- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

Stablecoins like USDC and DAI are pegged to USD one-to-one, meaning they have price stability. Thanks to that, they can be used to buy and trade other cryptocurrencies or invest in DeFi projects.

In this USDC vs DAI review, we’ll explain the differences between the two stablecoins and list the risks and benefits of trading them.

The History of Circle (USDC) and DAI Coin (DAI)

USDC was launched by Circle, a consortium that includes the Coinbase exchange, in 2018.

Initially, USDC was supposed to be backed by dollar reserves, though the company later amended that policy to back the stablecoin with other investments, such as corporate bonds, US Treasury bonds, and commercial paper. According to Circle, around 61% of USDC reserves are made up of cash and cash equivalents.

Circle advertises USDC as a transparent and regulated stablecoin. However, the stablecoin’s dependability has been questioned as of late, especially since the fall of Silvergate Bank (SVB), which held a substantial amount of USDC reserves of around 3.3 billion USD.

USDC remains the second-largest stablecoin by market cap, coming after Tether’s USDT.

DAI stablecoin was launched in 2017 by MakerDAO, a decentralized autonomous organization founded by Rune Christensen in 2014. MakerDAO members (MKR holders) can vote on the stablecoin’s future and participate in the decision-making process, hence the “decentralized autonomous” label.

However, DAI received criticism for being quite centralized due to Christensen and the founding team holding a lot of decision-making power. Another criticism DAI often receives due to its dependence on USDC.

Unlike USDT or USDC, which are backed by fiat money and other real-world assets, DAI is mostly backed by other cryptocurrencies. That means the token is vulnerable to price swings, especially if the value of the underlying tokens is affected by legal or market developments.

In 2022, MakerDAO passed a motion to make DAI reserves more decentralized by investing in real world-assets. In the future, DAI may become a real-world asset-collateralized stablecoin.

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

You can learn more about the histories of DAI and USDC in our reviews.

How Do USDC and DAI Work?

As you may already know, stablecoins pegged to USD should always be worth 1 USD, unlike other volatile cryptocurrencies, such as Bitcoin (BTC) or Ethereum (ETH).

Like most other stablecoins, USDC and DAI keep their price stability thanks to collateral loans (algorithmic stablecoins are the exception to the rule, but they are known to fail). Basically, USDC and DAI have underlying assets that provide them with price stability.

Here is how it works: When Circle issues a new USDC on the market, they lock up the cash equivalent of the USDC they issue in their reserves. For example, if the company is issuing 100 USDC tokens, it must add 100 USD to its reserves. That way, the company guarantees a single USDC is worth 1 USD because the company always buys it at that price.

DAI works a little differently because DAI reserves aren’t made up of dollars but other tokens and stablecoins like Ethereum and USDC. As you can guess, that makes it a little more vulnerable to market conditions because DAI must depend on crypto price stability to function. To make up for that extra vulnerability, DAI employs a system known as over-collateralizing.

We can understand over-collateralizing better if we compare it to how USDC works. As we just explained, 100 USD is enough to buy 100 USDC. You give the Circle 100 USD, and the company puts it in its reserves and gives you 100 USDC in return. Your 100 USD is now collateral for your USDC.

If DAI worked like USDC, you would only need to give 100 USDC to MakerDAO to get 100 DAI. But that’s not how it works! In reality, you need to give between 120 to 150 USDC to MakerDAO to be issued 100 DAI. That makes DAI an over-collateralized asset.

DAI needs this sort of over-collateralizing because crypto prices, even stablecoin prices, are vulnerable to price swings. Hence, MakerDAO tries to ensure their asset has a protection bubble in case crypto prices fall hard.

The exact collateral ratio is decided by Maker Protocol, which employs algorithms to keep track of collaterals to ensure DAI price remains stable. When you deposit tokens to Maker Protocol, your assets are locked in Collateralized Debt Positions (CDPs) smart contracts. If the value of your collateral falls beneath a certain level, the smart contracts automatically liquidate assets to ensure the DAI price remains stable.

What Are the Main Use Cases of USDC and DAI?

Stablecoins can be used to purchase and trade most altcoins. Most crypto exchanges operate altcoin markets denominated in USDC or USDT since they are the two biggest stablecoins.

The biggest advantage of USDC is its easy conversion mechanism. You can buy and sell USDC with fiat currency, i.e., enter and exit the crypto market via this stablecoin. For example, if you want to cash out your profits from a BTC sale, you can trade your BTC for USDC and cash out via a centralized exchange.

DAI is not as popular as USDC for trading and buying digital assets. Since it usually can’t be directly converted to cash, it’s not great for quick exits from the market. However, it’s a popular DeFi asset. You can deposit your DAI to Maker’s DSR smart contract to earn a 1% savings rate.

Of course, you can also deposit or loan your DAI and USDC assets to different DeFi protocols to earn interest.

USDC and DAI Price History

USDC Price History

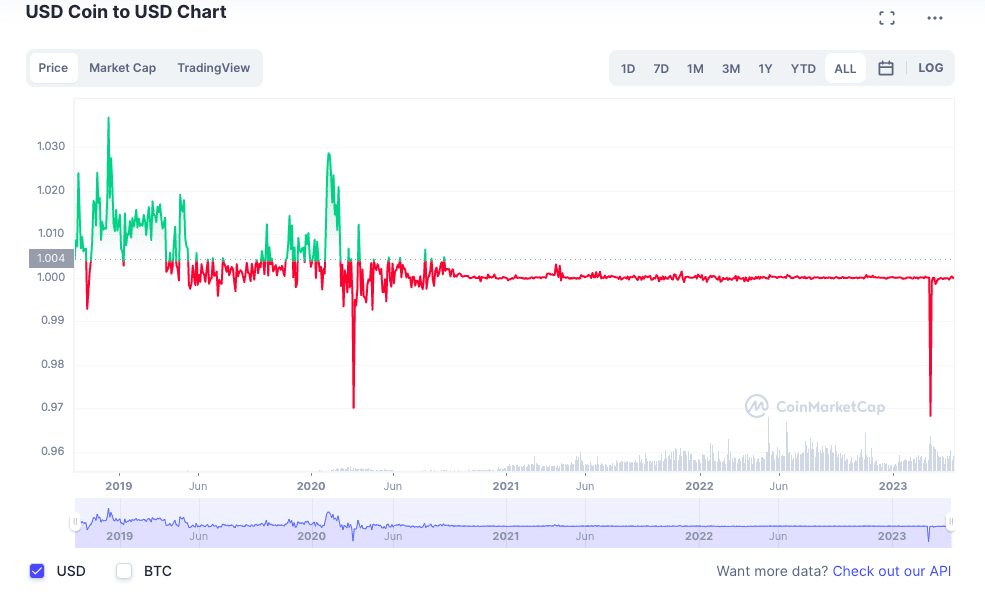

1 USDC should always be worth $1, though the price can sometimes fluctuate due to rapid market movements. When people buy or sell USDC in huge amounts in a short period, the price may move upwards or downwards, though it usually corrects itself very quickly.

DAI Price History

1 DAI should always be worth $1, though price fluctuations may occur. Price fluctuations usually happen when the demand rises or falls sharply in a short amount of time, but the price quickly recovers to $1.

Circle and DAI Market Cap

USDC Market Cap

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

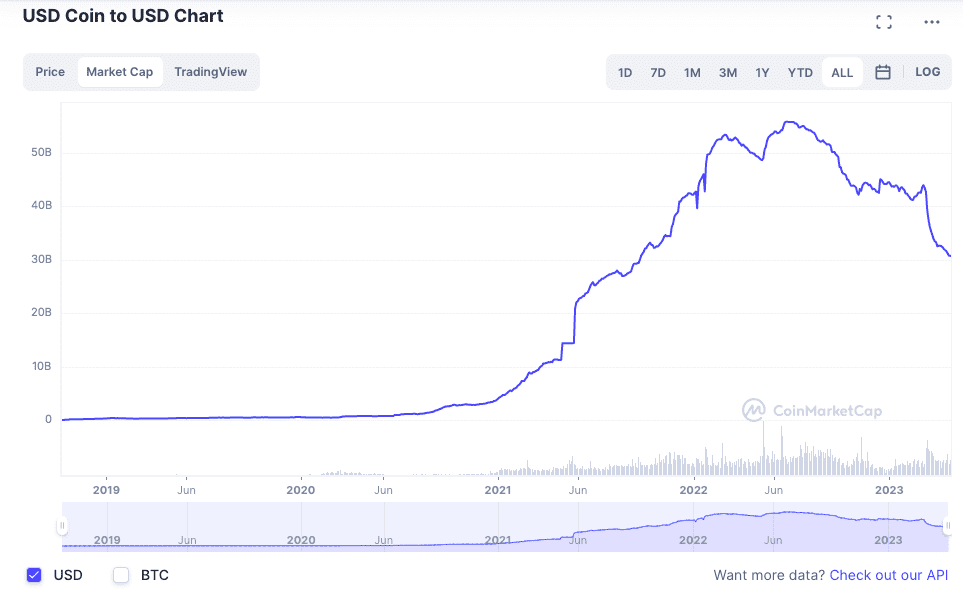

USDC is the second-largest stablecoin after USDT and the fifth-largest cryptocurrency by market capitalization. As of April 2023, there is a circulating supply of 32 billion USDC.

There is no set total supply for USDC as Circle-approved financial institutions can issue new USDC to the market as long as there is demand. When people sell USDC to get back their collaterals, the same institutions burn the excess USDC.

Although it was initially developed and launched on the Ethereum networks, USDC is now available on several blockchains, such as Solana, Hedera, Algorand, Tron, and Stellar.

DAI Market Cap

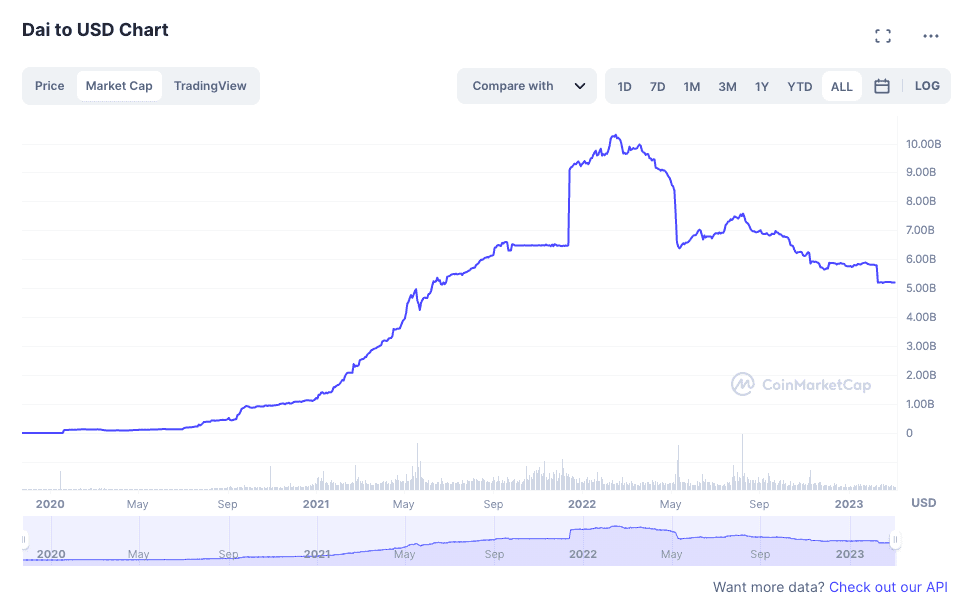

DAI is the fourth-largest stablecoin and the seventeenth-largest cryptocurrency by market capitalization. As of April 2023, there’s a circulating supply of 5.2 billion DAI.

There is no set total supply for DAI. New DAI tokens are automatically issued by the Maker Protocol smart contracts when people deposit collateral cryptocurrencies. MakerDAO is in charge of managing the protocol and deciding the collateral ratio.

Although MakerDAO has a reputation for autonomous and decentralized governance, the project is mostly controlled by the founding team, who own the majority of MKR tokens.

You can buy DAI on most crypto exchanges and deposit it on many DeFi protocols to earn interest.

USDC vs DAI Main Similarities

USDC and DAI are both stablecoins pegged to USD on a one-to-one ratio. Both assets are quite popular and can be found on most crypto exchanges. You can deposit or lock both assets in DeFi protocols to earn passive income.

The biggest similarity between USDC and DAI is how they are used in derivative finance applications. Both USDC and DAI are popular investment vehicles for earning interest. You can loan both assets to others with high-interest rates.

USDC vs DAI Main Differences

There are several differences between USDC and DAI, including differences in their market reach, pegging mechanisms, state of reserves, and governance. Let’s look at them in more detail.

Pegging Mechanism

In the previous sections, we explained how DAI and USDC work differently from one another. While USDC protects its peg by collateralizing real-world assets like cash and investments, DAI protects its value by over-collateralizing other cryptocurrencies, mainly Ethereum and USDC.

DAI is primarily backed by USD Coin (USDC) and Ether (ETH), as well as other tokens like Uniswap (UNI), Pax Dollar, Gemini Dollar (GUSD) and Wrapped Bitcoin, and a few others. That makes DAI almost completely dependent on several other cryptocurrency projects. If the value of these tokens crashes, the value of DAI can also drop.

Technically, the smart contracts operating the Maker Protocol are programmed to diminish the risks of devaluation through collateral liquidation. However, DAI could still lose value if a prominent token in its reserves completely crashed.

However, we should note that DAI has recently started acquiring real-world assets to decrease its dependency on crypto investments.

Since USDC is pegged to USD directly, it should remain liquid as long as Circle keeps enough cash reserves to back the asset. However, it should be noted that Circle doesn’t necessarily keep all the reserves in cash, and USDC could lose its peg if there aren’t enough reserves to support the token.

This brings us to the next big difference between these two assets.

State of Reserves

Stablecoin reserves are a thorny topic in general. For years now, Tether, the issuer of the world’s largest stablecoin USDT, staunchly refused to submit public audits despite calls from public and official authorities and despite several controversies regarding the assets backing.

USDC’s issuer Circle is no different. Instead of official audits, the company releases assessment reports from public accounting firms. Unfortunately, as many critics pointed out, the validity and the extent of the reports are far from transparent and decisive. Therefore, it’s impossible to know the state of USDC reserves without independent audits.

According to Circle, most USDC reserves consist of short-term treasury bills and cash equivalents.

DAI reserves, on the other hand, are more transparent. Since DAI is backed by crypto collaterals and smart contracts, the reserve information is public and can be accessed by anyone.

Governance

This one is a little tricky since MakerDAO and Circle aren’t very different when it comes to governance in practice. In theory, they are quite different. Let’s illustrate what we mean in more detail.

In theory, MakerDAO is a decentralized autonomous organization, which means DAI is managed by members of the Maker community. Community members can delegate their MKR tokens (Maker Protocol governance tokens) to representatives to vote on their behalf on critical issues about the DAI and MakerDAO. So, in theory, DAI is quite decentralized.

However, like most other “decentralized” projects, DAI is also quite centralized in its governance due to the pooling of MKR tokens at the hands of a few. These interested parties include venture capitalists and founders, and managers of the DAI. MakerDao founder Christensen holds enormous power in the DAI ecosystem.

For example, in 2022, MakerDAO passed a controversial plan regarding the future of stablecoin, thanks to Christensen’s MKR holdings. That means decisions regarding the project are, in fact, quite centralized.

On the other hand, USDC issuer Circle is a private, centralized company. Therefore the company controls the USDC minting process as well as any and all major decisions regarding the project’s future.

Market Capitalization

The biggest difference between USDC and DAI is their market cap. USDC is the second biggest stablecoin by market cap. DAI, on the other hand, is only the fourth.

USDC is accepted by most mainstream institutions and can be traded against almost all altcoins. DAI remains a rather niche stablecoin compared to USDC.

Risks Associated With USDC and DAI

Risk of Losing Their Peg

The primary risk with stablecoins is price volatility. Stablecoins can lose their price peg under certain circumstances, usually when their reserves are too low to back the number of tokens in circulation.

Such a scenario is possible if the issuing companies don’t keep enough cash and cash equivalents in reserves or if the reserves get stolen or lost or are otherwise inaccessible.

Stablecoins can briefly de-peg from their dollar value at times but usually quickly recover their price point. However, if a de-pegging event isn’t quickly followed by recovery, the price may spiral downwards, triggering insolvency.

Usually, that means the stablecoin in question will completely crash, wiping off its dollar value from the market and leaving token holders with worthless tokens.

With DAI and USDC, the risk of de-pegging may be compounded. Since USDC makes up most of DAI collateral, thus a problem with USDC reserves could also trigger a de-pegging event for DAI.

Since both DAI and USDC are popular assets in DeFi, the effects of a price crash could create ripples across the whole crypto market.

Let’s look at some concrete examples of possible issues:

In 2023, Silvergate Bank (SVB), a popular institution among crypto-businesses, declared bankruptcy. At the time, SVB held around 3.3 billion deposits from USDC, a significant amount that constitutes a generous portion of USDC reserves.

The news of SVB’s bankruptcy caused USDC to lose its dollar peg. While Circle was quick to assure investors they had the necessary funds to cover the missing 3.3 billion USD, the event exposed that even cash-based stablecoins are vulnerable to market failures.

USDC stopped spiraling only after regulators stepped in to announce that depositors would regain access to their funds. Normally, the FDIC deposit insurance only covers up to 250,000 USD, which is far lower than deposits held at SVB.

Of course, USDC’s de-peg would also have hurt DAI in the long term if the asset could not recover its price peg. But that’s not all. DAI is also collateralized by various other tokens, including Gemini USD (GUSD).

Gemini USD (GUSD) is a potential risk for DAI because Gemini itself is in serious trouble regarding its finances. Gemini lost around 900 million USD after the fall of Genesis, which managed the Gemini Earn program. If Gemini finances fail and GUSD prices fall, that could put DAI reserves at further risk.

Legal and Financial Risks

As we explained, stablecoins are perfect entry and exit points into the crypto market. You can buy stablecoins on an exchange and send them anywhere in the world to transfer large amounts of money.

As regulators become increasingly aware of how stablecoins are used, they are becoming warier about letting these assets move around the world without regulation.

As you know, the primary selling point of crypto coins like Bitcoin (now stablecoins) is fast and borderless transactions, unhampered by costly and time-consuming bureaucracies of the banking world.

While this is an attractive proposition, it also completely ignores why traditional banking works this way. Banks employ different kinds of regulations for a reason, and that is to prevent money laundering, financing terrorism, and other criminal activities.

In recent years, authorities have begun to track how stablecoin transactions are used to transfer funds illegally between actors and are taking steps to regulate these assets more thoroughly.

For example, when the Office of Foreign Assets Control ordered a sanction against Tornado Cash in 2022, crypto exchange services had to black-list several wallets connected to Tornado.

Tornado Mixer is an anonymous trading service for covering up one’s digital footprints on the blockchain and can be used for breaking OFAC sanctions and money laundering.

In the aftermath of the order, Circle blacklisted 38 wallet addresses holding at least 75,000 USDC. This is a relatively small sum for Circle (compared to SVB held 3.3 billion USD), but it still raised alarms in the crypto ecosystem about how regulations can put crypto investment at risk.

While crypto often markets itself as ruled by code, the truth is that in order to operate, these services must comply with the rules and regulations of the financial world.

Where Can You Buy USDC and DAI?

You can purchase USDC and DAI on almost all crypto exchanges. The biggest markets for DAI are Binance, Coinbase, Uniswap, and Kraken. Similarly, the biggest markets for USDC are Binance, Kraken, Uniswap, and Kucoin.

Most centralized exchanges allow you to buy DAI and USDC with fiat currencies like USD or EUR through online banking methods, including wire transfers, credit and debit cards, and third-party payment providers.

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

You can also obtain DAI by locking up collateral via the Oasis Vault Portal or DeBank and DeFi Saver.

How Can You Exchange USDC for DAI?

You can exchange USDC for DAI on most crypto exchanges. Uniswap and Curve offer large USDC/DAI markets, but you can check whether your crypto exchange lists USDC/DAI pairs.

Future Plans for Circle and DAI

The OFAC order against Tornado Mixer and the bankruptcy of Silvergate Bank (SVB) has been significant events for both USDC and DAI. The future of both assets depends on how people in charge of managing these assets will respond to these roadblocks.

MakerDAO has passed several plans in recent months that may spell huge changes for the stablecoin. In fact, whether DAI will stay a stablecoin remains an open question.

Let’s see future plans for DAI and USDC in more detail.

In 2022, the MakerDAO community held a vote on Rune Christensen’s controversial plan for DAI’s future, dubbed “Endgame.” Christensen is a loud proponent of “sustainable finance” and action against global warming, and the “endgame” plan consists of several scenarios to address his financial and environmental worries.

The plan consists of three phases and a lot of moving parts that the MakerDAO community can enact over time.

The short-term goal is to earn as much money as possible in order to be able to buy more ETH for DAI’s future. Since DAI is already based on Ethereum, Christensen argues, it makes sense to bet on ETH rather than USDC and other stablecoins.

The long-term goal is to decrease DAI’s USDC reserves in order to ensure reserve protection. In the long term, the plan requires MakerDAO to invest in real-world assets to diversify DAI reserves.

The plan foresees purchasing real estate and US government and corporate bonds to have protection against crypto instability.

At the final stage, the plan involves de-pegging DAI from USD to let it become a free-floating asset. This is incumbent on several other conditions but remains a real possibility in the future, depending on how the crypto economy develops.

Circle, on the other hand, has taken a different approach for more stability. Circle’s Tarleton Watkins suggested it’d be best if the stablecoin company could hold dollar reserves with the Fed instead of banks like SVB. Referred to as the full Fed reserve model, this would guarantee the safety of reserve funds without the risk of bankruptcy.

SVB’s bankruptcy exposed a bitter irony at the heart of crypto: Crypto economy was once hailed as a break with traditional financial institutions like banks. Bitcoin was famously launched as a battle cry against the failing banking system that unloaded its troubles on the public by making them pay for the mistakes of the failing banking institutions.

However, the latest crisis with SVB and USDC shows that things aren’t so straightforward.

USDC managed to regain its 1 USD peg only after Federal Reserve and the Treasury Department removed the FDIC coverage limit for SVB. Federal Reserve launched a new Bank Term Funding Program to mitigate the possible losses due to SVB’s failure, which the US Treasury Department supports with a 25 million USD fund.

Despite the apparent troubles with authorities, regulators may prove to be the saviors of crypto in the long term.