USDC vs BUSD

USD Coin (USDC) and Binance USD (BUSD) are very prominent in the crypto market as the second and third-largest stablecoins in the market. In this USDC vs BUSD review, we will compare and discuss the risks of investing in these assets.

The History of USD Coin (USDC) and Binance USD (BUSD)

USD Coin was launched in 2018 by the US-based crypto exchange Coinbase and its partner company Circle Consortium. The coin quickly became a prominent asset in the market, touted as a regulated and transparent alternative to the stablecoins in the market.

However, in 2020 it became clear that despite Coinbase’s initial promise to keep USDC reserves in cash, the company had broadened its reserves to include a multitude of assets, including cash, cash equivalents, commercial paper, corporate bonds, and US Treasury bonds.

USDC’s price peg and market cap took a serious hit in 2023 once the Silvergate Bank (SVB) applied for bankruptcy protections. At the time of bankruptcy, Circle kept 3.3 billion USD in SVB as part of USDC reserves. One of the few banks in the US to collaborate with crypto companies, SVB’s bankruptcy signaled even the cash assets kept in banks might not be safe from market failures.

The asset recovered its peg once the US authorities stepped in to announce FDIC limit (250.000 USD) would be removed to cover the losses of SVB bank.

BUSD was launched on Ethereum and Binance Smart Chain in 2019. Binance advertised BUSD as a regulated and transparent token, developed and managed in collaboration with Paxos, a regulated NY-based fintech company. BUSD quickly became the third-largest stablecoin in the world.

However, in 2022, Paxos announced that only Ethereum-based BUSD tokens were minted and backed by Paxos. The company’s reserves did not cover the BUSD tokens issued on BNB Smart Chain. US authorities started investigating Binance and Paxos for deliberately misleading customers and possibly committing other crimes.

In 2023, journalists and data analysts reported that BUSD had been largely unbacked throughout 2020 with an almost 1 billion USD deficit in reserves. Binance claims the assets have been 100% backed by 2023.

How Do USDC and BUSD Work?

Since USDC and BUSD are both USD-pegged stablecoins backed with reserves, they work similarly.

In theory, issuers keep a dollar in their reserves for every coin they issue. So basi̇cally, you give them a dollar, and you get 1 USDC or 1 BUSD. When you want to cash out, you take your tokens to the company, and they give you your dollars back. In other words, reserves ensure your tokens are always worth what you initially paid them.

Essentially, stablecoins provide seamless exchanges between fiat currency and cryptocurrencies. Of course, you usually buy and sell these assets from crypto exchanges. Then you can exchange them for various other crypto assets like Bitcoin or Ethereum.

In practice, most stablecoin reserves are a mix of cash and other assets. These other assets can be in various forms, like commercial paper, bonds, or even other crypto assets.

However, since these stablecoin companies are for-profit ventures with little transparency, it is impossible to know if they are actually keeping dollar reserves for their tokens.

What Are the Main Use Cases of USDC and BUSD?

One of the most important functionalities of stablecoins is instant value transfers. While it may take a lot of time to send thousands of dollars internationally due to anti-money laundering regulations, you can instantly send thousands of dollars worth of stablecoins to someone on the other side world with a click.

Another advantage is their market reach. You can buy other cryptocurrencies with USDC and BUSD. Since USDC is Coinbase’s native stablecoin, most crypto assets are denominated in USDC. That means you can use USDC to trade other digital assets.

The same is also true for BUSD and Binance. Also, these exchanges offer rewards for using their stablecoins, such as fee reductions and other benefits.

You can also use BUSD and USDC in DeFi protocols. Many protocols allow you to lend your tokens to others and earn profits.

USDC and BUSD Price History

USDC Price History

As you can see from the chart above, the USDC price is usually stable at 1 USD. However, the asset depegged for a couple of days in 2023, as concerns about the USDC reserves spiked due to SVB bankruptcy.

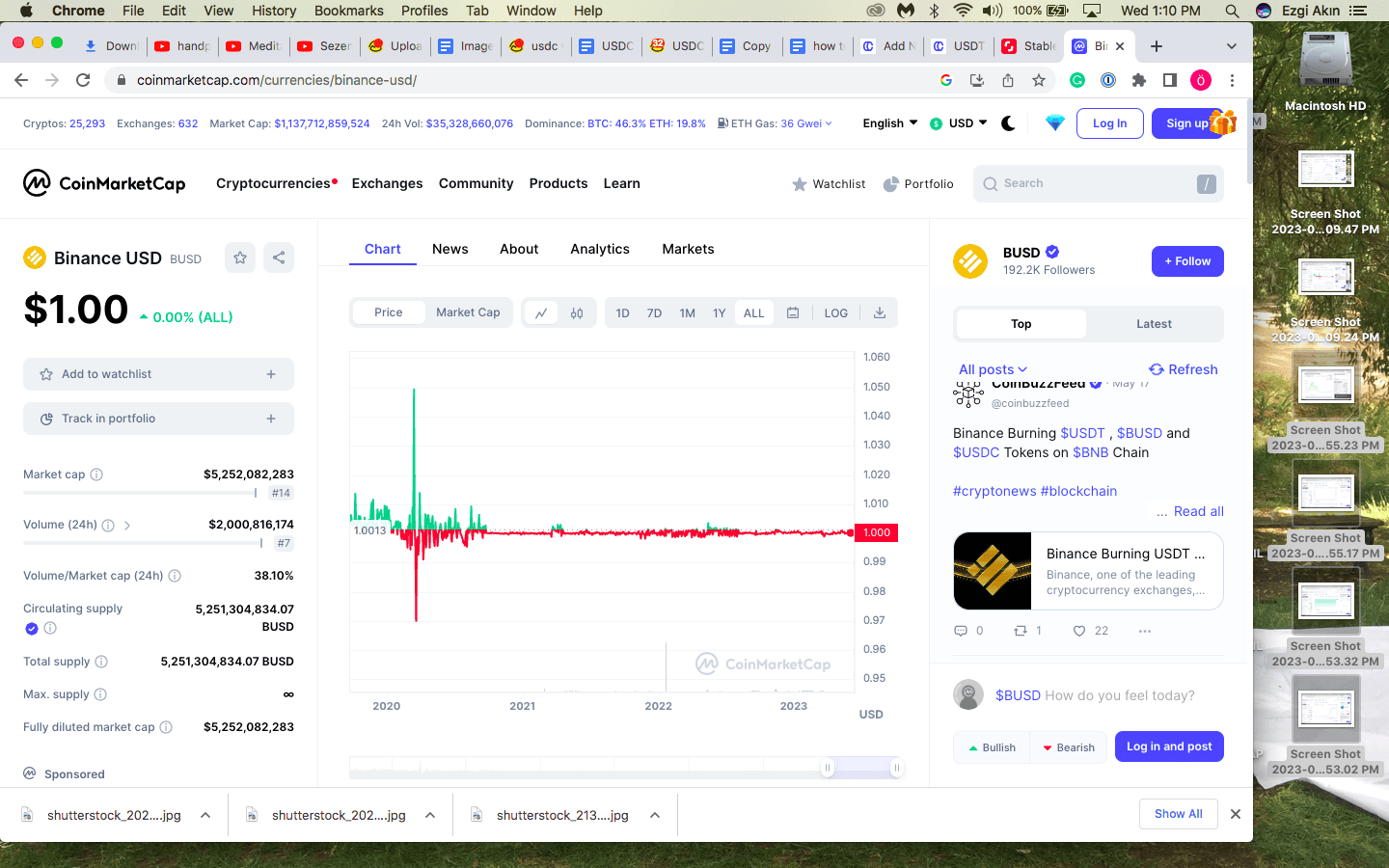

BUSD Price History

As you can see, the BUSD price is usually stable at 1 USD; however, the asset has been experiencing slight fluctuations due to legal and financial concerns about BUSD.

USDC and BUSD Market Cap

USDC Market Cap

Despite losing a significant market cap in 2023, USDC remains the second-largest stablecoin by market cap, with around 30 billion USDC.

Like any other cryptocurrency, the USDC market cap increases when more people invest in the asset. When people sell USDC, the market cap shrinks.

You can buy USDC on most exchanges, most easily on Coinbase.

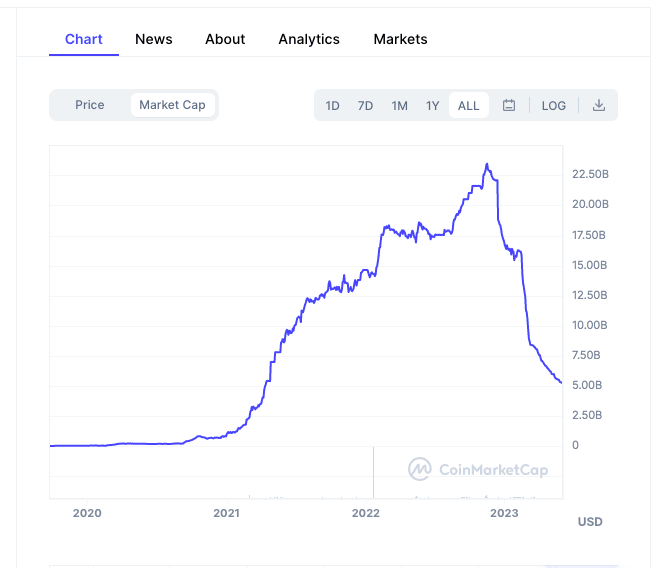

BUSD Market Cap

BUSD’s market cap shrank considerably after news of unbacked BUSD became publicly known. However, it still remains the third-largest stablecoin with around 6 billion BUSD in the market.

As of 2023, Paxos no longer issues any BUSD.

You can buy BUSD on Binance and many other exchanges. The token is issued on Ethereum and Binance Smart Chain.

USDC vs BUSD Main Similarities

Since USDC and BUSD are both stablecoins, they can be used for similar purposes like sending money, crypto trades, and DeFi investments. They are both pegged to USD with external reserves.

BUSD and USDC are issued by for-profit companies. Neither asset is regulated since USDC is US-based and issued by Coinbase, a public company; it is regarded as a more transparent and reliable asset than BUSD.

On Binance, you can exchange BUSD for many other assets. This is the same for USDC on Coinbase.

USDC vs BUSD Main Differences

BUSD is issued on two networks, Ethereum and Binance smart Chain, whereas USDC is issued on several blockchains, including Ethereum, Solana, and TRON. That means you can quickly transfer USDC for cheaper fees between different networks.

Since Circle, a US-based consortium, issues USDC, it is more transparent compared to BUSD. Binance promoted BUSD as a regulated token, but it became clear that the asset was largely unbacked and unregulated for a long time.

Both Binance and Circle issue public assessment reports on their reserves. However, as assessments are not audits, it is hard to know whether the companies are truthful about their reserves. Recently, data analysts have exposed that BUSD reserves were, at times, 1 billion USD short of necessary backing.

Risks Associated With USDC and BUSD

Stablecoins could lose their value if they are not backed by adequate reserves. Also, they could be banned from use if the issuing companies don’t comply with cryptocurrency and stablecoin regulations in the countries they operate.

USDC’s issuer Coinbase is generally known for its compliance with the authorities to do business in the US and elsewhere and is generally regarded as more reputable than its rival exchanges, a fact which the company took full advantage of when it marketed the stablecoin.

However, compliance and transparency are thorny issues for all crypto businesses. While USDC has a better reputation compared to its chief rivals, USDT and BNB, it’s hard to know how stable these stablecoins are in reality.

BUSD’s issuer, Binance, is infamous for avoiding or stepping around regulations. The company has been accused of hiding its liabilities, lying about its reserves, and trading against its customers.

In 2023, it was revealed that Binance didn’t have the reserves to back up BUSD at certain times during the past years. If there had been a strong bank run on BUSD back then, BUSD would have crashed, and people would have tanked the crypto prices by withdrawing or selling their assets from all major exchanges as quickly as possible.

Binance doesn’t release information regarding its finances, and while CEO Changpeng Zhao is very active on Twitter, he rarely addresses the controversies surrounding the exchange in a meaningful way. Overall, it shows that the company has no plans to take steps to ensure transparency in its operations.

Where Can You Buy USDC and BUSD?

Of course, it makes sense to buy USDC on Coinbase and BUSD on Binance, as they are native to these exchanges, but there is no need to limit yourself to these options if you want something else. Almost all cryptocurrency exchanges list both of these assets.

We reviewed the best 21 crypto exchanges in the business to give you an idea of what you can expect from each platform. You can buy both assets from any of these platforms.

How Can You Exchange USDC for BUSD?

You can exchange USDC for BUSD on most cryptocurrency exchanges. Go to your favorite exchange and search for USDC/BUSD market. Most exchanges offer free trades between stablecoins.

In 2022, Binance actually delisted USDC, but you can still swap USDC for BUSD on Binance. You can also swap BUSD with USDC on Coinbase.

Future Plans for USDC and BUSD

The future of stablecoins is a big question mark in the crypto market. All around the world, journalists, data scientists, economists, and regulators are sounding the alarm over stablecoins’ effect on financial markets and raising suspicions over criminal uses like money laundering.

Stablecoins are an excellent way of transferring value. However, it became apparent that although blockchain technology makes it possible to trace the money, without adequate regulations, it’s very hard to keep track of stablecoin trades.

In 2022, the Biden administration announced their plans to regulate crypto assets more tightly, especially stablecoins. The announcement was followed by bans on certain coin-mixing services and wallets, as well as investigations into stablecoin issuers like Binance and Paxos.

While SVB went bankrupt, other crypto-related banks are also facing trouble. Signature Bank announced it shrunk its crypto business considerably and has been under investigation since the bankruptcy of FTX.

Circle management suggested that the best way to protect USDC reserves might be with the support of the US Federal Reserve though no official announcements have been made yet.

BUSD, on the other hand, shrank about 25 billion since the end of 2022, no doubt due to reports of unbacked tokens. With US-led fraud investigations hanging over the stablecoin, it remains to be seen whether the asset will remain in circulation in the following months or years.