The GMX exchange is a workable alternative to controlled markets that may be found on Web3. This platform gives you the opportunity to trade crypto and earn money by providing ample liquidity for your trading activities.

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

In the GMX ecosystem, the GMX token (GMX) serves as the governance token. Here are the details.

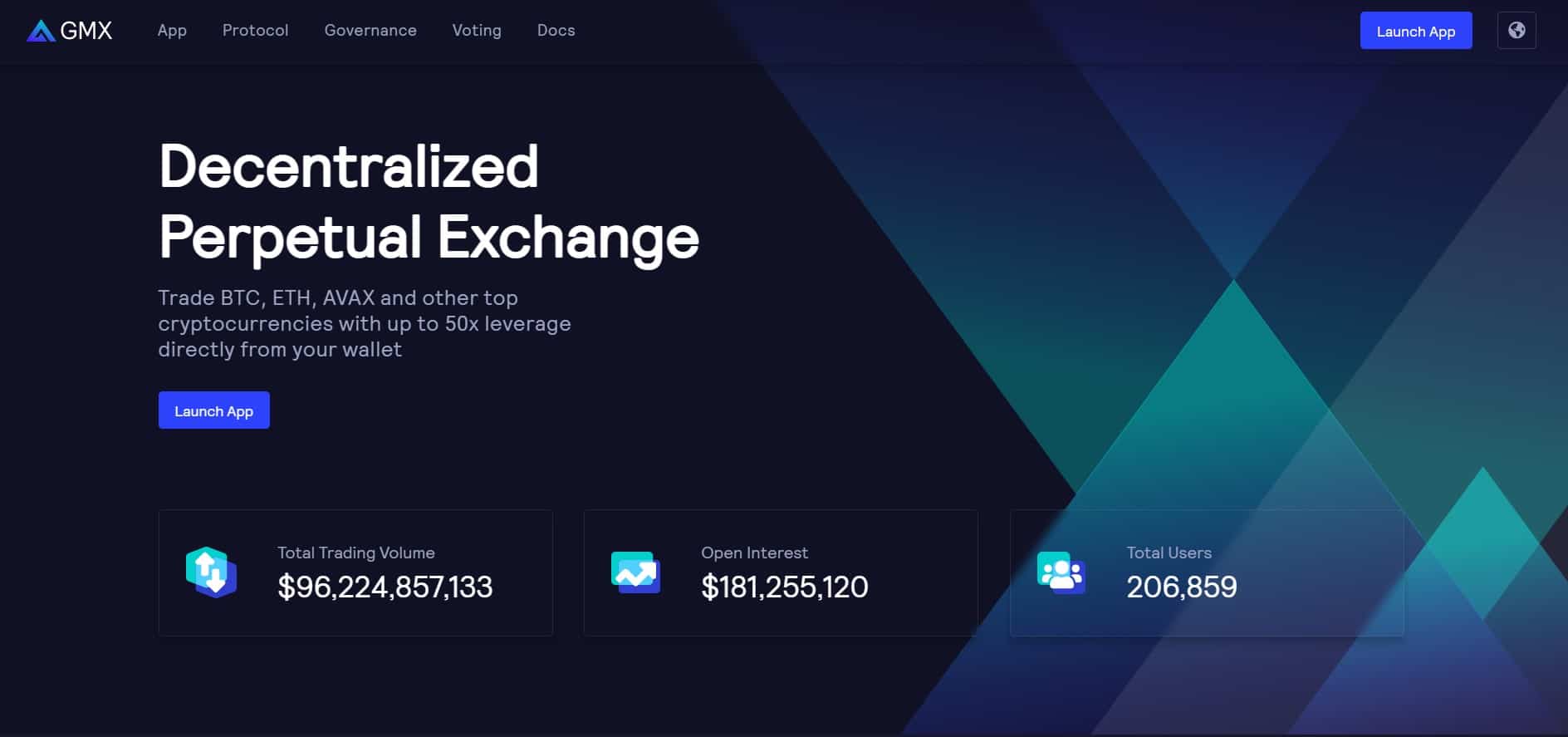

The GMX.io Exchange

GMX.io is a decentralized spot and perpetual crypto trading platform developed on the Arbitrum and Avalanche platforms. Users can trade their Bitcoin (BTC), Ethereum (ETH), and other prominent cryptocurrencies at low fees directly from their wallets with up to 30x the standard leverage.

In addition, the exchange is backed by a multi-asset pool that provides liquidity providers with revenue in the form of fees for market making, swapping, and leverage trading. The platform’s dynamic pricing is backed by Chainlink Oracles and an aggregate of quotes from the most liquid exchanges.

To mitigate the risk of liquidation caused by temporary wicks, the algorithm aggregates a price feed from the highest volume exchanges. When a user’s collateral is insufficient to keep a deal, the platform will liquidate the trade by closing the position forcibly and keeping the deposit to offset its loss.

GMX records the current value of the user’s collateral at the time they opened the trade or deposited the collateral. No matter what happens to the underlying asset’s price during the course of the deal, the value of the collateral will remain constant.

Fees

The opening and closing commission for a trade is 0.1%. Each hour, a percentage of the deposit is used to pay a borrowing cost that varies depending on the market. The cost of a swap is 0.33%. Since the protocol itself acts as the counterparty, the cost of entering and terminating a trade is negligible.

In order to secure a long bet, the user must deposit their collateral in the same token they are betting on. If they make a profit, it will be distributed in the same currency. Only GMX-supported stablecoins (USDC, USDT, DAI, and FRAX) can be used as collateral for shorts. However, the profit from the short-selling positions is paid out in a stablecoin of choice.

Tokens

The GMX.io ecosystem consists of two tokens: the GMX token and the GLP token. The staked GMX utility token and governance token will receive 30% of all fees generated through swaps and leverage trading in the form of ETH / AVAX.

On the other hand, GLP is the liquidity provider token responsible for the accumulation of 70% of the platform’s earned fees.

How Does the GMX Token (GMX) Work?

There is no actual buying or selling of tokens on the GMX.io platform. You will instead deposit collateral to participate in both long and short positions. When the trade is settled, the platform reimburses the financial gain in USDC (for shorts) or the other token in the pair (for longs).

To power the community-driven operations of the platform, GMX.io developers have created their native GMX utility and governance token.

Like many other native DEX tokens, GMX derives both its value and its utility from the fees that are levied by the protocol. The greater the platform’s fee income, the higher the value of the GMX token.

More precisely, 30% of the overall protocol fees are allocated to GMX stakers, while 70% are allocated to GLP holders. What makes GMX stand out from the crypto pack, though, is that staking GMX will net you rewards in ETH (if you’re on Arbitrum) or AVAX (if you’re on Avalanche) rather than any other token.

What Is GMX Token (GMX) Used For?

Apart from being used as a utility token of the GMX blockchain, the GMX token allows you to earn a yield that increases over time and comes with additional staking bonuses.

In addition to the approximately 22% APY that you can earn by staking your GMX tokens, there are additional benefits that encourage crypto investors to stake their coins for extended periods of time.

For one, staked GMX tokens will earn you Multiplier Points at a 100% annual percentage rate (APR). GMX.io’s multiplier points are a way to financially reward investors who stick with the platform over time without fueling price inflation. Users who stake GMX get a predetermined amount of Multiplier Points equal to 100% APR. If you staked 1,000 GMX for a full year, you would receive 1,000 Multiplier Points.

After that, you can stake your multiplier points and redeem them for additional reward fees. In this way, your staking benefits are increased by a factor of 100.

Where to Buy GMX Token (GMX)?

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

GMX is currently available for trading on Bybit, MEXC Global, BingX, and BKEX. It is also available to buy on many DEX marketplaces, including Uniswap.

How Long Has GMX Token (GMX) Been Around?

Founded in 2017 as Gambit on the Binance Smart Chain (BSC), the rebranded GMX.io had its initial launch in late 2021 on the Ethereum Layer 2 network Arbitrum and subsequent deployment to the Avalanche network.

After the official introduction, the project has swiftly gained the traders’ interest by providing crypto investors with leverage that is up to 30 times greater than their deposited collateral.

What’s Controversial About GMX Token (GMX)?

Since this cryptocurrency project just started, there hasn’t been much time for GMX testing.

The present bear market has served as a harsh reminder of the importance of doing risk assessments to determine whether or not a project can survive extreme market conditions, such as a banking crisis or a 95% decline in TVL.

Since GMX didn’t get off the ground until roughly September 2021, we can’t even consider it to have finished one full cycle just yet. Personally, I have a lot more trust in a model that has weathered maximum market stress and come out on the other side because it demonstrates that the system can recover quickly and will be able to weather similar storms in the future.

Moreover, the whole GMX team operates under complete anonymity, and there are no known investors from the outside working on the project.

How Many GMX Coins Are There?

The official documentation of GMX.io states that the maximum number of GMX tokens that can ever be produced is 13.25 million. However, the GMX.io team can raise its maximum supply if they think there’s a need for liquidity mining.

Still, network users will have the right to vote before the team implements any changes. Also, the production of GMX further than the maximum supply is restricted by a timelock that lasts for 28 days. To this end, the GMX.io team has developed a dashboard that provides users with access to all of the information on the GMX token.

There are currently 8.2 million tokens in circulation, and around 85% of those tokens have been staked.

Can GMX Be Mined?

Yes. However, as GMX is the platform’s native governance token, the DAO should reach a consensus before any additional GMX tokens can be mined.

Market Cap and Price History of GMX Token (GMX)

According to CoinMarketCap, the current price of GMX is $47.94, and the market capitalization stands at $285 million. The number of tokens utilized for marketing or collaborations and the number of tokens that become vested will affect the total number of tokens released into circulation.

Biggest Competitors of GMX Token (GMX)

There are five major alternatives to the GMX token: the Jarvis Network, UniDex, Deri Protocol, Perpetual Protocol, and Linear Finance.

What Does the GMX Token (GMX) Project Road Map Look Like?

The GMX community plans to strengthen the platform’s defenses and ensure its continued stability. As a result, they’ll be able to address any problems more efficiently.

Even though the developer team regularly reviews and maintains the security of GMX’s operations, the GMX community has decided it’s time to do a more in-depth review of everything about the platform. The upcoming review will look at the domain name systems and hosting setups to detect the areas that could be improved.

The next priority will be to refine the platform’s offering and user experience. In doing so, the GMX community will be able to give its users more ways to trade and let them take a position in any marketplace, all while increasing their yield.

Pros and Cons of GMX Token (GMX)

Pros

- Enables permissionless trading with a leverage of up to 30x for DeFi users;

- Lowers the potential for insolvency.

Cons

- GMX investments carry the same risks as every other investment in the cryptocurrency world.

GMX Token User Reviews

Review Summary

Recent GMX Token Reviews

There are no reviews yet. Be the first one to write one.