Looking for the best way to step into the cryptocurrency market? Then buckle up! We’ve listed the 22 best cryptocurrency exchanges you can use, along with 8 great alternative options.

Don’t want to read the whole thing? Our top 3 picks are the following:

- Binance – Lowest fees of any major exchange.

- Youhodler: Available in 221 countries around the world and offers crypto Loans up to 90% LTV.

- Kraken: 200+ cryptocurrencies, available in 190 countries but also US based.

- Uphold: Has 250+ of the largest crypto assets and allows you to stake crypto and earn yields up to 16% (yield not available to US residents).

- Coinbase: Probably the safest exchange out there. US based and publicly listed.

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

In the table below, we listed the number of cryptocurrencies each platform offers and the fees for each trade.

We listed the starting fees, but you may receive discounts based on your trading volume and other variables on certain platforms. Remember that these are not instant buy fees, which can be much higher (typically around 1%).

We offer a detailed review for each option with pros and cons clearly laid out so you can find the right platform.

Without further ado, here are the best 22 exchanges you can use to buy crypto and 8 alternatives.

| Exchange Name | Number of Cryptocurrencies |

Fees |

| Binance | 350+ | 0.10% (maker and taker fees) |

| Coinbase | 200+ | 0.40% (maker fees) and 0.60% (taker fees) |

| Gate.io | 1,400+ | 0.2% (maker and taker fees) |

| Kucoin | 700+ | 0.10% (maker and taker fees) |

| HTX Global | 500+ | 0.20% (maker and taker fees) |

| Kraken | 120+ | 0.16% (maker fees) and 0.20% (taker fees) |

| Bitfinex | 170+ | 0.10% (maker fees) and 0.20% (taker fees) |

| Coincheck | 17 | Not applicable, varies depending on cryptocurrency |

| Crypto.com | 250+ | 0.075% (maker and taker fees) |

| Binance.US | 120+ |

|

| Gemini | 120+ | 0.2% (maker fees) and 0.4% (taker fees) |

| bitFlyer | 11 | 0.15% (maker and taker fees) |

| Bitstamp | 78 | 0.30% (maker fees) and 0.40% (taker fees) |

| Bybit | 100+ | 0.10% (maker fees) and 0.60% (taker fees) |

| OKX | 350+ | 0.08% (maker fees) and 0.10% (taker fees) |

| Poloniex | 350+ | 0.14% (maker fees) and 0.15% (taker fees) |

| MEXC Global | 180+ trading pairs | 0.20% (maker and taker fees) |

| BitMart | 100 | For class A trading pairs start at 0.25% For class B pairs, fees start at 0.4%. |

| Uphold | 200+ | Spreads around 1-2% |

| Blockchain.com | 40 | 0.20% (maker fees) and 0.40% (taker fees) |

| Luno | 7 | Spread vary between 0.75%-1.5% |

| Bitpay | 14 | Varies depending on the operation. 1% network fee. |

| etoro | 40 | 1% plus the spread |

| Robinhood | 15 | Spread fees around 1% |

| Revolut | 30 | 1.99% fee |

| Webull | 40 | 1% fee |

| Tradestation | 10 | 0.30% (maker and taker fees) |

| Exodus | 200 | Varies |

| Public.com | 25 | 1-2% |

Binance

If you’re looking for liquidity, look no further than Binance, the world’s largest crypto exchange by trading volume.

Binance was launched in 2017 and quickly became one of the most popular exchanges in the world. It offers numerous trading markets, over 350 digital assets, and a whole crypto ecosystem, including its own wallet, NFT market, crypto research, and academy sections.

The platform offers many advanced trading tools for experienced traders. Alongside an excellent spot market, you get access to many derivatives trading products, including Binance Margin, Binance Futures, and Binance Options. You can trade with up to 10x leverage on the platform.

Binance fees are very competitive, one of the reasons why the exchange is so popular worldwide. The platform employs a tiered fee schedule, and as you level up, you pay less in transaction fees. You can also use Binance Coin (BNB), the platform’s native token, to offset trading fees.

The fee schedule for derivatives trading varies, while spot trading starts at 0.10% for makers and takers. In 2022, Binance started offering free spot trading between BTC pairs and the ETH/BUSD pair.

Binance USD or BUSD is the platform’s native stablecoin, and holders enjoy many perks, including staking rewards and high annual percentage yield (APY) returns.

Overall, the platform offers pretty much everything you can ask for, but it’s also quite complicated and requires some experience to navigate. Another downside is its turbulent relationship with state authorities. Binance is banned in several countries, including the US, and it’s under investigation for money laundering and tax evasion.

If you’re based in the US, you can instead use Binance US for crypto trading, which we’ll cover down the list.

Pros

- Wide range of cryptocurrencies

- Margin, futures, and options trading

- Very competitive fee schedule

- Mobile app available

Cons

- The global platform isn’t available to US-based customers

- Complex user interface

- Legal troubles with state authorities

- No phone support for customer service

Coinbase Exchange

Coinbase is a reputable veteran exchange based in the US. The platform has been a cornerstone of the crypto market since its founding in 2012. It’s highly regulated and widely considered one of the best exchanges in the crypto market, thanks to its intuitive interface and stellar reputation.

The company offers two distinct trading platforms: Coinbase, with a friendly interface oriented toward beginners, and Coinbase Pro for more experienced traders. In June 2022, the company announced the Coinbase Pro platform will be replaced with an Advanced Trade option on the main platform.

Coinbase’s biggest plus is its good reputation and ease of use. If you’re a beginner who wants to take it slow and steady with crypto investments, you can easily dip your toes into the market by buying Bitcoin or Ethereum on the Coinbase platform. The platform supports over 150 digital assets.

However, Coinbase is also notorious for its higher-than-average transaction fees. Coinbase Pro platform amends that to a degree: it employs a maker/taker model that’s more advantageous. However, the Coinbase Pro interface is similar to other non-beginner-friendly exchanges like Binance or Bitstamp, and the fees are also slightly higher.

Coinbase Pro employs a maker/taker model based on your 30-day trading volume calculated in USD. Trade fees vary from 0.00% to 0.40% for maker fees and 0.05% to 0.60% for taker fees.

The platform supports PayPal, ACH, Bank wire, SEPA, and SWIFT deposits and withdrawals. You can access Coinbase through a web browser or mobile app.

Pros

- Over 150 assets

- Reputable and regulated exchange

- Available in over 100 countries

- Mobile app available

Cons

- No margin trading

- No leveraging

- High fiat deposit and withdrawal fees for bank wires

- While there is automated phone support, you can’t actually talk to a Coinbase representative on the phone

Gate.io

Launched in 2013, Gate.io is an unregulated crypto exchange based in the Cayman Islands. It’s a crypto-to-crypto exchange that supports over 1,400 digital assets and 2,500 trading pairs. If you’re looking for less-known altcoins, Gate.io likely has you covered.

Gate.io offers spot trading and supports margin, futures, options, and derivatives trading as well. You can also earn interest on your crypto balance by lending your holdings.

Since it’s a crypto-to-crypto trading platform, users can’t deposit or withdraw fiat currencies. You can deposit crypto assets to Gate.io to fund your account.

Gate.io has a tiered maker/taker fee schedule. Maker and taker fees for spot trading start at 0.2% and decrease depending on your 30-day trading volume and GT (Gate Token) balance.

Futures trading fees start at 0.015% for makers and 0.050% for takers. There are deposit fees, but withdrawal fees vary depending on the cryptocurrency. You can trade with up to 10x leverage on the exchange, though the maximum allowed leverage may change from one market to another.

Despite many attractive trading products and reasonable fees, Gate.io can be overwhelming for new users. The interface is cluttered and glitchy, and the explanations aren’t very clear. Also, the global platform is no longer available to US-based customers.

Pros

- Incredibly wide selection of cryptocurrencies

- Many trading pairs

- Reasonable fees

- Derivatives trading

Cons

- The main platform isn’t available to US-based customers

- The website is hard to navigate and can be glitchy

- Customer service is slow

- It can be hard to withdraw assets

KuCoin

Kucoin is an unregulated global exchange launched in 2017 and based in Seychelles. The platform offers over 700 crypto assets and various markets for derivatives, futures, and margin trading. Users can also access a peer-to-peer exchange market on the platform.

You can deposit cryptocurrencies to your KuCoin account or purchase digital assets with your debit or credit card. The exchange doesn’t support bank wire and other fiat deposit methods.

KuCoin has a maker/taker fee schedule with different tiers. You move up the tiers as your 30-day trading volume (calculated in BTC) increases or as you purchase KCS, the native KuCoin Token.

For tier 1 users, trading fees start at %0.10 for both makers and takers. Withdrawal fees vary depending on the crypto asset. Futures and margin trading fees also vary, though maker fees start at 0.02% and taker fees at 0.06%.

Users can take advantage of leverage trading, with a maximum of 100x for futures trading and 10x for margin trading. You’ll have to verify your identity and pass a KYC check to take advantage of leverage options.

Unfortunately, KuCoin isn’t licensed in the US, and US customers can’t access most feature Kucoin offers, including the futures market.

Although US-based customers can open KuCoin accounts, they may not be able to withdraw their assets if the exchange is banned from operating in the US, as many others have been.

Kucoin isn’t easy to navigate, especially for beginners, though there are helpful articles on the web page to understand how the exchange operates. The platform has a mobile app as well.

Pros

- Over 700 crypto assets

- Access to derivatives, margin trading, and futures markets

- High liquidity

Cons

- US customers can’t access most features

- The user interface is complex and hard to navigate

- Customer service can be problematic as the only option is to submit a ticket

- Fiat deposit options are limited to credit and debit card purchases

HTX Global

HTX Global is a cryptocurrency exchange that launched in 2013. It can be accessed in over 100 countries, though it’s unavailable in countries like the US and UK.

The platform offers over 500 digital assets and 300 trading pairs and deep liquidity for BTC/USDT and ETH/USDT pairings. HTX offers a spot market alongside many derivatives products, including margin, futures, and options trading.

Users can stake their coins to generate passive income on their assets and take out crypto loans. The platform also offers several high-yield crypto products.

You can trade Bitcoin and Ethereum contracts in the futures market with up to 200x leverage in the futures market. It’s also possible to trade with 3x leverage for cross-margin.

As a global exchange, HTX supports several fiat currencies, including but not limited to EUR, GBP, USD, and AUD. However, the exchange is known to disable fiat deposits and withdrawals without notice.

Like many other exchanges, HTX employs a maker/taker tiered fee structure. Base maker/taker fees start at 0.2%, but you can earn discounts as you accumulate HTX Tokens (HT), the platform’s native cryptocurrency.

You can also become a professional trader on Hubo if you hold more than 5 BTC in your HTX account. Professional traders pay fewer transaction fees: maker fees start at 0.0362%, and taker fees start at 0.0462. Pro traders can earn further discounts based on their trading volume and account holdings.

HTX can be an attractive option for professional traders, especially those who prefer high-risk, high-reward leverage trading. The platform isn’t very beginner friendly, as there are too many products and services that can be confusing to navigate.

HTX Global has had its share of regulatory issues and can’t be accessed in many parts of the world, including the US and Canada. Users from New Zealand and the UK can’t access derivative trading products.

Pros

- Wide selection of cryptocurrencies

- Deep liquidity

- Derivative trading products

Cons

- The global platform isn’t available to US-based customers

- Hard to navigate

- Fiat withdrawals can be unavailable

Kraken

Kraken is a US-based exchange that was launched in 2013. Not only it’s a veteran crypto trading platform, but it’s also a veteran platform famous for its top-notch security.

Kraken supports over 120 cryptocurrencies and many trading pairs. Despite the fact that it’s a US-based exchange, it also has a high EUR-denominated trading volume and accepts seven other fiat currencies, including CAD, JPY, and AUD.

Kraken has a simple, easy-to-use interface, though experienced traders may prefer the Kraken Pro platform, which is substantially more complicated. Kraken Pro offers derivatives and index products, margin and futures trading, as well as a spot market.

If you’re a beginner, you can easily purchase crypto on the central platform through the Instant Buy option, but the convenience comes at a price: You have to pay a 1.5% transaction fee for cryptocurrencies and 0.9% transaction for stablecoins, though the fees may increase depending on the payment method.

Kraken Pro fees are much lower and depend on your 30-day trading volume. Beginner traders can expect to pay 0.16% in maker fees and 0.26% in taker fees.

If you’re an advanced trader, you can trade with leverage up to 5x on Kraken Pro, though leverage levels vary depending on the currency pair. You can also stake your coins to earn profits on Kraken and Kraken Pro platforms. You can access both platforms through a mobile app or a web browser.

Kraken allows bank wires, as well as credit and debit card purchases. However, deposits often cost a high fee. The bank deposit fee is 0.5%, while credit and debit card purchases cost 3.75%, and additional charges may apply depending on your bank.

You can reach customer service through phone, live chat, and a support ticket system. One big downside is that Kraken isn’t available to residents of New York and Washington states. Unfortunately, US citizens aren’t eligible for futures trading either.

Pros

- Secure exchange

- Competitive fee structure on Kraken Pro

- Margin and futures trading available

Cons

- Customer service can be slow

- Basic Kraken platform fees are quite high

- US-based customers aren’t eligible for futures trading

Bitfinex

Bitfinex is a global crypto exchange founded in 2012. It’s a subsidiary of iFinex Inc., the company that owns the stablecoin Tether (USDT).

Bitfinex is one of those exchange platforms where you can find everything you ask for. Besides a high liquidity spot market, the exchange also offers derivatives and margin trading. You can also open a demo account and test your strategies using play money – otherwise known as paper trading.

The exchange supports over 170 cryptocurrencies and many trading pairs. Users can buy, sell, trade, lend, and borrow assets on the platform and take advantage of leverage trading and APY on products.

Bitfinex has a maker/taker fee model: maker fees start at 0.10%, while taker fees are 0.20% for spot trading. Derivatives fees are 0.020% for makers and 0.065% for takers. You can receive discounts on transaction fees based on your UNUS SED LEO balance, the platform’s native token.

You can fund your account with wire transfers and credit/debit card purchases. Wire transfers (deposits and withdrawals) cost 0.1% in fees, or 60 USD, whichever is higher. Express bank wire withdrawals cost even more at 1.000% or 100 USD. Credit card payment fees vary, but the industry standard is around 3.5% to 5%.

Bitfinex has had its fair share of troubles with regulators over the years. Not only did the platform try to keep its relationship with its parent company and Tether supplier Ifinex a secret (you’d think they’d pick a less obvious name), but the exchange was also accused of spoofing and pumping crypto prices.

US authorities revealed Tether and Bitfinex had falsely claimed Tether had been backed by US dollars.

The exchange isn’t available to users in the US and Canada.

Pros

- Offers margin and derivatives trading

- Large selection of cryptocurrencies

Cons

- Regulatory issues and lack of transparency

- The platform isn’t available to US-based customers

Coincheck

Coincheck is a popular Tokyo-based crypto exchange launched in 2012 and regulated by Japanese authorities.

Coincheck only supports 17 cryptocurrencies, including the most popular large-cap coins like Bitcoin and Ethereum. As for fiat, the platform supports the Japanese Yen.

The exchange doesn’t support advanced trade orders and derivatives markets like other global giants like Binance do, but it features something called the Coincheck Payment. This option allows users to pay their bills and make purchases with Bitcoin. The platform also supports crypto lending and has its own NFT market.

The fee structure on Coincheck is quite different from the standard maker/taker model since the exchange doesn’t charge transaction fees. Instead, users pay deposit and withdrawal fees that vary according to the amount they transfer.

Fees are calculated and denominated in the cryptocurrency you’re trading with, so if you’re depositing or withdrawing Bitcoin, your fees are also calculated in BTC.

You can make Japanese Yen fiat deposits through bank transfers and bank cards or make payments from convenience stores.

Coincheck isn’t available in the US, though the exchange has taken steps to be listed on the Nasdaq stock exchange.

Pros

- You can pay your bills with BTC through its Coincheck Payment program

- No transaction fees

Cons

- Not available to US-based customers

- Lists a limited number of cryptocurrencies

- Deposit and withdrawal fees vary and can be hard to navigate

Crypto.com

Crypto.com Exchange is a Singapore-based platform launched in 2019. It’s appropriate to call it a trading ecosystem since it offers its own crypto wallet, NFT marketplace, and credit card, in addition to regular crypto trading opportunities.

You can find around 250 cryptocurrencies and 100 trading pairs on the exchange. The platform offers a spot trading market and supports margin and derivatives trading as well.

In August 2022, Crypto.com announced it reduced its transaction fees by 80%. Now, spot trading fees start at 0.075% and derivatives markets fees at 0.034%. You can also get further discounts based on your trading volume or Cronos (CRO) holdings, the platform’s native token.

One thing that’s a bit confusing about Crypto.com is its relationship to other Crypto.com products, particularly the Crypto.com wallet. Namely, the exchange doesn’t support fiat deposits and withdrawals.

However, you can set up a Crypto.com wallet and deposit several fiat currencies via bank transfer, including AUD, USD, CAD, GBP, and EUR. This is your Crypto.com account, which you can use to purchase cryptocurrencies on the Crypto.com app or top up your Crypto.com credit card.

Since the exchange doesn’t support fiat deposits and withdrawals, you can’t deposit fiat directly into your account. You can purchase crypto assets on another exchange or via the Crypto.com app and transfer them to your crypto.com exchange account afterward.

As you may have already guessed, margin trading isn’t available to US-based customers. You can check the full list of restricted countries on the official information page.

Pros

- A wide selection of cryptocurrencies

- Very competitive fees

- Many integrated products, including a credit card

Cons

- US-based customers get limited access to trading features

- You can deposit or withdraw fiat currency

Binance.US

If you are based in the US, you can’t use many of the global exchanges we described above, including Binance. Fortunately, Binance has a US-specific exchange as well called Binance.US.

Binance US was launched in 2019 in response to Binance’s growing problems with financial authorities in the US. The platform is operated by BAM Trading Services.

However, Binance.US differs from the main platform in many ways, including trading pairs, transaction fees, and deposit and withdrawal methods. You can find about 120 cryptocurrencies on the US platform, a far cry from the 600 assets the global platform lists.

Nonetheless, you won’t have trouble finding most large-cap coins on the platform. There are around 60 different trading pairs.

Binance.US offers users a developed spot market, OTC service, and staking opportunities. There is a simpler, beginner-friendly buy and sell function, but more experienced users can also take advantage of the advanced trading interface to access professional market charts.

Predictably, the US platform doesn’t offer derivatives, future, or margin trading opportunities.

What makes Binance US particularly attractive is its unique fee structure. The platform offers free Bitcoin trading for many pairings, including BTC/USD, BTC/USDT, BTC/USDC, and BTC/BUSD.

You can also trade altcoins at a low price on Binance US. The platform has a maker/taker fee model and a tiered model. The transaction fees for Tier 1 crypto pairs start at 0.1% for makers and 0.2% for takers. Fees for Tier 2 crypto pairs start at 0.4% for makers and 0.6% for takers. You can also pay your fees with BNB and get a 25% discount on transaction fees.

ACH and wire deposits are free on the platform, though wire withdrawals cost $15.

Pros

- Very competitive fee structure

- Free BTC trading

- Educational resources

Cons

- Doesn’t offer margin trading or derivatives products

- Doesn’t offer as many cryptocurrencies as the global platform

Gemini

Gemini is a US-based regulated exchange that is available in 60 countries, including Canada, UK, and Australia. The platform was launched in 2015 by the famous Winklevoss twins, who won 65 million in a settlement with Marc Zuckerberg of Facebook.

Gemini is one of the few regulated exchanges available in all US states, thanks to its focus on regulatory compliance.

The platform offers 120 digital assets and 21 trading pairs and features a beginner-friendly interface and a crypto library for educational purposes, where beginners can easily learn how the crypto ecosystem works by browsing through the topics.

Users can buy and sell crypto assets easily on the platform. More experienced traders can take advantage of the Gemini ActiveTrader platform to place multiple orders and execute different trading strategies. Advanced Trader platform is also available as a mobile app.

You can also collect interest on your crypto holdings through Gemini Earn or stake your cryptocurrencies to generate a passive income.

Gemini has a complicated fee structure, and the fees vary depending on how you execute your transaction. The platform has four separate fee schedules for trading via API, ActiveTrader, Web and Mobile platforms.

The fees are calculated according to a maker/taker fee schedule, based on your 30-day trading volume. Maker fees for Active trader platform start at 0.2% and taker fees start at 0.4%. You pay even less for stablecoin trades.

Crypto and wire transfer deposits are free on the platform. Debit card deposits are charged a 3.49% fee, and PayPal deposits a 2.5% fee. Withdrawal fees vary depending on the asset and the amount you’re withdrawing.

Gemini provides strong asset security and has insurance for the funds in their hot wallet. The exchange is regularly audited by security experts.

Pros

- Available in all US states

- Funds are insured against hacking attempts

- Strong security

Cons

- Only 120 digital assets on the exchange

- Trading fees are high if you’re not using the Active Trade platform

BitFlyer

Bitflyer is the top Japanese exchange in operation. The Tokyo-based exchange launched in 2014 and operates in Japan, the EU, and the US. There is also a separate BitFlyer US platform based in the States.

The platform offers two distinct modes: a simple Buy/Sell feature for beginners and a BitFlyer Lightning platform with an advanced trading interface.

The platform lists 11 cryptocurrencies, including major assets like Bitcoin, Ethereum, and Tether. Japanese Yen is the major fiat currency, though USD is also accepted.

Users can engage in spot and margin trading, and there are several derivatives products for more advanced users. Users can trade with up to 2x leverage on the Lightning platform.

There are no fees for market trading (simple buy/sell), but the spreads vary from 0.1% to 6%. Spot trading fees start at 0.15% for the Lightning Spot market. Users can receive discounts based on their 30-day trading volume and trade futures for free.

Payment methods include instant bank transfers and PayPal. Withdrawal fees depend varying on the asset and withdrawal method.

US-based customers can trade up to 9 cryptocurrencies on the exchange, but they can’t take advantage of margin trading and other derivatives products. Bank wire transfers are free for fiat deposits and withdrawals.

Pros

- Secure and regulated platform

- Competitive fees on the Lightening Spot exchange

- Intuitive user interface

Cons

- Spreads can be very expensive

- A limited number of cryptocurrencies

- Crypto derivative products aren’t available to US-based users

Bitstamp

Bitstamp is a regulated Slovenian exchange launched in 2011. It’s one of the oldest European exchanges and has built a good reputation over the years. The platform has offices in the UK, Luxembourg, Singapore, and United States and is available in over 100 countries.

You’ll find 78 cryptocurrencies for trading, a spot market, and a simple buy/sell feature that lets users purchase major assets easily and quickly. There is no margin trading or other derivatives products, though you can stake Ether (ETH) and Algoraland (ALGO) on through Bitstamp Earn to generate APY.

Beginners can quickly buy and sell cryptocurrencies on the Bitstamp online platform, while experienced traders may prefer the active trading platform. The basic platform supports instant buy orders and lets you place market, stop, and limit orders too.

Bitstamp uses a maker/taker model, and users receive discounts as their 30-day trading volume increases. Fees start at 0.30% and 0.40% for makers and takers, respectively. The platform doesn’t charge fees for staking but collects 15% of staking rewards as commission.

You can deposit USD, EUR, and GBP to the platform through various payment methods. SEPA, ACH, and Faster Payments UK deposits are all free, but there’s a 0.05% deposit fee for international wire transfers and a 5% fee for credit card purchases.

Withdrawals through SEPA cost 3 EUR, Faster Payments UK cost 2 GBP, and international wire transfers cost a 0.1% fee. Crypto deposits are free, though withdrawal fees vary depending on the cryptocurrency.

The company goes through regular audits, and there’s insurance coverage in case of theft or hacking.

Pros

- Reputable and regulated exchange

- Beginner friendly

- Competitive fees

- Staking for select digital assets

Cons

- A limited number of supported cryptocurrencies

- No margin trading or other crypto derivatives

Bybit

Bybit is an unregulated global crypto exchange launched in 2017, with service restrictions in the US.

Bybit lists around 100 cryptocurrencies and more than 300 trading pairs. In addition to a spot trading market, users can find several other trading products on the platform, including an instant buy option, P2P market, perpetual contracts, futures, options, and leverage trading. There is also an NFT marketplace.

Users can trade with up to 100x leverage on crypto derivatives products on the exchange. The platform offers isolated margin and cross-margin trading opportunities.

Bybit has a tiered maker/taker fee structure. Spot market transaction fees start at 0.10% for both takers and makers, while perpetual contract trade fees start at 0.01% for makers and 0.06% for takers.

There are no deposit fees for depositing crypto on the platform, but withdrawal fees and minimums apply and vary depending on the digital asset.

Other deposit methods vary according to country restrictions and available third-party payment processors. Bybit allows fiat funding for TRY, BRL, ARS, and RUB. Residents of other countries may be able to deposit euros via SEPA. The deposit fees depend on the payment method.

Bybit also offers zero-fee spot trading on the platform at certain times.

The platform offers a very competitive fee structure and many crypto products that experienced traders enjoy, including leverage and margin trading. Predictably, Bybit is not available to US residents.

Pros

- Competitive fees, with zero-fee spot trading at times

Cons

- Not available to US-based customers

OKX

OKX, previously known as OKEx, is an unregulated exchange launched in 2017. The exchange is a part of the OKCoin ecosystem, along with the OKX wallet, and offers around 350 digital assets and 500 trading pairs.

You can find many trading products on the platform, including a spot market, P2P market, derivatives trading, options, futures, margin trading, perpetual swaps, staking opportunities, and crypto loans. Users can take advantage of trading bots to automatize their trading strategies.

Crypto beginners can use the simple buy/sell feature to purchase digital assets in a few minutes through bank wires or debit/credit cards. More experienced traders can use the advanced trade feature to access charts and different order types.

OKX has a maker/taker fee schedule. Advanced traders receive discounts based on their 30-day trading volume, while regular users might get discounts if they own OKB, the platform’s native token. Regular maker fees for the spot market start at 0.08%, and taker fees start at 0.10%.

Perpetual contract fees start at 0.020% and 0.50%, and options fees start at 0.020% and 0.30% for makers and takers, respectively.

OKX accepts deposits through several third-party banking apps, including Moonpay, Banxa, and Simplex. Deposit fees vary depending on the method but you can deposit GBP, EUR, AUD, and many more currencies.

Like many other global exchanges that offer derivatives products, OKX isn’t available to US-based customers.

Pros

- A large number of cryptocurrencies available

- Very competitive fees

- High yields from staking

- Supports many third-party payment apps

Cons

- It isn’t available to US-based customers

Poloniex

Poloniex is a global crypto exchange founded in 2014. Once a US-based exchange, it’s no longer available to US residents due to regulatory complications.

The exchange offers spot, margin, and futures trading, as well as perpetual swaps and a peer-to-peer lending product.

The exchange offers over 350 digital assets and 200 trading pairs. Customers from eligible countries can use Simplex to purchase digital assets with credit and debit cards and fund their accounts with fiat currency via bank transfers. However, Simplex charges a 3.5% fee for all transfers.

Poloniex allows customers to margin trade with up to 2.5x leverage and trade with up to 100x leverage on the Futures market. Staking, borrowing, and lending is also offered.

Poloniex uses a maker/taker fee structure, and users can receive discounts based on their 30-day trading volume and TRON (TRX) balance.

Maker fees start at 0.14%, while taker fees start at 0.15%. Users can earn 30% discount if they pay their fees with TRX, bringing down basic fees 0.1015% and 0.1085% for makers and takers respectively.

The exchange doesn’t offer phone support, but has a decent library and explanations on how to use the exchange.

The biggest issue with Poloniex is its troubles with security. When the exchange was hacked in 2014, the losses were socialized among all the users, effectively reducing their BTC balances by 12%. The exchange was implicated in another hacked again in 2020.

That being said, Poloniex management has changed hands many times since then. It was acquired by the crypto investment firm Circle in 2018, and sold to a consortium led by Justin Sun (founder of Tron) in 2019. However, given Tron’s troubles with authorities and his alleged mismanagement of Poloniex funds, it might be a good idea to approach this platform with caution.

Pros

- A large number of crypto assets

- Supports margin trading and derivatives products

- Competitive fees

Cons

- The platform isn’t available to US-based customers

- Troubles with regulators

- Security issues

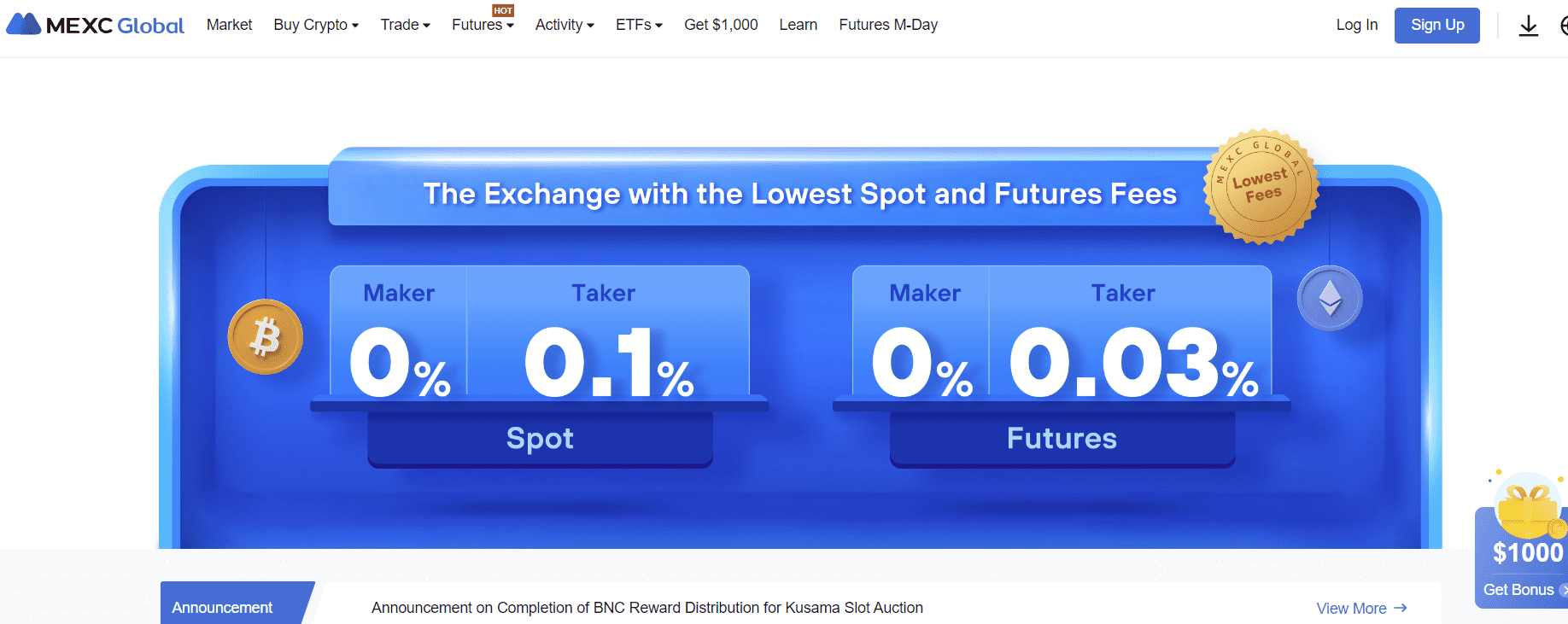

MEXC

MEXC is a global crypto exchange founded in 2018. The platform offers spot trading, as well as derivatives products, including margin, futures ETF, and leverage trading.

The platform is relatively new, but it still has a decent customer base and serious liquidity. The exchange offers around 180 trading pairs, including fiat to crypto pairs for USD and CAD.

You can deposit fiat currency to the platform via bank transfer, credit card, debit card, or third-party payment processors like Banxa, Simplex, and other options. While MEXC doesn’t charge deposit fees, you’ll have to pay a fee to the payment service/bank in question, depending on your chosen payment method.

MEXC spot trading fees start at 0.2% for makers and takers, and customers may receive discounts based on their MX token balance. MEXC also offers zero-fee trades for makers at certain periods.

Futures fees start at 0.02 and 0.06 for makers and takers, respectively. Users receive fee discounts based on their USDT balance in the Futures wallet or 30-day trading volume.

You can trade EFTs with leverage up to 5x. The platform also allows trading with up to 125x leverage in the futures market.

Withdrawal fees vary depending on the cryptocurrency and the method of payment.

You may think that, as an unregulated exchange with derivatives products, MEXC isn’t available to US citizens, but that’s not the case. US citizens can sign up and use the platform, at least for now.

MEXC website states that the exchange “is regulated, either directly or through affiliates, by some of the world’s most renowned jurisdictions.” As you can guess, the statement is quite ambiguous and doesn’t actually say that MEXC is regulated in the US or in most other countries it operates.

Since crypto exchange platforms that offer derivatives products are rarely accessible to US customers, MEXC may seem like a wonderful choice. However, it’s highly likely that the exchange has managed to fly under the authorities’ radars for some time, though the trend may not continue for long, especially since the platform has gained a lot of visibility.

That means US customers could lose access to their accounts if the authorities take action against the exchange, as they have done so in many other cases. Unfortunately, that puts MEXC users at a huge risk.

Pros

- 180 trading pairs available

- Derivatives available

- Staking rewards

- Low fees

Cons

- Regulatory status unknown, which could lead to a loss of funds in the future

- Not transparent about regulatory issues

- Problems with deposit and withdrawals

BitMart

Bitmart is an unregulated global exchange that launched in 2018. It’s known as a one-stop shop for many crypto needs, though its security and transparency have been questionable.

The biggest advantage of BitMart is the number of cryptocurrencies it offers. There are around 1000 cryptocurrencies listed on the platform, with many trading pairs.

The platform also offers derivatives products, margin and futures trading, lending, and staking features, not to mention a simple buy/sell feature for novices.

You can deposit to the platform via third-party payment processors, including PayPal and Apple Pay, or use bank transfers, credit cards, and debit cards to fund your account. These services often charge 3-5% of the whole transaction and can be very expensive to use.

Bitmart has a maker/taker fee structure. The trading pairs are divided into classes A and B, where each class has a different fee schedule. For class A trading pairs, fees start at 0.25% for regular users. For class B pairs, fees start at 0.4%. Users receive discounts on the fees as their Bitmart token (BMX) holdings increase.

Futures fees are 0.0200% and 0.0600% for makers and takers, respectively.

Crypto deposit and withdrawal fees vary depending on the cryptocurrency in question. You can use third-party providers to purchase crypto with fiat currency for the instant buy feature.

As you may have guessed, Bitmart doesn’t offer derivatives or lending products to US-based customers.

Crypto exchange hacks are quite common and, unfortunately, customers often bear the consequences of loss. Bitmart lost around 200 million worth of crypto in a hack back in 2021.

Pros

- Lists around 1000 cryptocurrencies

- Staking opportunities

Cons

- Recently lost $196 million worth of crypto in a hack

- US-based customers can’t engage in derivatives trades

Uphold

Uphold is a multi-asset trading platform where you can buy and trade national currencies, equities, cryptocurrencies, and precious metals. The platform also offers a debit card you can fund with your assets.

The platform offers over 200 cryptocurrencies, and users can trade their cryptocurrencies for any other crypto they like, thanks to Uphold’s unique trading system. Users can also trade between asset classes, so it’s possible to sell crypto to buy precious metals, for example.

Uphold doesn’t have a maker/taker fee schedule; in fact, instead of paying transaction fees, users only pay spreads. Basically, fees are automatically added to the market price when you’re purchasing crypto and other assets.

Unfortunately, spreads are often much more than the market prices, and buying crypto on Uphold can be more expensive compared to other options.

Spread fees vary depending on the region, asset, and volatility at a given time. Typically spread fees for ETH and BTC are between 0.8% and 1.2% for the US and Europe. However, spreads can increase depending on market volatility and available liquidity. You can expect higher prices when the price volatility is higher or when the liquidity is lower.

You can deposit and withdraw fiat currency through your bank account or with a credit or debit card.

Credit and debit deposits cost a 3.99% and 2.49% fee, respectively. Withdrawing crypto costs a flat fee of $2.99, and withdrawing via bank transfer costs $3.99.

Pros

- Over 200 cryptocurrencies

- You can trade precious metals as well as crypto

- Prepaid debit card.

Cons

- Expensive prices

- Equity trading is not available for US and Europe-based customers.

- High fees for withdrawals

Blockchain.com

Blockchain.com started out as a blockchain explorer for Bitcoin and other cryptocurrencies back in 2011. The company launched its own global exchange, allowing customers to trade over 40 different assets and around 120 trading pairs.

The exchange supports an instant buy feature and a more advanced trading environment for experienced traders. It’s available in most countries and 30 states in the US.

The platform offers margin trading with up to 5x leverage and crypto-backed loans to institutional traders. Margin trading isn’t available to US-based customers.

Users can deposit crypto, USD, GBP, and EUR to their trading accounts via ACH, wire transfer, open banking, SEPA, and FPS. Open banking, SEPA, and FPS withdrawals cost 0.25 EUR, while the wire transfer fee is 25 USD.

The platform has a maker/taker fee schedule, and users can receive discounts based on their 30-day trading volume. Starting transaction fees are 0.20% for makers and 0.40% for takers. Unlike other global exchanges, blockchain.com doesn’t have a native cryptocurrency.

The platform is relatively easy to navigate, and beginners can learn their way around the exchange quite easily. There is a dedicated FAQ help center.

Users can access the platform via browsers or mobile app.

Pros

- 120 trading pairs

- Staking rewards

- Easy to navigate

Cons

- Available to 30 states in the United States

- High withdrawal fees

- Limited customer support

Luno

Luno is a mobile global exchange and wallet based in the UK. It’s available in many countries though the features can be limited in many locations, including the US.

Luno offers around 7 cryptocurrencies, including BTC, ETH, BCH, LTC, XRP, ADA, and SOL, and 25 trading pairs for UK-based customers, so it’s a very boutique exchange in many ways.

Users can buy, sell and store cryptocurrencies, but the platform doesn’t offer more than that. There is also an instant buy option for certain assets, though instant buy is more costly than maker/taker charges.

If you’re based in the US, your options are very limited. Luno only offers Instant buy for Bitcoin and Ether to US-based customers, and they can’t take advantage of the market order book. Instant buy fees are 0.75% for BTC and ETH.

UK-based customers have more options, but Instant buy fees are even higher for them, around 1.5%. Maker and taker fees vary depending on the asset but are around %1 for BTC and ETH.

Overall, Luno is quite expensive, especially compared to other exchanges we covered in the article. Crypto offerings are very limited, and fees can be confusing, as each trading pair costs a different fee.

Pros

- User interface is easy to navigate

Cons

- A limited number of cryptocurrencies

- High fees

- Location-based restrictions

8 Alternative Crypto Gateways

These alternatives let you buy cryptocurrency in a few minutes, as easy as downloading an app and signing up, or at least that is the ultimate promise they advertise, often in big capital letters.

The flashy promises aside, while it’s true that using these platforms can be easier than dealing with a fully-fledged crypto exchange, they are often not as useful or transparent as they claim. You’ll often see most platforms advertise a zero-fee policy, whereas they almost always charge higher fees than crypto exchanges, though disguised as “spreads.”

Overall, these platforms are quite costly compared to the other exchanges, less transparent in pricing, and most don’t allow you anything other than purchasing crypto, including the option to remove it elsewhere to trade it on different markets.

Since their prices are mostly decided by the spreads, which are far higher compared to the rest of the industry, you can’t make profitable trades unless there is a huge upswing in the prices.

Yet, it’s true that these platforms pose an easy way to purchase cryptocurrency. However, it is debatable if they are easier than using, for example, a simple instant buy option at any other exchange suitable for beginners, like Coinbase.

That said, these platforms can be beneficial if your aim is to HODL (to purchase crypto as a long-term investment without planning to sell or trade).

Bitpay

Bitpay is a payment gateway for cryptocurrencies. It’s a little different from the other options on the list because it’s not exactly an exchange nor a platform for depositing and swapping crypto.

It gives you the opportunity to purchase goods and services via crypto through their Bitpay crypto debit card. You can use the card to withdraw cash from Mastercard-compatible ATMs as well.

Like many alternative options on our list, you won’t be able to withdraw or sell the cryptocurrency you have in your Bitpay account. You read that right: once you put your crypto on the platform, there is no going back. You can swap one crypto asset for another one listed on the platform, but you can’t withdraw it otherwise.

So what’s the benefit of using Bitpay? Well, if you want a debit card backed by your crypto assets, Bitpay has that covered. You can use your assets to fund your Bitpay debit card, and the platform will convert your crypto to fiat cash.

However, that can be quite costly in the long run. When you pay for goods and services with your debit card, Bitpay charges merchants %1 processing fee as their Network Cost Fee.

Merchants may choose to relegate that fee to you, so you might have to pay an extra 1% conversion fee every time you use the card. This is pretty frustrating, and it isn’t advertised clearly and transparently on the BitPay website.

The same goes for ATMs as well. There is a flat fee of $2.50 for every ATM withdrawal. These fees could add up to quite a lot in the long term.

Funding your BitPay debit card is easy. You can either connect it to your BitPay or Coinbase wallet.

BitPay lets you purchase cryptocurrencies with credit cards, debit cards, and Apple Pay. You can also use third-party providers like Simplex and Wyre. Of course, there are additional fees for these services. The platform accepts over 40 fiat currencies, including EUR, GBP, and USD.

You can only purchase and swap 14 cryptocurrencies on Bitpay, including Bitcoin, Ethereum, Dogecoin, Litecoin, Polygon, Dai, and Binance USD.

Pros

- Offers a prepaid debit card

Cons

- A limited number crypto

- No withdrawals

- High fees

Etoro

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

eToro is a global trading service that enables users to invest and trade in stocks and cryptocurrencies. eToro offers a multi-currency crypto wallet and around 40 cryptocurrencies.

eToro is famous for its advanced social trading feature that lets users copy trades of top traders on the platform. Essentially, eToro allows you to learn from other traders and execute strategies even if you don’t necessarily understand the crypto market.

eToro charges a 1% fee for all crypto trades, and you also have to pay a market spread. Overall, it can be quite expensive to trade on eToro.

You can only withdraw a few digital assets from the platform. These are Ethereum, Bitcoin, Litecoin, Bitcoin Cash, Tron, XRP, and Stellar. Unfortunately, that’s not all. In order to transfer your crypto to another wallet, you first have to send your assets to the eToro Money crypto wallet. The transfer could take up to 5 days and costs a 2% fee.

You can deposit fiat on eToro through debit/credit cards and your bank account. USD deposits are free, but you may have to pay fees to third-party providers a fee for their services. US customers can use Payoneer to deposit fiat money into their accounts.

eToro also recently launched a separate crypto platform, eTorox, catering to more advanced crypto traders.

Pros

- Reputable exchange

- Social Trading

Cons

- High fees

- A limited number of digital assets

Robinhood

Robinhood is a brokerage that offers several trading options, including EFTs, stocks, options, and 15 cryptocurrencies. The platform advertises commission-free and quick crypto purchases.

The no-commission purchases, of course, come at a hefty price nonetheless. Robinhood adds fees on top of the market price as a spread.

You can purchase major cryptos like Bitcoin and Ethereum on the platform and exchange them for other assets. You can also buy EFTs (exchange-traded funds) with your crypto.

Robinhood has an intuitive and accessible trading system that lets you place advanced order types, including limit orders.

You can deposit fiat money to your Robinhood account via debit card or your bank account. However, you may not be able to make instant deposits, as the feature is offered to select customers.

You can’t deposit crypto to your Robinhood account. You can only purchase crypto on the platform, and it stays in your platform account unless you sell it.

You can withdraw money with a debit card or via a bank account, but debit card withdrawals cost a 1.5% fee.

The biggest problem with Robinhood, as with many other similar platforms, is that you can’t remove your crypto from the platform without selling it. You can swap different digital assets on the platform with each other, but you won’t be able to take your BTC to another exchange with better prices. That means you’re very limited with your trading choices.

This may change in the future, as Robinhood is building a digital crypto wallet of its own. If their non-custodial wallet takes off, users may be able to move crypto between the platform and other wallets. The wallet is expected to be ready for users by the end of 2022, and you can sign up for the beta version of the wallet on the Robinhood website.

Pros

- User-friendly interface

- You can trade crypto for ETFs and stocks

Cons

- You can’t move crypto off the platform

- Only 15 cryptocurrencies

Revolut

Revoult is a London-based banking start-up that offers many financial services, including peer-to-peer payments, crypto, and fiat exchanges and prepaid a debit card.

Revoult’s crypto offerings are meager and vary depending on your location. Currently, US-based users can buy Bitcoin, Ethereum, and Litecoin on the Revoult app. Other users may be able to purchase over 30 coins.

Revoult exchange prices are quite opaque: they set the prices, and it’s hard to estimate how much the spreads are. There are also transaction fees.

Revoult charges standard and plus users either a 1.99% fee or a £0.99 fee for crypto transactions, whichever is greater. The minimum amount you can purchase varies depending on your location.

Revoult offers several plans for users: though standard users can use them without paying extra. However, standard users are also charged an extra fee once their monthly trade volume exceeds £1000. For every trade after that, you’ll be charged an extra 0.5% fee on top of what you’re already paying.

The platform offers SEPA and bank transfer deposits.

You might be able to move crypto to an external wallet, but that feature varies depending on your location. You may have to cash out in order to withdraw funds from the platform.

Unfortunately, it’s hard to say a lot about Revoult’s crypto offerings, as the platform doesn’t provide a good account of their services and fees.

Pros

- Offers a prepaid debit card you can top with crypto

Cons

- Expensive fees

- You may not be able to withdraw crypto to an external wallet

Webull

Webull is another financial services app that lets you purchase cryptocurrencies. The platform offers around 40 digital assets.

Unfortunately, like with many other alternative platforms, you can’t transfer your crypto to or from your Webull account. You can only purchase crypto on the platform, and once purchased, you can only trade or sell it on the platform.

The platform allows market, limit, stop limit, and GTC (good till canceled) orders. However, stop limit and GTC orders may not be offered to all customers.

Webull has an interesting fee schedule, even compared to other platforms that profit from spreads. The platform calculates the spreads as “basis points” and charges you 100 basis points for every crypto purchase, which amounts to 1% of your trades.

Wire deposits cost 8$, and wire withdrawals cost 25$.

Like most trading platforms that don’t specialize in crypto, Webull uses a third party to manage crypto funds: Apex technology firm. Apex used to provide the same service for Robinhood and continues to manage the crypto services of Public.com.

Pros

- You can buy over 40 cryptocurrencies

Cons

- You can’t move crypto assets to external wallets

- High fees

Tradestation

Tradestation is a comprehensive trading platform for all your needs, including crypto trading.

The platform is suitable for experienced investors and offers advanced technological solutions, though the crypto feature is still a bit fresh.

You can buy and trade 10 cryptocurrencies on the Tradestation Crypto platform. There’s a simple buy option that lets you buy digital assets easily and quickly. You can customize the trading interface to see price charts and analyze market trends.

However, sophistication has its downsides as well. Tradestation is relatively more complex than the other alternatives we cover here, and you can just as easily use a regular exchange with more crypto options.

Tradestation Crypto has a maker/taker fee schedule and charges 0.30% for makers and takers. You can receive discounts based on your trading volume.

You can deposit fiat currency to the platform via bank or wire transfer. Crypto withdrawal fees vary depending on the digital asset.

Pros

- Advanced platform with complex charting options

Cons

- Only 10 cryptocurrencies available for purchase

Exodus

Exodus was primarily known as a cryptocurrency wallet, but over time, it has also become a decentralized exchange for cryptocurrencies. It allows you to purchase and trade over 250 cryptocurrencies.

Exodus is the only decentralized exchange on our list, and it’s a little different than other options on the list. Your assets aren’t managed by the exchange, instead, users are fully in control of their own assets and their security.

The best thing about Exodus is its versatility. You can swap cryptocurrencies with your peers on Exodus’s decentralized exchange or connect to a centralized exchange to purchase crypto.

The platform offers staking options for several coins, with APR rates from 1% to 20%. The wallet is compatible with Trezor hardware wallets, which help you secure your crypto savings.

Exodus offers several ways to buy crypto. Usually, you can’t really fund your account with fiat currency on decentralized exchanges. Exodus’s partnerships with third-party operators like Ramp and MoonPay help you bypass that block.

You can use Ramp and fund your account with a debit/credit card, Apple Pay, or linking your bank account. Ramp allows you to buy 24 cryptocurrencies with fiat money.

Another option is using MoonPay. Moonpay allows you to deposit money via Apple pay, Google Pay, debit and credit cards, and bank transfers. You can purchase 61 coins via Moonpay, although US-based customers can only purchase 29 digital assets.

Pros

- Over 200 cryptocurrencies available

- Several fiat deposit methods

- You can use Exodus in tandem with Trezor hardware devices for security

- Staking opportunities

Cons

- It can be complicated for beginners

Public.com

Public.com is a portfolio management service that allows you to purchase over 25 cryptocurrencies, including major coins like Bitcoin and Ethereum.

Unfortunately, you can’t move your assets to an external wallet. You can only buy and swap cryptocurrencies on the platform. If you want to withdraw, you have to sell your assets. Withdrawal can take up to 2 days.

The platform charges a 1-2% fee for crypto trades, though the prices can be higher at times. Apex Crypto manages cryptocurrency purchases on Public.com and charges a varying spread fee on all purchases.

Like many other non-exchange platforms, Public.com has daily maintenance hours, where you can’t make trades.

Pros

- Good learn section, with clear answers to questions

Cons

- You can’t move crypto assets to external wallets

- High fees

Crypto Price Volatility

There is an important aspect to crypto trading in general, and that is liquidity. In a volatile market like crypto, the forever juggling prices can mean opportunity but also a tremendous loss for traders and platforms. When the prices fall or jump unexpectedly, the liquidity can quickly dry up, barring investors from purchasing or selling their assets.

Of course, another possibility is straight-up bankruptcy, which happened to Voyager Digital, a broker company that focused on crypto lending in 2022. Before its fall, the company had been quite popular among those who wanted a simple way to invest in crypto assets.

Unfortunately, when the crypto prices fell through the roof in 2022, the investors who placed their assets with the company lost it all. FTX offered to buy out the assets, but soon also went under, draining millions from customers worldwide.

This brings forward another issue: both investing platforms like Voyager (and others we suggest in the article) and more traditional crypto exchanges like FTX (though traditional may not be the right word for brokers barely older than a decade) are still quite vulnerable to market swings, and in turn, can be quite predatory, as is the nature of unregulated markets.

A Note of Caution

There have been more regulations regarding crypto and crypto trading in general in the past few years, and rules have tightened up considerably (as you can gather from the restrictions against margin trading in the US, for example), but that doesn’t mean the market is anywhere near transparent, or as often the case with financial markets, only slightly muddled.

You can see what we mean just by looking at Voyager, which claimed to have FDIC ( Federal Deposit Insurance Corporation) insurance protection for their funds. Crypto assets brokerages held aren’t protected by the government, as Federal Deposit Insurance Corporation clearly spelled out in their press release after issuing cease and desist letters to 5 separate crypto platforms in august 2022. One of the companies that received a warning was Voyager, and another one was their prospective buyer, FTX.US.

Of course, claiming FDIC insurance is just a negligible example of opaqueness in the crypto business. Still a fledgling market, the crypto business breeds a lot of controversy, schemes, mysteries, and, in some cases, outright lies.

Reading the Fine Print

That doesn’t mean there isn’t profit in crypto, or there are no good investment opportunities and tools available. Indeed we sought out the best ways to enter the crypto market in a long list of alternatives for you, but it does pay to be cautious in this ecosystem, lest you are left with loss and risk you didn’t sign up for.

One way to be cautious is to do your research and go to primary sources as much as possible. We listed the fees and conditions for the most liquid exchanges you can use, but prices can – and often do – change quickly in this market.

Putting time and work into reading the fine print and checking out independent reviews can help you make the best of your investment in the long run. Finally, remember that if a deal seems too good to be true, it most likely isn’t.