USDC vs FRAX

On paper, USDC and FRAX are pretty similar: they are stablecoins pegged to the US dollar. However, they have important differences you should know about before you buy either coin.

In this article, we compare USDC and Frax to help you understand the risks and benefits of investing in these stablecoins. Without further ado, here is our USDC vs FRAX review.

The History of USDC and FRAX

Issued by Coinbase, one of the biggest crypto exchanges in the world, and Circle Consortium, USDC is the world’s second-largest stablecoin by market cap.

USDC was first launched in 2018 as a US-based and regulated alternative to USDT, the world’s first and most successful stablecoin. The asset was supposed to be backed by US dollars in federally insured banks, although Circle eventually admitted that USDC reserves weren’t entirely made up of cash in 2020.

Of course, even keeping reserves in bank accounts isn’t a perfect solution, as it became apparent in 2023 when Silvergate Bank declared bankruptcy. Circle had 3.3 billion worth of USDC at the Silvergate Bank at the time and suffered a peg-break once news hit the stands.

USDC quickly recovered its 1 USD peg once Circle and FDIC announced that Silvergate’s accounts would be covered and customers would not suffer losses.

Frax was launched in 2020. It’s issued by Frax Finance, a DeFi company. While it was quite popular when it launched, it lost some ground to other stablecoin projects due to its risky pegging mechanism that partially depends on algorithms.

How Do USDC and FRAX Work?

If you know how stablecoins work, you already have an idea about how FRAX and USDC work. These stablecoins can be exchanged for 1 USD at any time, as they are price stable, hence the name stablecoins.

But how do they keep their price fixed at 1 USD? Well, USDC does it the classic way. It keeps a reserve consisting of assets like cash, commercial paper, and bonds that guarantee that USDC issuer Circle can always buy back USDC from you at 1 USD.

You can think of it like a bank. You put the cash in, get the crypto out, and if you no longer need crypto, you just trade it back for cash.

Frax differs from stablecoins like USDC and USDT in two ways. First, it’s not backed by cash or cash equivalents but by other cryptocurrencies like USDC. You give the issuing company your coins; they give you FRAX. When you want your coins back, they buy FRAX from you with these crypto reserves. In other words, it’s dependent on other crypto assets.

In order to mint FRAX, you must collateralize a mix of cryptocurrencies, including Frax Finance’s own native governance token. You need to lock up a certain amount of FXS along with another crypto coin like USDC to get your hands on FRAX.

As you can imagine, that introduces an extra element of risk to the process: If cryptocurrencies that back FRAX lose their value, the company can no longer guarantee 1 USD peg for FRAX. To mitigate that risk, FRAX uses an algorithm to decide the exchange rate between crypto collaterals and FRAX. Thus, FRAX is a semi-algorithmic coin.

However, FRAX’s dependence on FXS is another weak point. For example, if you buy 1 FRAX by locking up 0.50 USD worth of USDC and 0.50 USD worth of FXS, the value of your asset is tied to the value of both USDC and FXS. Ideally, the value of FXS should go up as FRAX gains more popularity, but historically, it has been the opposite.

In other words, unlike USDC, FRAX is under-collateralized. That means the reserves that back FRAX are not enough to ensure FRAX price stability completely.

What Are the Main Use Cases of USDC and FRAX?

One of the main use cases of stablecoins is instant value transfers: You can send thousands of dollars to anyone in the world simply by buying USDC and sending it to their accounts. Sending USDC is a lot faster than wiring money, especially when you are making cross-border transactions.

As the second-largest stablecoin in the world, USDC has several other use cases as well: Many crypto exchanges operate USDC markets for various other coins, denominating coin prices in USDC. That means you can trade most other cryptocurrencies with USDC.

Another benefit of USDC is its usefulness as a DeFi investment product. You can lock up your USDC in DeFi pools to earn passive income on your funds.

FRAX isn’t as useful as USDC in these aspects. It’s considerably harder to transfer value with FRAX due to its small market cap and under-collateralized nature. Most crypto exchanges don’t operate FRAX/USD markets either.

However, FRAX’s popularity slightly increased in 2023, as the issuer offers several services, including staking and lending pools for the asset. One of the most popular services they offer is their Frax Ether pool, where users can earn 6-10% interest on their Ethereum deposits.

USDC and FRAX Price History

USDC Price History

As you can see, 1 USDC is worth $1. However, USDC broke its peg in 2023 briefly due to news of Silvergate Bank’s bankruptcy. USDC price quickly recovered after it was announced that the bank’s FDIC coverage would be extended to protect USDC reserves.

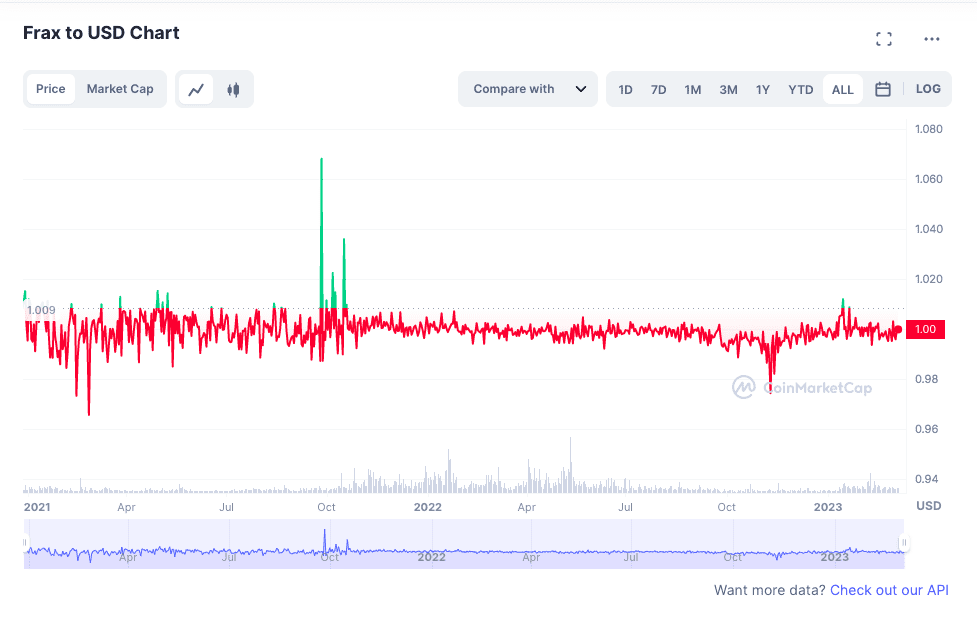

FRAX Price History

Frax is worth around 1 USD, though there have been times when the price moved up and down. Price fluctuations can be attributed to sudden increases or fall in demand.

USDC and FRAX Market Cap

USDC Market Cap

USDC has lost some market share in the first quarter of 2023, most likely due to news of Silvergate bankruptcy. However, despite the losses, the asset still remains the second most popular stablecoin in the market.

There are around 29 billion USDC tokens in circulation.

There is no pre-set upper limit for USDC. Circle and associated organizations with the right credentials can mint more USDC tokens as long as there is a demand for them. When the demand falls, and people sell USDC for USD or other tokens, surplus USDC tokens are burned.

USDC is issued on Ethereum, Stellar, Solana, and Algorand blockchains, and you can also access TRON USDC on the Tron network.

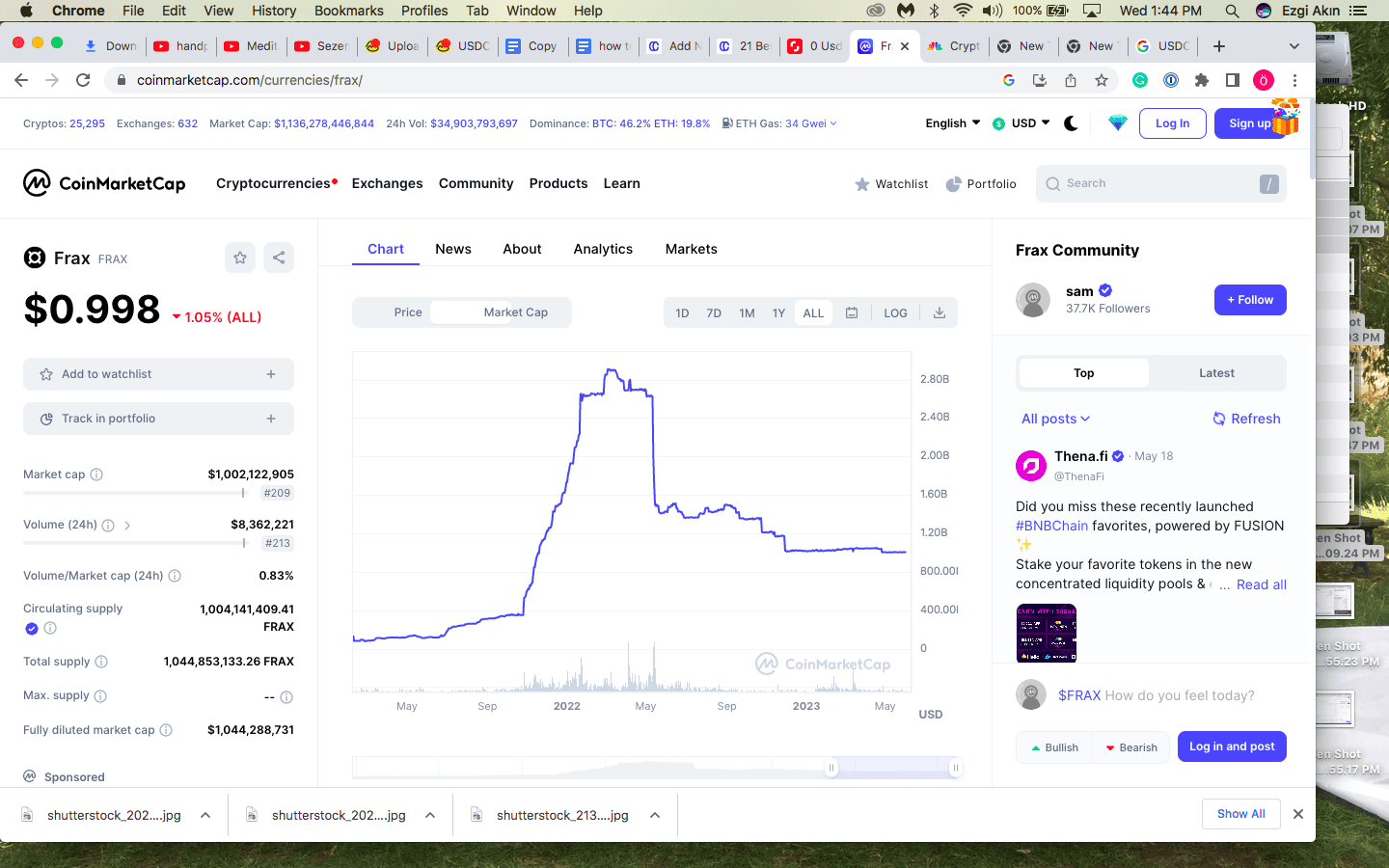

FRAX Market Cap

FRAX, once one of the top stablecoins in circulation, has lost its popularity after the fall of Terra UST. As a partially algorithmic coin backed up by USDC, it is deemed less useful and dependable compared to other options in the market.

There are around 1 billion FRAX in the market. The market cap is quite small compared to USDC. To be fair, very few people ever stray from USDT, USDC, and BUSD when it comes to stablecoins, so Frax’s low popularity isn’t abnormal.

Like other stablecoins, there is no set limit for FRAX. You can mint more FRAX by locking up collaterals in smart contracts. You need to lock up FXS tokens along with another accepted cryptocurrency (mostly USDC) to mint FRAX.

FRAX doesn’t have its own blockchain and is issued on Ethereum.

USDC vs FRAX: Main Similarities

The main similarity between USDC and FRAX is that they are both stablecoins pegged to USD. Here are a few other ways they are similar.

DeFi Rewards

Stablecoins are popular DeFi assets, but although both USDC and FRAX are quite popular, there’s an important difference in terms of their market reach: While you can use USDC in pretty much all DeFi protocols, FRAX offers way fewer opportunities to earn passive income.

To put it simply, you can lock up USDC in most pools for a decent return. Frax lets you stake Ether in exchange for frxEther, which you can stake in Frax’s own tdrxEther in a pool for profits.

When it comes to DeFi rewards, we can say that FRAX just doesn’t have the same demand as USDC.

Centralization

It might surprise you, but despite its label as a “decentralized autonomous organization,” Frax Finance isn’t actually very decentralized and, in fact, can be considered a centralized project, much like USDC. Why?

Well, a couple of reasons. Now, as many of you know, when a crypto project is centralized, it means there are a couple of people who are making crucial decisions about the coin and its future. The issuer of USDC, for example, the Circle Consortium, is a centralized organization with different stakeholders. It’s a bit more decentralized compared to other coins but still far from an autonomous, community-run project.

Frax Finance, unsurprisingly, is also controlled by a few people. FRAX administrators have privileged access to the protocol, and a security audit in 2022 exposed several flaws in the project protocol that are incompatible with FRAX’s decentralized image.

It was discovered that select validators can be appointed by administrators, who, in return, can exploit the network for their benefit. These administrators can mint unlimited frxETH if they wanted to.

USDC vs FRAX: Main Differences

Both stablecoins promise a price guarantee: FRAX and USDC should always be worth 1 USD. However, they have different methods to accomplish this promise.

Collaterals

USDC and Frax use different kinds of collaterals to guarantee their pegs to USD.

USDC is a fully collateralized asset. It’s backed by cash and cash equivalents so that every USDC in circulation can be exchanged for a dollar.

FRAX, on the other hand, is under-collateralized with USDC. So, you can get half a USDC for each FRAX you have, plus some FXS.

Reserves

Early on, we emphasized that it’s important for stablecoins to be backed one-to-one with cash-like assets to prevent de-pegging.

Since USDC is backed by cash and cash equivalents, USDC reserves are kept in banks. This is generally a safer option compared to other reserve options like crypto reserves because cryptocurrency theft and loss are more common than losing your money in a bank.

However, banks can also fail. This is exactly what happened to USDC with Silvergate Bank, with the project almost losing 3.3 billion USD after the bank declared bankruptcy.

But the key word here is almost. Circle managed to recover its USDC reserves thanks to government intervention to expand FDIC coverage above the pre-determined 250,000 USD limit.

Of course, what we know of USDC reserves is pretty much entirely limited to what Circle says. Without an independent audit, it is impossible to be 100% sure about USDC’s financial backing.

FRAX, on the other hand, is backed by USDC, but since it’s algorithmic and under-collateralized, it’s not even fully backed. Its one advantage over USDC is that you can track FRAX’s USDC reserves, which technically adds a little more transparency to FRAX.

That being said, given what we know about how centralized FRAX can be, transparency can be an illusion. Since administrators hold special privileges on Frax Finance network, they can also manipulate smart contracts.

Market Capitalization

Remember how we said USDC has several use cases? Well, that is because USDC is a highly liquid coin with a huge market capitalization. Basically, USDC is useful because so many other people use it as a medium of value. After all, it’s the world’s second-largest stablecoin.

FRAX, on the other hand, is a very small fish in the stablecoin pool. It doesn’t break the top ten in market reach, let alone being anywhere close to USDC.

It should be said that FRAX is a newer addition to the stablecoin world. USDC entered the market two years before FRAX, so it has a time advantage. The Terra UST meltdown may have also shrunk FRAX’s market reach, as people became vary of algorithmic coins after its colossal failure.

Risks Associated With USDC and FRAX

Risk of Depegging

When a stablecoin pegged to USD de-pegs, it either falls below or rises above its guaranteed 1 USD price.

While slight price fluctuations are considered normal due to sudden increases and falls in stablecoin demand, a de-peg is a more significant event. De-pegs signify a big change in price, and price stabilization either takes some time or never happens.

If a stablecoin de-pegs and spirals down in value, the coin becomes pretty much worthless. Therefore, de-pegging represents a serious risk to stablecoins.

There is always some risk of de-pegging with stablecoin assets, though USDC and FRAX encounter that risk somewhat differently.

USDC could de-peg due to a sudden loss of reserves, which happened in the first quarter of 2023 when news of Silvergate’s bankruptcy became public. The de-peg event was short-lived but still cost USDC a fair amount of its market share.

If USDC de-pegs for good, that also affects FRAX’s peg as well, since FRAX reserves are made up of USDC.

On the other hand, FRAX could also collapse or de-peg due to its semi-algorithmic structure. If the FXS token (Frax finance token) tanks, that can trigger a de-peg reaction for the asset.

Legal and Financial Risks

Stablecoins fill a unique role in the crypto environment: they bridge the traditional economy and money with the crypto economy. However, this also means they have to dance around various legal limits.

For example, while you can rapidly transfer large amounts of money through stablecoins without dealing with red tape and bank lines, you can also use that privilege for a number of illegal dealings, including breaking international sanctions, laundering money, and financing crime and terror. Unsurprisingly, these facts don’t endear stablecoins to regulators.

Most recently, US authorities showed their unwillingness to tolerate stablecoin-related illegal actions by dark listing several wallets linked to Tornado Cash, a coin-tumbling service used for hiding crypto’s digital footprint. Around 38 Tornado Cash-related wallets with more than 75,000 USDC were black-listed.

This is exemplary of legal and financial risks that are associated with cryptocurrencies, and USDC in particular.

FRAX, on the other hand, is at risk due to its semi-algorithmic structure. Regulators have talked about banning algorithmic coins completely, and FRAX straddles lines between algorithmic and collateral-based stablecoins.

Worse, if USDC lost its value due to any one of the above reasons, FRAX would also soon follow since it depends on USDC to guarantee price stability.

Where Can You Buy USDC and FRAX?

You can buy USDC and FRAX on most cryptocurrency exchanges. Centralized exchanges allow you to purchase USDC (and sometimes FRAX) with cash. You can also find these assets on decentralized exchanges like Uniswap or Changelly.

Since most crypto exchanges operate their own crypto markets, some may have more liquidity when it comes to these assets. You can learn which exchange has the largest USDC or FRAX trading market by checking out their market data on Coinmarketcap.com.

How Can You Exchange USDC for FRAX?

You can buy FRAX on any exchange that lists it. All you have to do is to visit your favorite exchange and search for USDC/FRAX pairing. As long as the exchange lists USDC/FRAX paring, you won’t have trouble.

Uniswap, Curve, and Solidly offer the largest USDC/FRAX markets. Gate.io is a centralized exchange you can trade USDC for Frax.

Future Plans for USDC and FRAX

Sam Kazemian, the founder of Frax Finance, announced in 2023 that he was considering building a completely regulation-compliant stablecoin. Since algorithmic coins are in hot water with regulators, Kazemian’s plan requires an asset with fully-backed with collateral.

But it’s not yet certain how FRAX fits into this scheme. If Frax gets banned in the US due to its semi-algorithmic structure, it would be hard for the coin to protect its peg.

To make matters worse, US authorities are also coming down hard on “staking” services provided by centralized exchanges and pools. FRAX has enjoyed an uplift in popularity after it launched its liquidity pool in October 2022, but if regulators come after DeFi and derivatives staking, that too could be short-lived.

USDC, on the other hand, seems tired of the unwillingness of regular banks to work with crypto companies. Circle CFO suggested that the best way to ensure USDC reserves’ safety is to store them in the Federal Reserves.