Tether (USDT) vs USDP

Tether’s USDT and Paxos’s USDP are both stablecoins pegged to USD, meaning they should always be worth 1 USD.

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

In this Tether vs. USDP review, we’ll compare their similarities and differences and explain the risks and benefits associated with each coin.

The History of Tether (USDT) and Pax Dollar (USDP)

USDP was launched in 2019 by Paxos Trust Company based in New York. The asset was called Paxos Standard (PAX) at its launch but was rebranded as Pax Dollar (USDP) in 2021. It’s the sixth-largest stablecoin in the market by market cap.

In 2019, Paxos started issuing the world’s first regulated gold-backed token, PAX Gold. In 2021, the company received SEC approval to test blockchain technology for settling stock trades. As of 2023, it’s trying to negotiate with the authorities to start a bank charter.

However, recent developments may have thrown a wrench in those plans, as Paxos’s reputation took a hit due to their collaboration with Binance in issuing BUSD, Binance’s stablecoin.

USDP is known as one of the first regulated stablecoins in the market, but the company has been embroiled in various controversies recently.

In Feb 2023, Paxos announced that the company would stop issuing BUSD after it was revealed that BUSD had lost its peg several times in the past years, and Paxos only kept reserves for BUSD issued on the Ethereum blockchain, but not on the BNB chain.

Paxos has a coveted crypto license from The New York Department of Financial Services (NYDFS) as a stablecoin issuer, but Bloomberg has reported that the NYDFS is investigating the company. Paxos was in the works to collaborate with PayPal to offer a new stablecoin, but the plans were paused in light of recent events.

Both BUSD and USDP redemptions increased exponentially after the news hit the stands, and USDP supply diminished by 19% soon after. BUSD and PAX Gold also saw a significant increase in redemptions.

Finally, Silvergate bank, one of Paxos’s partners, revealed its teetering on the edge of bankruptcy in Feb 2023. Paxos claims it has no material exposure to Silvergate, but the effects of the bank’s fallout remain a mystery.

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

USDT was launched by Tether Holdings Ltd. in 2014. It’s the largest stablecoin by market cap but has a very controversial reputation.

Tether Holdings is a subsidiary of iFinex, the company which also owns the Bitfinex exchange. The relations between the two companies were only revealed in 2017, sparking outrage and a huge lawsuit.

Tether has been accused of manipulating Bitcoin price by issuing unbacked USDT and using it to purchase BTC when the assets market price was falling. Further investigations by US authorities revealed Tether had loaned its reserves to Bitfinex, leaving the stablecoin unbacked between 2019 and 2021.

Tether settled with the New York State Attorney General’s (NYAG) office and the CTFC by paying around 60 million USD in fines.

To learn more about Tether and Paxos, check out our articles on USDT, Bitfinex, and BUSD.

How Do Tether and USDP Work?

USDT and USDP are stablecoins pegged to USD. Basically, unlike volatile cryptocurrencies, they should always be worth 1 USD.

In theory, stablecoins hold their value by having reserves (except algorithmic stablecoins, but those seem to have lost all credibility since Terra UST’s disastrous descent into nothing).

The issuer puts assets (cash, cash equivalents, sometimes other cryptocurrencies, stocks, and so on) in reserve in exchange for every token they issue, something known as collateralization. This way, when people want to redeem their tokens, they can get their money back.

However, stablecoins have been very contentious since their launch because the issuer companies don’t really have to prove that they have the reserves to back their tokens.

USDT, for example, became the largest stablecoin in the world without proving the stablecoin was pegged to USD one-to-one. For a long time, crypto markets simply took Tether for its word (and mostly still do despite the authorities’ warnings).

On paper, Tether and Paxos have similar collateral mechanics: You send them money, and they issue you stablecoins. When you redeem your coins, you get your money back.

Technically, the exact procedures may be a little different: These companies usually issue coins to other market makers like exchanges and capital investment companies, and individuals (retail buyers) usually purchase coins from crypto exchanges.

Both companies publish attestations from public accounting firms to prove they have the reserves they claim. However, it should be noted that attestations aren’t exactly proof: accounting companies only comment on the reports provided by issuers and don’t review the truth of those statements.

The issue is further complicated by crypto firms’ relations with banks: Most banks don’t accept crypto companies as customers, and the few that do are in serious trouble. The Silvergate Bank has recently announced its troubles with finances after FTX fell and was dropped by many customers, including Paxos. It remains to be seen whether the bankruptcy of these institutions will trigger another market crisis.

What Are the Main Use Cases of USDT and USDP?

As the largest stablecoin in the world, USDT has several use cases:

You can use it to purchase other cryptocurrencies on crypto exchanges or trade your assets for USDT. There are thousands of altcoins in the crypto market, and usually, you can only purchase these with stablecoins like USDT and USDC.

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

USDT is mostly used in decentralized finance protocols. Pretty much all DeFi experiments use USDT in one way or another. Users can stake or loan their assets to earn passive income from their USDT funds.

You can easily move around large amounts of money through USDT and USDP. Normally, it takes some time to move large amounts of money in and across country borders, as there are several anti-money laundering checks built into the banking system. Stablecoins are a fast way to move around money, though this is also one of the reasons why authorities are very interested in regulating them.

USDT and USDP Price History

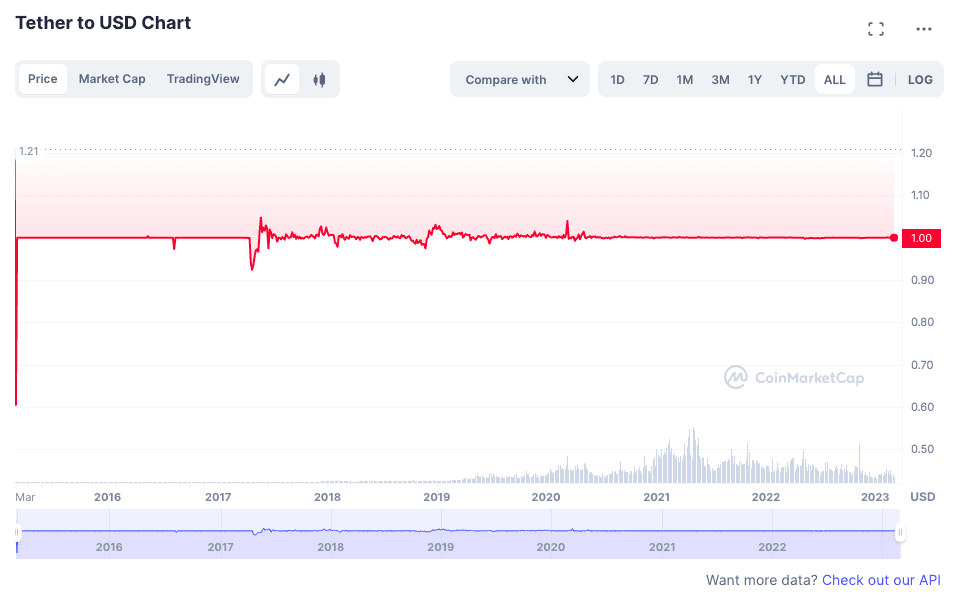

USDT Price History

Over the years, USDT price has remained relatively stable at $1. Slight price fluctuations occur during high-traffic trading periods, but the price quickly recovers to $1.

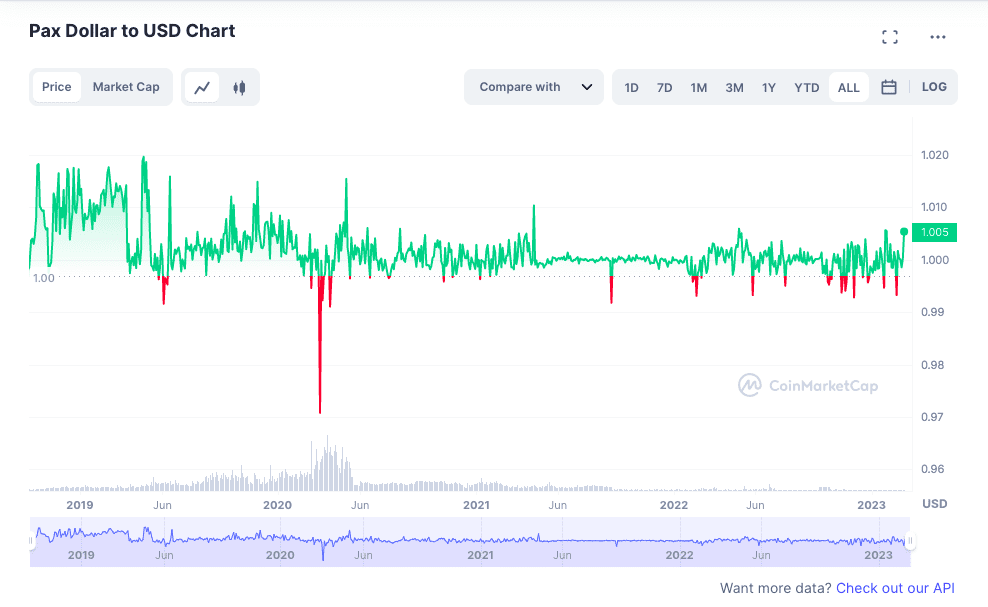

USDP Price History

1 USDP should always be worth $1, though the USDP price shows slight fluctuations at times. Fluctuations may be due to rapid market movements.

Tether and USDP Market Cap

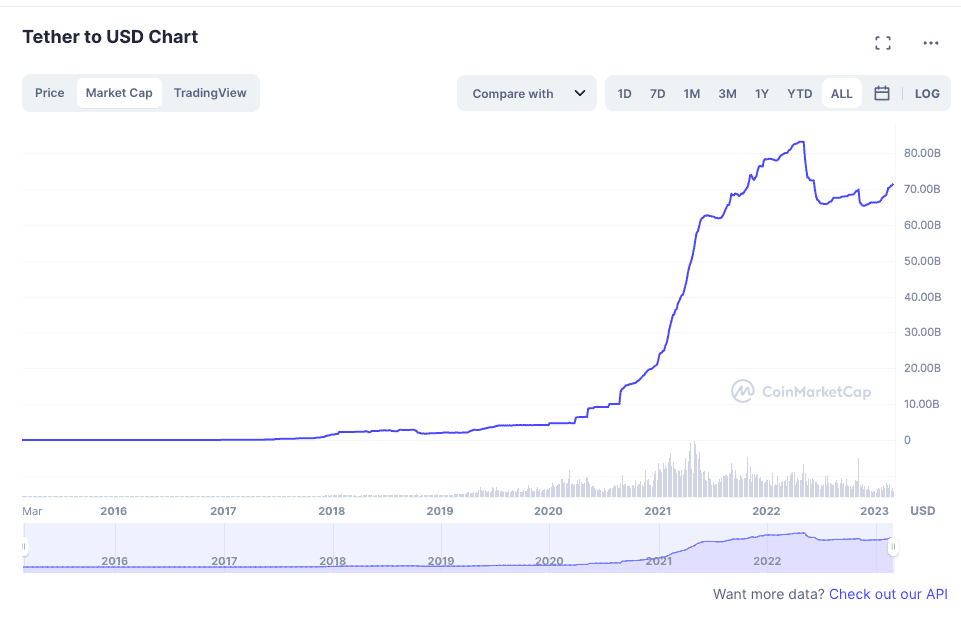

USDT Market Cap

As of February 2023, there are over 60 billion USDT tokens in circulation. There is no set total supply, as Tether issues new USDT tokens when there is demand and burns the surplus when USDT is redeemed. Tether controls the USDT supply.

You can find and trade USDT on all major exchanges. The coin is issued on many blockchain networks, including Ethereum, Solana, Algorand, Hedera, and Tron.

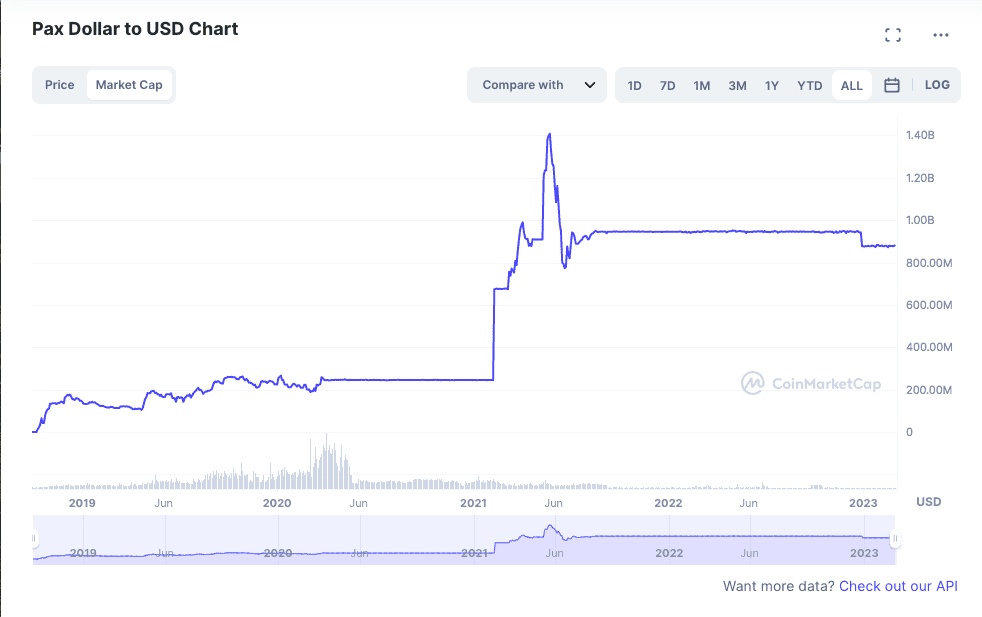

USDP Market Cap

USDP is the 6th largest stablecoin by market capitalization. As of January 2023, there is a circulating supply of 877 million USDP.

USDP doesn’t have a total supply, as USDP tokens can be issued or burned based on the demand for the asset. The process is controlled by Paxos.

USDP runs on the Ethereum blockchain and is available on most crypto exchanges.

USDT vs USDP Main Similarities

USDT and USDP are both stablecoins pegged to USD. Neither asset has a set supply, as they can be minted depending on the demand.

You can find USDT and USDP on most crypto exchanges. You can use both stablecoins to send funds to others quickly through blockchain networks.

Governance

Both Tether and Paxos are private and for-profit companies. That means USDT and USDP are both centralized assets.

USDT vs USDP Main Differences

USDT and USDP have quite a few differences, including their market reach and regulatory status.

Market Reach

USDT is the largest stablecoin in the market and can be used in almost all DeFi protocols for various purposes. USDP is a relatively minor stablecoin and doesn’t have a lot of DeFi uses.

You can trade USDT with most cryptocurrencies, but USDP pairs are less common.

Regulatory Status

Paxos markets USDP as one of the first regulated stablecoins in the world. Paxos has a license from the NYDFS to issue USDP.

However, it has been reported that NYDFS is investigating Paxos, possibly because of the company’s involvement in issuing BUSD.

In 2023, it was revealed that while Paxos-issued BUSD tokens had been sufficiently backed as the company promised, Binance-issued BUSD hadn’t been. While Paxos doesn’t accept responsibility for the confusion, it’s clear that Binance used Paxos’s reputation and regulatory relationship with NYDFS to market BUSD as a regulated and backed-up asset.

Tether and, by extension, USDT are both unregulated.

State of Reserves

Tether and Paxos both publish attestations about the stablecoin reserves.

Tether’s assessments come from BDO Italia. The company hasn’t been audited, despite widespread controversy regarding its reserves.

Paxos publishes assessments from WithumSmith+Brown, PC, an independent third-party accounting firm. The assessments include liabilities and other details to increase public trust in Paxos.

Risks Associated With Tether and USDP

Risk of Losing Their Peg

Tether’s missing reserves caused a huge controversy in the crypto markets because if USDT isn’t sufficiently backed, a strong bank run may cause a downward spiral for the whole crypto economy. USDT has become the backbone of most DeFi projects since its launch, with several other stablecoins backed by USDT.

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

Since USDP doesn’t have the market reach of USDT, it wouldn’t cause a catastrophe even if the stablecoin collapsed. However, that isn’t very likely, as the company claims USDP reserves are protected from liquidation even if Paxos went bankrupt. On the other hand, it isn’t clear what happens if the banks that hold Pexos reserves go bankrupt, but we might be about to find out: Silvergate bank, one of Paxos’ custodians, is on the brink of bankruptcy.

Legal and Financial Risks

Tether has been in hot water with regulators ever since 2017 when its relation to Bitfinex and the state of its reserves became a public concern. With further reports on crypto revealing more and more about USDT and its relation to Binance, FTX, Alameda, and other questionable actors, there is a possibility that Tether will run into legal problems in the near future.

USDP is generally regarded as a low-risk stablecoin, both financially and legally. However, it remains to be seen whether the company will keep its NYDFS license after the latest events surrounding the former BUSD issuer.

Where Can You Buy USDT and USDP?

You can purchase both assets on popular crypto exchanges, including Coinbase, Bitfinex, HTX, and Binance.

You can buy USDP and USDT with fiat currency through payment methods like credit and debit cards, bank transfers, third-party payment providers, Paypal, Apple Pay, and Google Pay.

You can also purchase USDT and USDP on decentralized exchanges in exchange for cryptocurrency.

Canadian crypto users can’t use Crypto.com to buy USDT, as the exchange delisted the asset due to regulatory issues. It remains to be seen whether other exchanges will follow suit.

How Can You Exchange USDT for USDP?

You can exchange USDT for USDP on most crypto exchanges, including Coinbase, Kraken, and Bitfinex. Just check whether the crypto exchange you choose lists the USDT/USDP paring.

Future Plans for Tether and USDP

Despite all the controversy, Tether and USDT remain on top of the crypto markets. However, whether Tether will manage to protect its dominance remains to be seen, with journalists, blockchain analytics firms, and the US authorities investigating the asset and its ties to suspicious markets. New and stricter rules for stablecoins are also coming, with SEC tightening rules on reserve holdings.

USDP lost some market ground following the bust of BUSD, but that’s not the end of bad news for the company and the asset. There are rumors that the company’s application to form a national charter is on shaky ground with the latest allegations, and the payment giant PayPal has paused its plans to establish a stablecoin with Paxos.