Coinbase is indeed a great place for newcomers to the cryptocurrency industry to get their feet wet, but experienced traders may find the limited range of tools to be a hindrance to their investment strategies.

Therefore, if you want to diversify your crypto holdings beyond the most fundamental crypto trading widgets without worrying that your trading charges will eat into your profits, this article will assist you in choosing between some viable Coinbase alternatives.

Read on.

10 BEST COINBASE ALTERNATIVES

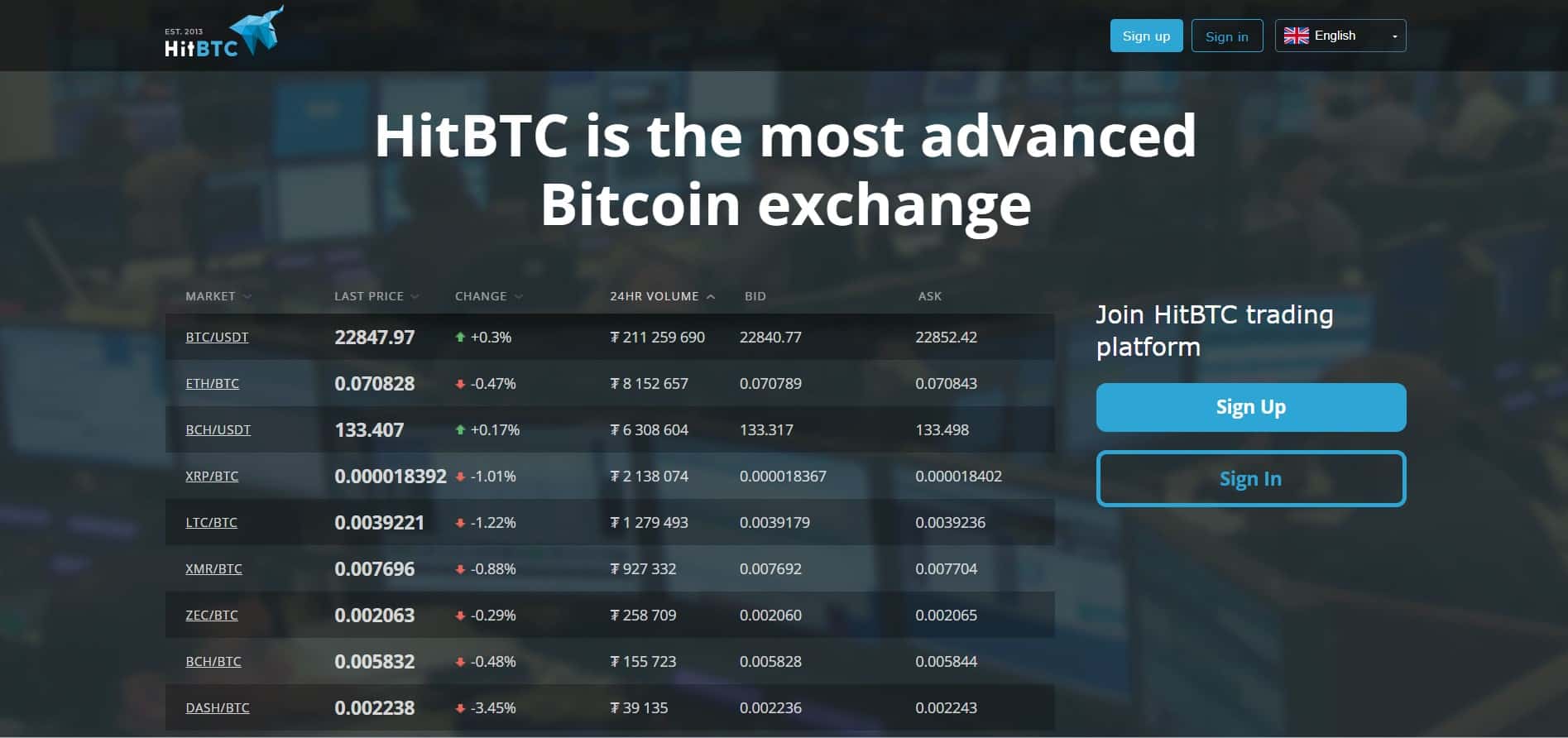

1. HitBTC

When it comes to trading cryptocurrency and other digital assets, HitBTC is one of the most seasoned marketplaces available. The business started up in the UK in 2013. The cryptocurrency market’s headquarters were relocated to Chile and Hong Kong in 2021.

When it comes to trading cryptocurrency and other digital assets, HitBTC is one of the most seasoned marketplaces available. The business started up in the UK in 2013. The cryptocurrency market’s headquarters were relocated to Chile and Hong Kong in 2021.

If you’re just getting started with buying and selling cryptocurrencies, HitBTC is a great option. The exchange provides a user-friendly trading platform that even a complete trading newbie can master in a short amount of time.

All of the major cryptocurrencies, as well as a plethora of lesser-known altcoins and tokens, are readily available for trading on this platform. With such a wide variety of coins to choose from and such low fees, HitBTC is a great place to look for underappreciated but highly valuable small coins.

Furthermore, there are three different fee tiers for using the HitBTC trading platform: a free “starter” account, a standard “general” account, and a “verified” account. For both the basic and advanced accounts, the fees are a flat 0.1% for liquidity providers and 0.25% for liquidity takers.

Additionally, there is an extensive library of educational resources available for those just getting started in the trading world. Also, under favorable circumstances, traders can bring in passive income which is important for crypto beginners. That being said, HitBTC might very well serve as a decent crypto exchange to kick things off.

2. Gemini

Gemini is another trading platform similar to Coinbase that allows users to purchase and sell a wide variety of digital currencies while still keeping the platform simple enough for inexperienced traders.

In addition, there’s an order book instead of the standard marketplace for buying and selling cryptocurrency you’ll find on Coinbase.

Another added benefit of choosing Gemini as a Coinbase alternative is that you can analyse the order book data trends in real-time. Inexperienced crypto investors can learn the basics of fundamental indicators by studying these charts and recognising common market fluctuations patterns.

3. Kraken

Kraken was one of the first places where digital currencies could be bought and sold. It was launched in 2015, almost two years after Bitcoin was recognised as a legitimate currency. The vast majority of Kraken user funds (98%) are stored in cold storage wallets dispersed across multiple locations to eliminate the possibility of a single point of failure – and this is just a piece of Kraken’s security puzzle.

In turn, the multitude of safeguarding features that underpin this trading platform make this exchange not only one of the most secure trading platforms but also one of the safest crypto fortresses in the industry.

Furthermore, Kraken is an excellent destination for anyone seeking to diversify their cryptocurrency holdings. There are over 15 unique coins that may be traded on the platform, and the possible combinations are practically endless. The software also provides users with separate windows to view information on markets, trades, and accounts.

However, if you opt for Kraken as a possible alternative to Coinbase, keep in mind that it can appear daunting to inexperienced traders initially, as it features some of the most innovative financial instruments in the industry.

4. Binance

Binance is an excellent alternative if the exorbitant fees put you off from trading on Coinbase. Indeed, compared to Coinbase and other major exchanges, this one has some of the lowest trading costs available.

Binance uses the market maker/taker fee structure to establish the fees paid by investors for placing various sorts of trade orders. As a result, Binance’s commission rates change based on the total amount of cryptocurrency traded within a given 30-day period. There is typically a 0.5% charge assessed whenever cryptocurrency is bought or sold. The spot trading fee for order book trades is 0.1%.

If you are a liquidity provider or taker and have BNB tokens, Binance will automatically apply them to your trading fees, reducing them by up to 25% and potentially bringing them down to 0.075%.

Last but not least, Binance’s trading options provide you with enhanced flexibility to tailor your crypto trading strategies without going overboard with your investment capital.

5. eToro

eToro is an international financial service provider with its headquarters in London, United Kingdom. It is a social trading platform specialising in cryptocurrency trading at both the beginner and the advanced levels. Similarly to Coinbase, eToro has a user-friendly interface that allows it to quickly and easily invest in 20 digital currencies across various market caps.

Although eToro’s selection of accepted currencies isn’t extensive, the exchange’s special trading feature sets it apart from competitors. More specifically, eToro’s CopyTraderTM technology makes it simple to mimic a successful trader’s strategy and have it carried out automatically once the conditions of the trade have been met.

Unlike Coinbase, which charges astronomical fees for its services, eToro does not take a cut of any trades made on its marketplace. More precisely, neither buying nor selling cryptocurrencies, nor using the exchange’s financial instruments will cost you anything. The cryptocurrencies with eToro are yours to keep.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

6. KuCoin

KuCoin, a cryptocurrency trading platform, is widely regarded as one of the most cost-effective exchanges in the industry and a great alternative to Coinbase due to the cheap transaction fees imposed for trading over 200 virtual currencies and more than 400 trading pairs.

This marketplace appears to cater to seasoned traders due to the high-tech nature of its services. KuCoin offers a wide variety of trading options, including staking, spot trading, margin trading, non-custodial trading, and coin lending for passive revenue. For those unfamiliar with KuCoin, there is a “lite” version of the platform that allows users to make simple cryptocurrency purchases.

When it comes to fees, spot trades on KuCoin cost makers and takers 0.1% of KCS if the user has no KCS balance and trades less than 50 BTC in a 30-day period.

7. Crypto.com

Crypto.com, based in Hong Kong, is a favourite among investors worldwide because of the low fees associated with trading cryptocurrencies on their platform. Anyone interested in trading derivatives, placing spot orders, or borrowing coins has easy access to a wide variety of markets through the exchange. In this aspect, Crypto.com may be daunting for newcomers, but the site always provides a simple path to buying your preferred cryptocurrency. Let me explain.

Crypto.com, a trading network of DeFi services, aspires to make cryptocurrencies more accessible to the general public through its role as a hub for all decentralised trading instruments. Therefore, traders of various skill levels can use the Crypto.com offerings.

This platform offers not only the basic tools of an exchange widget, the convenience of crypto payments, and the chance to earn interest on your coins similar to Coinbase’s, but also more advanced financial instruments like over-the-counter trading and margin buying and selling.

9. HTX Global

When considering trading volume, diversity of currencies, liquidity, and market supply, HTX is among the most successful cryptocurrency trading platforms, as reported by CoinMarketCap. HTX is one of the first cryptocurrency exchanges to launch back in the early days of the blockchain revolution.

The platform provides extensive trading options at some of the lowest fees in the business. Trading fees for complex financial instruments are determined by whether you are opening a new order or filling one that has already been placed.

In addition, HTX charges a flat 0.2% commission on all trades, whether you’re buying or selling Bitcoin or another cryptocurrency. Professional traders incur between 0.0362% and 0.0462% as makers and takers, respectively.

Furthermore, this exchange has an incredible selection of digital assets, so you can be sure to find the best coin for your trading strategy among them. HTX supports more than 500 digital assets, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Cardano (ADA), Dogecoin (DOGE), and Litecoin (LTC), to name a few. The number of accepted fiat currencies is equally extensive, including over 40 others in addition to the likes of the Canadian Dollar, the Australian Dollar, the United States Dollar, and the Euro.

10. Phemex

Phemex‘s creators leaned on years of industry experience to design a trading platform that’s as intuitive as it is powerful. They improved upon the shortcomings of its predecessors, such as slow payment processing speeds, low trading volume, and high transaction fees (such as in Coinbase’s case), to establish a more robust and competitive marketplace in the crypto sphere.

Phemex provides a safe place to trade cryptocurrencies and does not take a cut of your profits beyond the costs inherent in the currencies themselves and their corresponding blockchains. You can effortlessly use the financial instruments provided by this exchange to expand your balance. As your balance grows, so will your earnings and the number of additional enticing prizes you are eligible to receive.

Overall, Phemex is a great substitute for Coinbase and has earned my unqualified recommendation.