USDT vs MIM

Tether’s USDT and Abracadabra’s MIM have a fixed price point of 1 USD. Unlike cryptocurrencies with free-floating value like BTC or ETH, these assets are supposed to remain at 1 USD, thus the name “stablecoin.”

Let’s check out how MIM compares to USDT and the benefits and drawbacks of investing in these stablecoins. Here is our USDT vs MIM review.

The History of Tether (USDT) and Magic Internet Money (MIM)

Magic Internet Money (MIM) was launched in 2021 by Abracadabra.money, a DeFi platform founded by two anonymous co-founders and Daniele Sestagalli.

Daniele Sestagalli’s crypto venture network includes several products, including the Wonderland project. In January 2021, it was revealed that Sestagalli had knowingly employed Micheal Patyrn as the treasurer of the Wonderland project.

Patyrn was one of the co-founders of the QuadrigaCX, a now-defunct Canadian exchange revealed to be a Ponzi scheme. Patyrn was convicted of robbery and other crimes, including bank, computer, and credit fraud.

Easily one of the most famous people in crypto-related crime, Patyrn’s involvement with Wonderland brought the project to ruin once the news hit the public. However, in true crypto fashion, this failure only meant the start of another venture.

Patyrn, after his exile from Wonderland, started a new venture called Sifu’s Vision. Wonderland invested 25 million USD to the project, with Patryn’s TIME tokens swinging the vote in his favor.

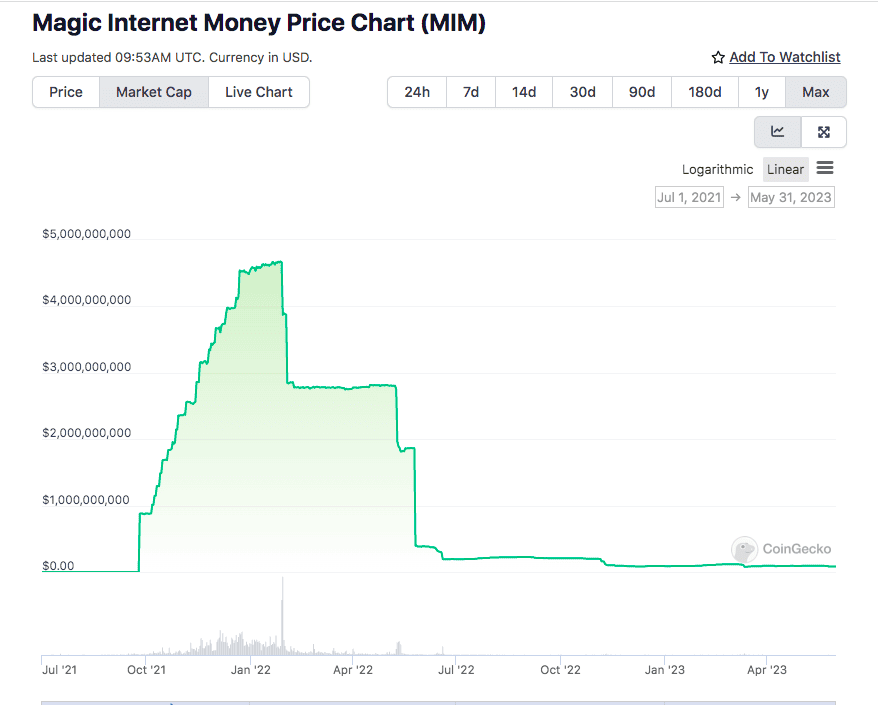

In the meantime, MIM depegged twice. The first price swing happened right after UST tanked in May 2022, as MIM had been largely collateralized by UST.

The stablecoin managed to recover its price again but lost its peg once more in November 2022, as FTX’s native token, FTT, tanked.

MIM is a minor stablecoin though it has somewhat moved up in ranks, especially after the collapse of UST.

Tether Holdings Ltd. launched USDT back in 2014 as the world’s first stablecoin. Thanks to its early start, it still dominates the market as the largest stablecoin.

USDT quickly became the cornerstone of the crypto-economy after its launch. It was first sold on the Bitfinex exchange and was adopted by other crypto exchanges once it proved its usefulness.

In 2017, it was revealed that Bitfinex and Tether were owned by the same company, iFinex, leading to charges of market manipulation and fraud. Researchers and journalists argued that iFinex had used USDT to manipulate BTC prices and trade against Bitfinex customers.

In 2021, US authorities conducted investigations into Tether and its parent companies Bitfinex and iFinex. The queries revealed that USDT had been severely unbacked for years. While iFinex and Bitfinex paid a substantial amount to settle the investigations, the asset’s reputation took quite a hit that has been hard to recover.

If you want to learn more about these stablecoins and their histories, visit our separate reviews of USDT, MIM, and Bitfinex.

How Do Tether and MIM Work?

USDT and MIM are both stablecoins, but they work somewhat differently.

Stablecoins often depend on collateral to keep their value. For example, USDT is pegged to the US Dollar, which means it should always be worth 1 USD. To ensure that’s true, Tether is supposed to keep enough cash and cash equivalents in its reserves so that anyone can swap 1 USDT for 1 USD anytime they want to.

While the state of Tether’s actual reserves remains pretty controversial, the theory is sound, and as long as the reserves are strong, the stablecoin remains stable.

MIM, on the other hand, is a bit different. It’s “soft-pegged” to the US dollar and is collateralized by other tokens and particularly interest-bearing tokens.

MIM isn’t the only stablecoin to be propped up by other tokens. For example, DAI stablecoin uses other stablecoins like USDC and USDT for its reserves (among others). But MIM takes it a step further by using interest-bearing tokens as reserves.

Interest-bearing tokens are basically receipts. When you stake an asset like USDT or BTC in a DeFi project to earn yields, you receive interest-bearing tokens in exchange, like yUSDT. These are pretty much illiquid, so you can’t really do anything with them.

However, Abracadabra allows you to deposit your interest-bearing tokens (ibTKNs) as collateral to borrow MIM from the platform. Since MIM is a stablecoin, you can use it to buy more assets and make further investments. That basically allows you to earn interest on your already staked tokens.

It’s an interesting business cycle that offers rewards but can also be perilous if something goes wrong. For example, if your collateral loses its value, it’s immediately liquidated. Professional traders often liquidate retail traders to make big bucks.

What Are the Main Use Cases of USDT and MIM?

As the largest and most popular stablecoin, USDT is the unofficial “official” currency of the crypto economy. You can trade almost all digital assets with USDT. It’s the lifeblood of several DeFi projects, as it’s considered a very liquid and profitable investment vehicle. Anyone can easily and quickly transfer USDT to make payments.

MIM isn’t as popular as USDT and has limited use cases: you can use it to purchase USDT and other tokens on certain exchanges.

USDT and MIM Price History

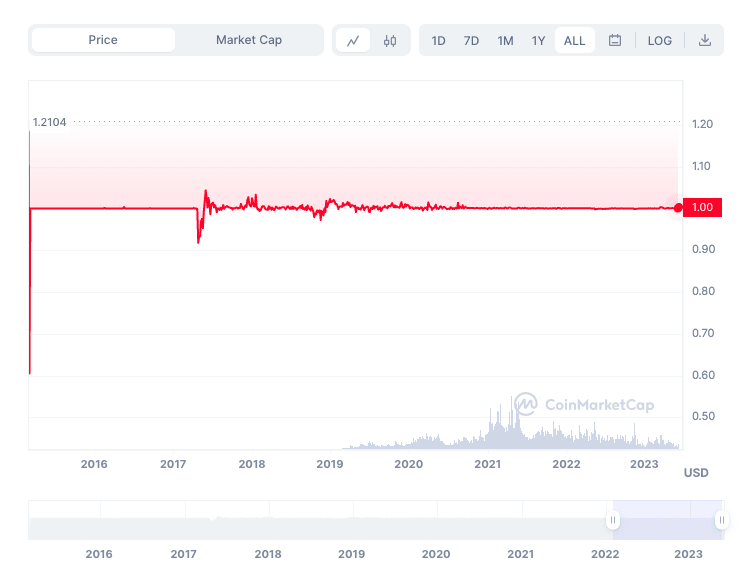

USDT Price History

The USDT price is fixed at $1, but it’s prone to slight fluctuations, though it usually recovers its 1 USD peg quickly.

MIM Price History

Although MIM should always remain at $1, the price has depegged at least twice during the controversial moments in the asset’s history. These fluctuations were due to the collapse of other underlying tokens like TIME or FTT.

Tether and MIM Market Cap

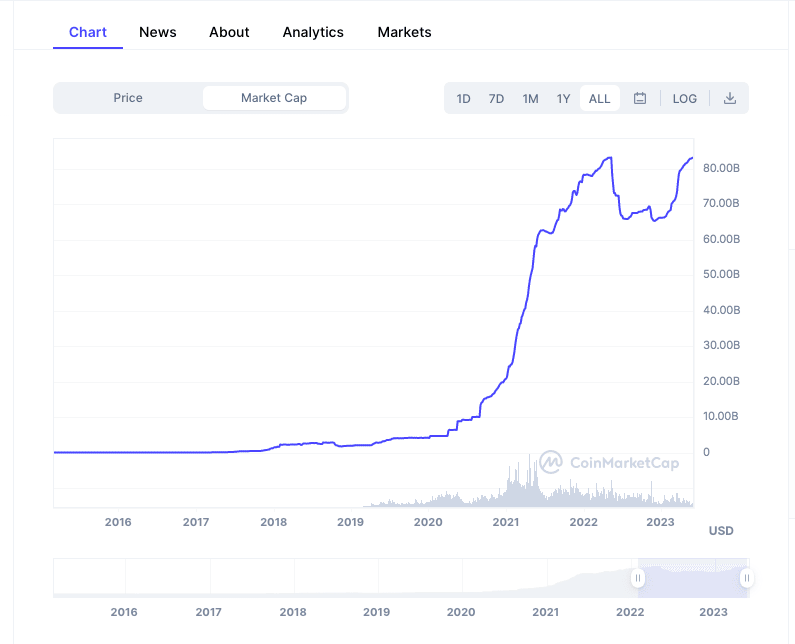

USDT Market Cap

The amount of USDT in circulation can vary depending on the demand for the asset. Tether mints or burns USDT depending on market dynamics. You can check out the current market cap by visiting the USDT page on Coinmarketcap. The USDT market cap increased from 60 billion USD to 80 Billion USD in the first quarter of 2023.

MIM Market Cap

MIM is a very small fry in the stablecoin business (51st by market cap) and doesn’t even break the top 10 stablecoins list. According to MIM, there are around 91 million circulating MIM tokens in the market. It’s hard to estimate its true market cap since numbers are self-reported by the project and may not reflect the right amount.

USDT vs MIM: Main Similarities

USDT and MIM are both stablecoins pegged to USD.

Governance

Tether is a private and for-profit company, so USDT is very much centralized.

MIM, on the other hand, is marketed as a decentralized asset managed by an algorithm.

However, the MIM project was founded and managed by Abracadabra.Money, another private, for-profit company. Please keep in mind that “decentralized” is a hype word used in crypto marketing, but most decentralized protocols are actually quite centralized, with power concentrated in the hands of a few.

Neither token is regulated.

USDT vs MIM: Main Differences

USDT and MIM are very different despite being stablecoins. They not only have different collateral mechanisms, but their market reach is also beyond compare.

Market Cap

While USDT is a giant in the market, accepted by almost all crypto exchanges, MIM is a minor stablecoin mostly traded in decentralized exchanges.

Reserves

As we explained before, the MIM reserve consists of interest-bearing tokens. So the value of MIM is dependent on other cryptocurrencies like Ether or USDT.

USDT reserves are made of cash and cash equivalents like treasury bills and commercial paper, though Tether hasn’t released an audit despite regulatory pressure.

Risks Associated With Tether and MIM

Risk of Losing Their Peg

It remains unclear whether USDT has a reserve problem or a transparency problem, but with the company staunchly rejecting to put forward an audit of its reserves, it is impossible to know.

What we do know is that if USDT loses its peg, the fallout could wreck the whole crypto economy and cause a ripple effect that will also negatively impact the non-crypto economy.

USDT is heavily used by almost every actor in the crypto economy, so if the token value was to plummet, the ensuing crisis could wipe off billions from the market.

If MIM loses its peg, the users can lose their entire investments and collaterals.

Legal and Financial Risks

Tether and USDT face a lot of legal scrutiny from authorities. Tether’s reserves constitute one problem, but authorities are also looking into Tether’s role in crypto-related money fraud.

MIM is an unregulated token launched by Daniele Sestagalli and two anonymous partners. Sestagalli received much criticism from the public after it came out that he knowingly employed former fraud convict Patryn as his project treasurer at Wonderland.

Sestagalli promised to refund Wonderland users who lost hundreds of millions of dollars after the project’s catastrophic end but never did.

Where Can You Buy USDT and MIM?

Thanks to its enormous popularity, USDT can be bought on almost all crypto exchanges. You can find it on centralized exchange platforms like Kraken, Gemini, Coinbase, and Binance.

You can buy MIM on several decentralized exchanges like Uniswap and Sushiswap, as well as on Bitfinex, in exchange for USD and USDT.

USDT has been delisted from Crypto.com for Canadian crypto users due to regulatory issues.

How Can You Exchange USDT for MIM?

You can exchange USDT for MIM on Bitfinex.

Future Plans for Tether and MIM

US authorities plan to regulate stablecoins more strictly in the coming months. The CTFC and SEC are also more active in pursuing crypto companies that don’t comply with existing regulations. It’s not very clear how these will affect Tether and USDT in the near future.

When it comes to MIM, Sestagalli announced he was leaving DeFi in Jan. 2022 after his role in Patryn’s participation in Wonderland became public, and the project’s native token tanked. Of course, the retirement didn’t last very long. In July 2022, he announced his return on Twitter.

MIM lost a lot of value after the fall of UST, Wonderland, and FTT. The project remains a minor stablecoin.