MEXC Global exchange is an unregulated cryptocurrency and crypto derivatives platform. The company is launched in 2018, and, like most other cryptocurrency businesses, it’s headquartered in Seychelles.

MEXC Global offers various services, such as spot trading for over 180 trading pairs, supports over 1,500 coins, and has advanced features like futures trading, margin trading with leverage, ETFs, staking, and a P2P market.

The exchange ranks among CoinmarketCap’s top exchanges list by trading volume and has a rating of 5.8. While the reported trading volume is small compared to big platforms like Binance or Coinbase, it does have deep liquidity.

The exchange is accessible to US-based users and allows them to trade derivative products. However, it isn’t clear if you can withdraw your profits from derivatives from the exchange.

US-based traders can’t access derivatives products on most exchanges due to the country’s crypto regulations. The fact that MEXC allows US traders to use the feature might seem nice, but it can be very problematic, as users probably won’t be able to withdraw their funds.

In this MEXC Global review, we’ll look into all aspects of the exchange, including the fees, features, and possible issues with the platform, so you can decide if it’s the right exchange for you.

Offer: Claim up to 1,000 USDT worth of bonuses for new users

Pros & Cons of MEXC Global Exchange

Pros

- Over 180 trading pairs and 1500 coins listed

- Competitive fees and zero-fee trading periods

- High yields from staking

- Supports many third-party payment apps

- Offers many derivatives products

Cons

- Not available to US-based customers

- Not regulated by financial authorities

About MEXC Global

MEXC Global was founded in 2018 and quite suddenly became one of the top-performing exchanges by trading volume, especially in regard to Ripple/Tether (XRP/USDT) markets.

The exchange was called MXC until 2021 when it rebranded itself as MEXC Global. There isn’t much information on the company besides the fact that it is founded by Metin Mehmet Durgun, and that the current CEO is John Chen.

The exchange is available in 9 different languages and over 200 countries if the official statement is to be believed.

The company claims MEXC “is regulated, either directly or through affiliates, by some of the world’s most renowned jurisdictions,” but the exchange doesn’t seem to have a license to operate in the US. While US-based users can access the exchange, this is most likely due to regulatory oversight.

It’s also possible that the exchange has obtained an MBS (money service business) certificate from FinCen for selling crypto but not for margin trading and/or derivatives.

This poses a tricky situation. You don’t have to complete KYC to trade crypto and use derivatives products on MEXC (which increases the likelihood that the exchange isn’t registered with authorities) but you have to complete KYC to withdraw your earnings.

If you are based in the US or any other area that restricts derivatives trading, you won’t be able to verify your account, preventing you from withdrawing your funds.

Another possibility is that authorities may take action against the exchange if they don’t have the proper licenses. In that case, the exchange will have to pay a fine and ban users from the US, and you may not have the time or the opportunity to remove your holdings.

Overall, MEXC Global is a risky exchange if you’re based in the US or other areas with strict crypto regulations.

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

Crypto Coins Available on MEXC Global

MEXC Global supports over 1,500 digital currencies, including popular digital assets like

As you can guess, the exchange lists an enormous amount of altcoins and tokens. This can be a good opportunity if you want exposure to low-cap altcoins, but it also increases the odds of wash trading and pump-and-dump schemes on the platform.

Low-cap coins are used as money-grabbing schemes, and traders try to take advantage of short-term opportunity windows.

Pump and dump operations are run on many exchanges, but unregulated exchanges that list hundreds of coins are typically hubs for this sort of market manipulation.

Fiat Currencies Supported on MEXC Global

While you can’t trade on the spot market with fiat currencies, you can buy cryptocurrency with fiat through the platform’s P2P market, OTC service, quick buy service, or with credit and debit cards.

The platform supports both Visa and Mastercard purchases. You can also use third-party payment services like Simplex, Banxa, and Mercuyo to buy cryptocurrencies. These platforms usually support multiple fiat currencies, including USD, GBP, EUR, and AUD.

The quick buy option lets you buy crypto with bank cards and Apple Pay, Google Pay, and Samsung Pay.

MEXC recently started allowing global bank transfers via SWIFT, ACH, Wire, and PIX. You can deposit USD or EUR to your account via bank transfers.

Finally, you can use the P2P market to buy and sell crypto for fiat. The market supports over 30 currencies and several payment methods, including Alipay, Skrill, and Advcash. You can also use Banxa, Mercuyo, and Moonpay to purchase digital assets on the P2P market.

Countries Supported on MEXC Global

MEXC Global is available in around 200 countries, but it isn’t very clear if the United States and Canada are among these countries due to ambiguous language used in the terms and conditions agreement.

The agreement states that the exchange may terminate suspicious accounts but doesn’t specify restricted countries. Instead, it gives a list of states from where it doesn’t accept trades or registration applications.

Currently, Canada and US-based users who complete KYC verification remain in “pending” status. Since crypto derivatives trading is not allowed in the US, there is little chance of users actually achieving verified status.

MEXC Global Trading Fees

Spot and Futures Trading Fees

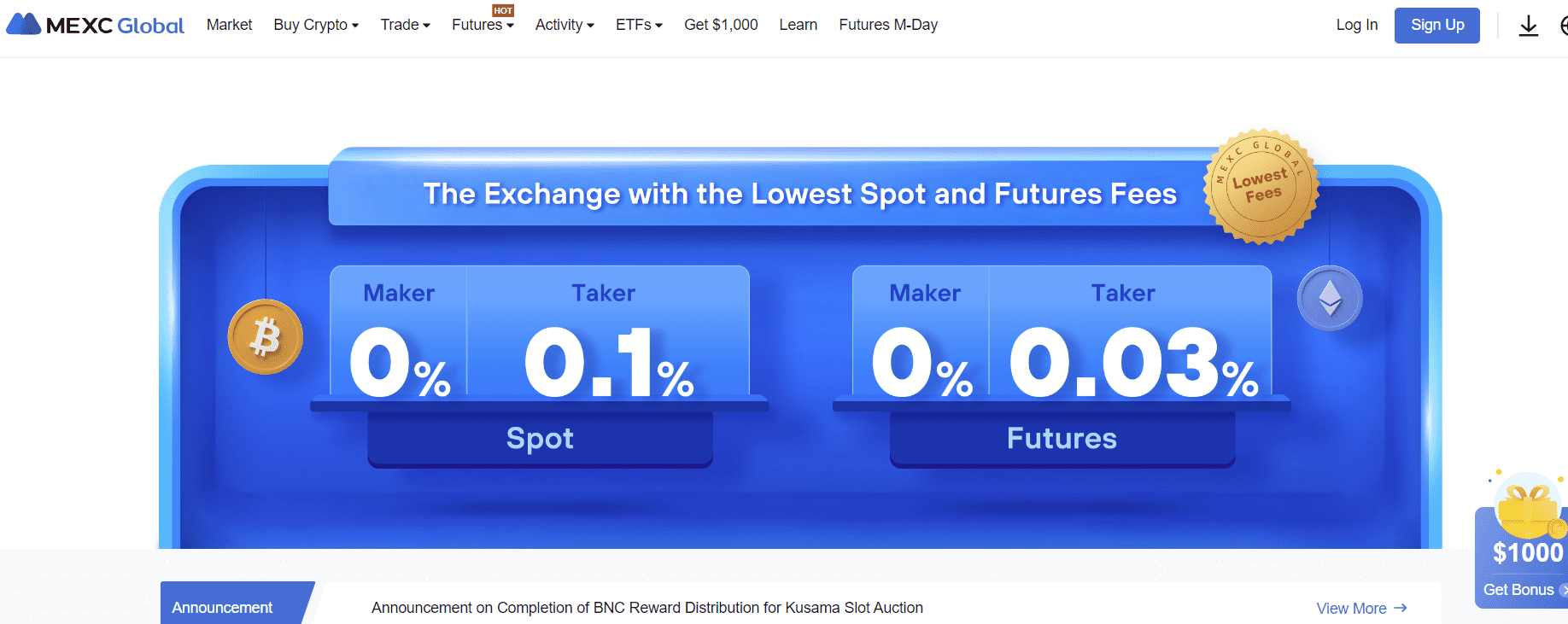

The platform uses a tiered maker/taker fee model. The standard spot trading fee is 0.2% for makers and takers. However, the platform is offering 0% fees for makers and 0.2% for takers as of December 2022.

Futures fees start at 0.060% for takers and are free for makers. You can earn trading fee discounts based on your 30-day trading volume.

Deposit and Withdrawal Fees

MEXC Global doesn’t charge deposit fees, but if you purchase crypto with third-party payment providers or credit cards, you’ll be charged associated fees.

Withdrawal fees and minimum withdrawal limits vary by the asset. For example, the minimum BTC withdrawal limit is 0.002 BTC and costs 0.0003 BTC. You can check out all the listed fees on MEXC Global website.

Beware that buying crypto with fiat can be expensive. Credit card companies, payment processors, and fiat gateways usually charge 1% to 5% fees.

Main Features of the MEXC Global Platform

MEXC Global offers many features, including spot and derivatives trading, P2P, mining pools, and trading bots. Let’s see some of the most notable features of MEXC Global in more detail.

Margin Trading

Margin trading is trading with borrowed funds to make higher profits. Since you trade with higher capital, you can end up with both large profits and losses.

MEXC offers margin trading with 5x to 10x leverage for several pairs. You can collateralize your funds to borrow crypto. Interest rates are charged hourly.

Derivatives Trading and Leveraged ETFs

Derivatives trading allows you to speculate on the future price of an asset and bet on your speculation. This type of trading can be very risky due to the volatile character of cryptocurrencies.

MEXC offers perpetual swap futures for many major cryptocurrencies, with leverage up to 125x on BTC and ETH. Most swaps require Tether as collateral.

You can also trade leveraged ETFs on the platform. Leveraged ETFs are futures contracts that track the price changes of an underlying asset.

P2P Marketplace

P2P trading is a good way to buy crypto directly from other users. P2P market supports various payment methods and allows you to buy and sell crypto with many local currencies. The platform has an escrow service to guarantee the security of P2P market deals.

MEXC Global Earn

There are several MEXC Global Earn products, including staking, third-party DeFi services, and trade mining. Trade mining deals offer you rewards for trading select tokens. Users receive shares from the prize pool based on their trading volumes.

Staking allows you to earn passive income on your cryptocurrency. The platform offers locked and flexible staking options for several coins. You can stake USDT, USDC, BTC, ETH, TRX, SHIB, DOGE, DOT, and many more on flexible terms.

Other earn products include a launchpad to invest in new tokens. New projects list their tokens, and traders can invest in the projects for cheap. Beware that most tokens don’t have a working product and never will. Investing in new crypto projects is very risky and rarely leads to profits.

Copy Trading

MEXC has a feature called Copy Trading, which allows you to follow other successful investors and mirror their trades.

If you are a beginner or don’t want to develop a strategy, you can follow successful crypto investors and copy their strategies.

How Easy Is It to Open a MEXC Global Account?

Opening a MEXC Global account is very easy. Go to the official MEXC Global website and sign up with your phone number or email address. You’ll receive a verification notification to sign in. Once you log in, you can start trading immediately without completing KYC.

MEXC Global doesn’t enforce KYC to trade on the platform. You can trade digital assets on the spot and futures markets without verifying your identity. However, you have to complete KYC verification to withdraw your profits from derivatives or make fiat currency purchases.

Please beware that US and Canada-based users report they can’t complete KYC verification.

How Secure Is MEXC Global?

MEXC Global employs industry-standard security measures, including cold storage for assets and two-factor authentication. You can enable extra security measures like SMS authentication, anti-phishing code, or setting up a password to withdraw funds.

The exchange joined the TRUST Network in 2022, a crypto industry network that complies with the Travel Rule that requires crypto exchanges to share basic information regarding their customers when sending funds from one exchange to another.

Has MEXC Global Ever Been Hacked?

MEXC hasn’t reported a hack or security breach.

Is MEXC Global a Regulated Exchange?

MEXC Global claims to be licensed and regulated by several authorities but doesn’t clarify which. Given that US-based users can’t complete KYC and that the exchange allows margin and derivatives trading, it is safe to say that US authorities don’t regulate MEXC Global.

If MEXC Global isn’t registered as a business in the US, users may risk losing their funds when authorities take action.

How Does MEXC Global Compare to Other Crypto Exchanges?

MEXC Global provides a lot of services, including spot and futures trading, earn products, staking, and access to a great number of markets. Let’s see how it compares to Binance, another comprehensive crypto platform.

Fees

MEXC Global charges 0.2% maker fees and 0% taker fees on the spot market. Binance spot market fees start at 0.10% for both makers and takers, but there are also several zero-fee trading pairs.

Please beware that MEXC is primarily a crypto-to-crypto exchange. Buying crypto with fiat can be expensive due to third-party fees. The exchange doesn’t charge deposit fees, but payment providers usually charge handsomely for the service.

Features

MEXC Global and Binance are very similar when it comes to features. Both platforms offer professional trading tools, margin trading, futures trading, staking, and so on.

The primary difference between MEXC and Binance is the number of offered coins. MEXC lists around 1,500 coins, whereas Binance offers around 350. If you want to explore no-name coins (think of them like penny stocks but unregulated), MEXC offers more opportunities.

Binance has a higher trading volume and is the biggest cryptocurrency exchange in the world.

Security

Please note that neither platform has undergone an official audit by an independent auditor. The public has no way of knowing how they deal with customers’ funds without such an audit.

Binance has been hacked a couple of times in the past years and experienced security breaches, withdrawal suspensions, and regulatory issues. MEXC Global hasn’t reported a hack since its launch.

As a rule of thumb, avoid placing large sums of crypto in centralized crypto exchanges. You may lose your savings if the exchange declares bankruptcy, freezes withdrawals, or becomes inaccessible due to regulations.

Does MEXC Global Have an App?

Yes, the MEXC Global exchange platform has a mobile app for iPhone and Android users. The app is available on both the App Store and Google Play stores.

The app operates in the same way as the desktop version and allows you to perform spot trading as well as margin trading from anywhere in the world.

Not only is the app a good option for those who already have a MEXC Global exchange account, but new users can also sign up for the platform via the app.

Make sure you download the official app, as there are unofficial scam apps that can use your information to access your funds.

MEXC Global Review: Final Thoughts

MEXC Global has become a popular exchange that offers a large number of cryptocurrencies and markets. However, its regulatory status is unknown, and the company reps haven’t been forthcoming about their business.

The platform allows US users to register and trade derivatives products, which breaks US crypto regulations. It’s likely that the exchange doesn’t have a license or has been working around the regulations. In any case, this means that US users may not be able to withdraw their profits from the platform and that the platform can soon become inaccessible.

You don’t have to complete KYC verification to trade coins, but you may have to for certain operations, including withdrawing from the exchange.

The platform features a spot market, futures, margin trading, perpetual swaps, P2P market, derivatives trading, options, and staking opportunities. There are over 1,200 coins you can buy on the platform.

Overall, MEXC can be hard to navigate if you’re a beginner.

To learn more about other cryptocurrency exchange platforms, check out our post on the Best 22 Crypto Exchanges.

MEXC User Reviews

Review Summary

Recent MEXC Reviews

Fraud

I became a victim of a fraudster who made me an account in Mexc and invested my money, there was an error when transferring the withdrawal of money and the money allegedly remained in Mexc and now I have been contacted by the alleged administrator of Mexc and that he will help me unblock the blocked account but it is necessary to pay 10 thousand euros, I have no idea how to check if it is realistically possible

(Originally written in Czech)

Scam

At first I was able to withdraw some money. As I invested, my money grew. When I wanted to withdraw it detected. The withdrawal and froze it. It asked me for 5000 dls. For unblocking. After I did it I tried to withdraw and they told me that my account was at risk in the block chain they asked me for 4999 dls which. I did it I wanted to withdraw and it wouldn’t let me. But I could operate I bought a coin of 80 000 USDT and asks me to pay 40200 dls according to taxes on 500 220 USDT of earnings I paid 34 500 and adjusting but I can not withdraw my funds I do not know what to do or who to turn to before this situation already seemed to me. A scam and I am in debt and already sick.

Note Comment originally written in Spanish.

Token killer

This exchange is a token killer please for new tokens about to launch don’t go anyway near it. I have lost so much from 5tokens that got listed there. Ai doge, Simpson PNB and Hosky just to mention these few.

I invested and won but it asks me to deposit to withdraw I don’t know what to do.

I was able to Deposit to withdraw and I don’t know if it works, I’m afraid of being scammed.

(Originally written in Spanish)

Futures are not available for Canada clients

MERC confirms that Canadians can use the exchange, but in reality it’s very limited because Canadians are not allowed to complete KYC.

Be honest MERC.