencies.

Most crypto payments are denominated in USDT as merchants can accept USDT without worrying about price volatility.

USDT is one of the most popular assets when it comes to DeFi. You can loan or stake USDT to earn interest on your funds.

USDD, on the other hand, doesn’t have as many use cases as USDT. USDD is far behind USDT in market popularity and de-pegged from its 1 USD value thrice within the first seven months of its launch.

However, there is one use case for USDD, and that’s the immensely high APYs promised for staking USDD. USDD is offered on many pools, with reward rates so astronomical that it’s hard to believe they are true. Tron DAO Reserve, for example, offered nearly 50% yields on staking, an unsustainably high amount.

But that brings forward a problematic issue: if the only use case for buying USDD is high rewards from staking the coin, what happens when the lock-up period ends or when it is no longer so profitable to stake the coin? The obvious answer is that people would sell USDD and cash out.

The scenario isn’t very far-fetched: in November 2022, a USDD curve pool was drained of USDC, DAI, and USDT when investors cashed out, raising the USDD percentage in the pool from 55% to 85% within a day.

USDT and USDD Price History

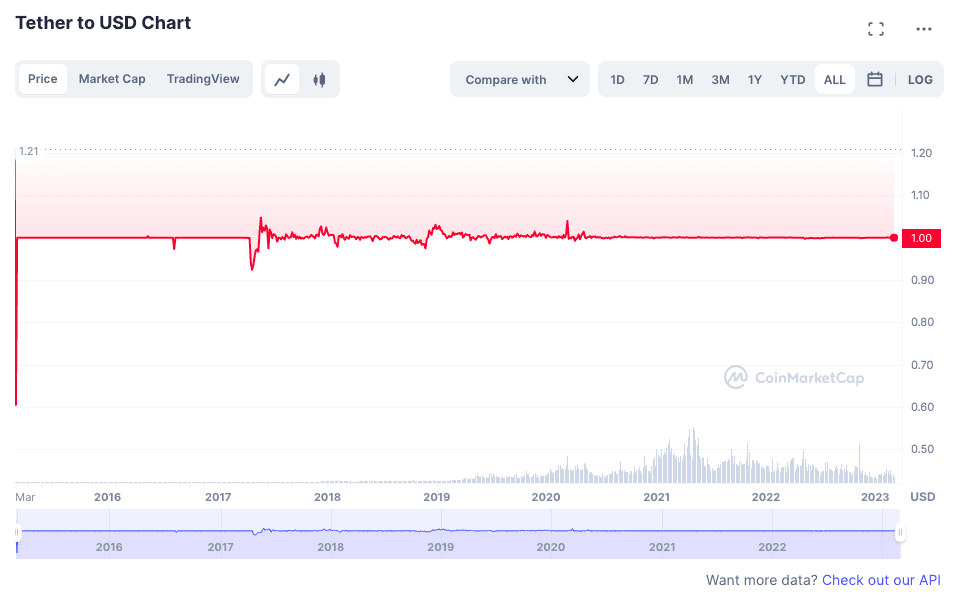

USDT Price History

Since USDT is pegged to USD, it should always be worth $1. Price fluctuations may occur when the demand rises or falls suddenly, but the price quickly recovers to $1.

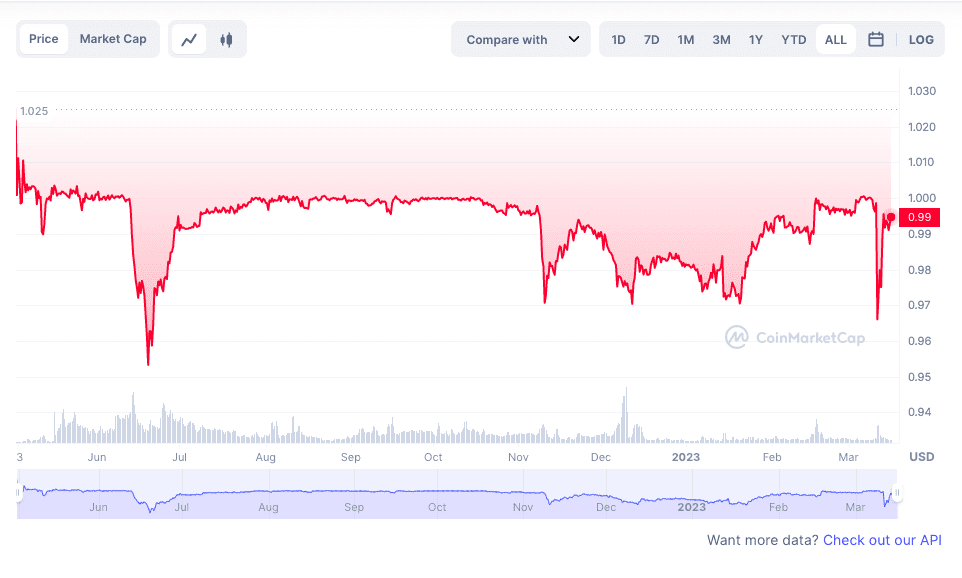

USDD Price History

1 USDD should always be worth $1, though this hasn’t been the case since USDD’s launch. While slight price fluctuations are normal when the demand for the asset rises or falls in a short period, the price should quickly recover to a $1 fixed price. It’s not known why USDD has trouble with keeping its peg at this time.

Tether and USDD Market Cap

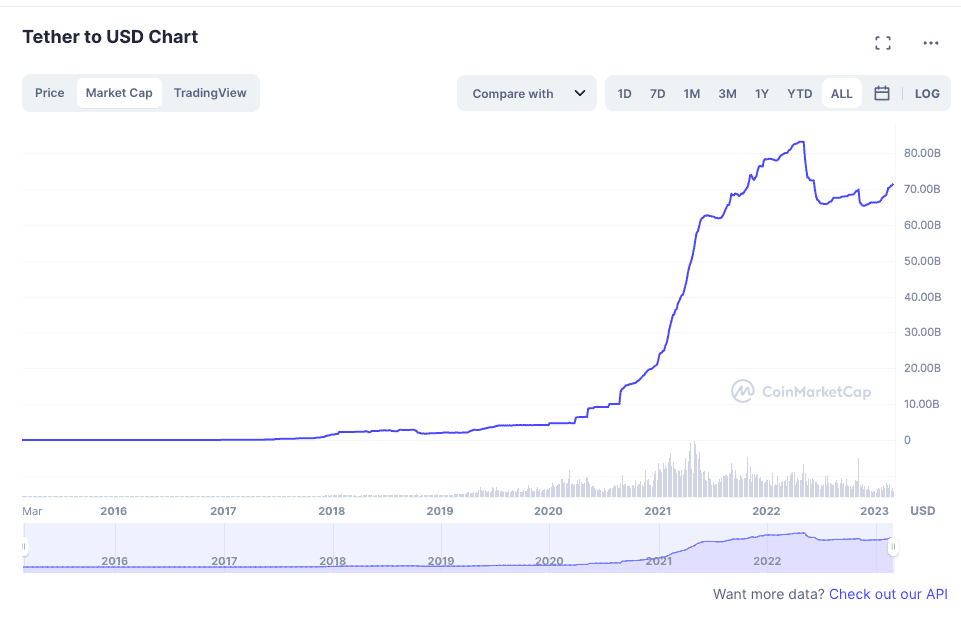

USDT Market Cap

There are over 60 billion USDT tokens in circulation as of February 2023. USDT doesn’t have a set total supply. Tether issues new USDT tokens when the demand for the asset increases. The company burns the surplus when USDT is redeemed for cash.

Tether controls the USDT minting and burning process. The company is supposed to have reserves for each minted USDT, though historically, this hasn’t been the case.

You can find and trade USDT on all major exchanges. The coin exists on many blockchain networks, including Ethereum, Algorand, Hedera, Tron, Solana, and more.

USDD Market Cap

USDD is the 8th largest stablecoin and the 66th largest cryptocurrency by market capitalization. As of January 2023, there is a circulating supply of 725 million USDD.

USDD doesn’t have a total supply, and new USDD tokens can be issued based on the demand for the asset. The process is controlled by Tron DAO. The total supply varies depending on the market demand.

Tron DAO Reserve (TDR) issues USDD and is responsible for ensuring USDD keeps its peg in case of price swings.

USDD runs on the TRON blockchain and is available on most crypto exchanges and many DeFi protocols.

USDT vs USDD: Main Similarities

USDT and USDD are both stablecoins pegged to USD. Neither asset has a set supply, as they can be minted depending on the demand.

You can find USDT and USDD on most crypto exchanges. Several DeFi protocols offer staking opportunities for both assets.

USDT is controlled by Tether, a private company. USDD is controlled by Tron DAO, which is controlled by a select few at the helm. Essentially they are both centralized, for-profit endeavors with opaque business structures.

USDT and USDD are both controversial assets.

State of Reserves

We can only speculate about Tether’s reserves since the company doesn’t release audits, although it has been promising since 2015.

A persistent and continuing lack of audits, especially after it came out that USDT hadn’t been properly backed for over a year, has made investors wary of Tether.

You may think that USDD reserves are more transparent than USDT reserves, as the reserves can be publicly viewed thanks to blockchain technology. That is somewhat true, but unfortunately, TRD also misleads customers regarding its reserves. According to analysts, stablecoins in TDR’s reserve wallets are locked in JustLend staking pool, while TRX is locked in another smart contract. Furthermore, 725 million USD worth of “burned” TRX seems to count as collateral, a huge red flag for some.

In fact, some think counting TRX as collateral is flawed from the beginning. If USDD crashes, TRX will probably follow, as was the case with Terra (UST) and Luna (LUNC). Therefore TRX reserves can’t protect USDD value if prices swing. If you accept this argument, then USDD is only 88% collectivized. But some argue that the actual figure can be as low as 33%.

Overall, USDT’s liquefiable reserves can be anywhere between 30% and 113%.

Governance

Despite the fact that Tether is a private company and TDR is a “decentralized autonomous organization,” both projects are quite centralized. USDD is controlled by Justin Sun, as Giancarlo Devasini and CEO Jean-Louis van der Velde control Tether and USDT.

USDT vs USDD: Main Differences

USDT and USDD have quite a few differences. The most obvious difference is related to their collateralization mechanics, as one is backed by external real-world assets (USDT), and the other is backed by algorithms and digital assets like BTC (USDD).

Market Reach

The biggest difference between USDT and USDD is their respective market capitalizations. USDT is the biggest stablecoin by market cap, while USDD is only the eighth.

That means USDT is available on almost all exchanges and can be traded against most cryptocurrencies. USDD pairs are less common than USDT pairs.

Pegging Mechanism

Stablecoins pegged to USD should always be worth 1 USD. In order to make that true, stablecoins employ a pegging mechanism.

In the case of USDD and USDT, that pegging mechanism is collateralization. The stablecoins are backed by collateralizing other assets to ensure price stability.

However, the collateral is very different for the two. USDT is backed with traditional financial assets like bonds, cash, and cash equivalents. USDD is backed with BTC, TRX, and USDT.

Risks Associated With Tether and USDD

Risk of Losing Their Peg

Stablecoins are only as strong as their reserves. If the reserves aren’t enough to back the asset, a stablecoin can lose its peg and crash.

What happens when a crypto asset crashes? Well, for the most part, nothing. Individual traders lose huge sums of money, but the wheel keeps turning. But when stablecoins crash, the risks are bigger. If a stablecoin with the market reach of USDT crashes, the ensuing effect can bring down the whole crypto industry. USDT is the biggest stablecoin in the market and almost all institutions have exposure to the asset at significant levels.

In fact, several traditional and non-crypto institutions also have been exposed to USDT, so much so that experts think the effects of a USDT crash could spread to traditional markets and destabilize the US economy.

When it comes to USDD, the stakes are much lower, but the risk is greater, as USDD has already de-pegged multiple times since its inception. USDD doesn’t compare to USDT in market reach, so a crash won’t have the same effect but will trigger a chain reaction that will still affect the crypto market. USDD is closely intertwined with TRX, Tron Blockchain’s native currency, and USDJ, another Tron-based stablecoin. It’s also not unthinkable that Sun will try to use the resources of HTX and Poloniex to save USDD and TRX if the assets crash.

It’s also important to consider why USDD keeps de-pegging and remains undervalued despite near-constant efforts to inject more capital into the project.

Legal and Financial Risks

Tether has drawn regulators’ ire over its refusal to publish audits. The company promised an official audit in 2015, which has never arrived. The CTFC ordered Tether to publish an audit after it came out that USDT hadn’t been properly backed, but so far, no word from the company.

It’s hard to summarize the legal and financial risks regarding USDD without writing extensively about its founder, Justin Sun, who is reportedly under investigation by the FBI. USDD is a new asset with an unstable trajectory, and it can’t be thought of separately from the man who launched it and controls it. For a more comprehensive look at the possible legal and financial issues USDD is facing, check out The Verge’s profile on Sun and further reports on his ventures.

Where Can You Buy USDT and USDD?

You can purchase both assets on popular crypto exchanges, including Coinbase, Bitfinex, HTX, and Binance, with fiat currency. These platforms accept several payment methods, including credit and debit cards, bank transfers, Paypal, Apple Pay, Google Pay, or other third-party payment providers.

You can also purchase USDT and USDD on decentralized exchanges in exchange for cryptocurrency.

Please note that Crypto.com delisted USDT for Canadian customers due to regulatory issues.

How Can You Exchange USDT for USDD?

You can exchange USDT for USDD on most crypto exchanges, including Binance, Coinbase, Kucoin, and Bitfinex. Just check whether the crypto exchange you choose lists the USDT/USDD paring.

Future Plans for Tether and USDD

Tether reigned supreme on the crypto market for years, leading many to conclude that it’s too big to fail. But its competitors are closing in, and the company’s reputation is catching up with it, narrowing down its opportunities for growth, especially as authorities are looking for new and stricter ways of regulating the cryptocurrency and stablecoin markets.

Of course, Tether has amassed a considerable fortune and isn’t afraid to use that money to defend its interests, mostly by donating to right-wing political candidates and parties.

When it comes to USDD, the future is even murkier. Justin Sun is infamous for skirting, if not breaking, several laws when it suits him, and his previous endeavors can be considered “profitable failures.”

The whitepaper and code base for TRON was largely plagiarized from other projects, the Poloniex exchange became a nest of fraud after he purchased it, and his stablecoins USDD and USDJ can’t maintain price stability at all. In 2019, cybersecurity testing revealed that the entire TRON blockchain could be brought down by a single computer. And yet, Sun manages to remain an important player in the crypto market.

Some think USDD will be another profitable failure: a project that will lose its value in the future but be profitable short term. But it could also be his bid to succeed in Asia, with rumors of China softening the crypto ban.