- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

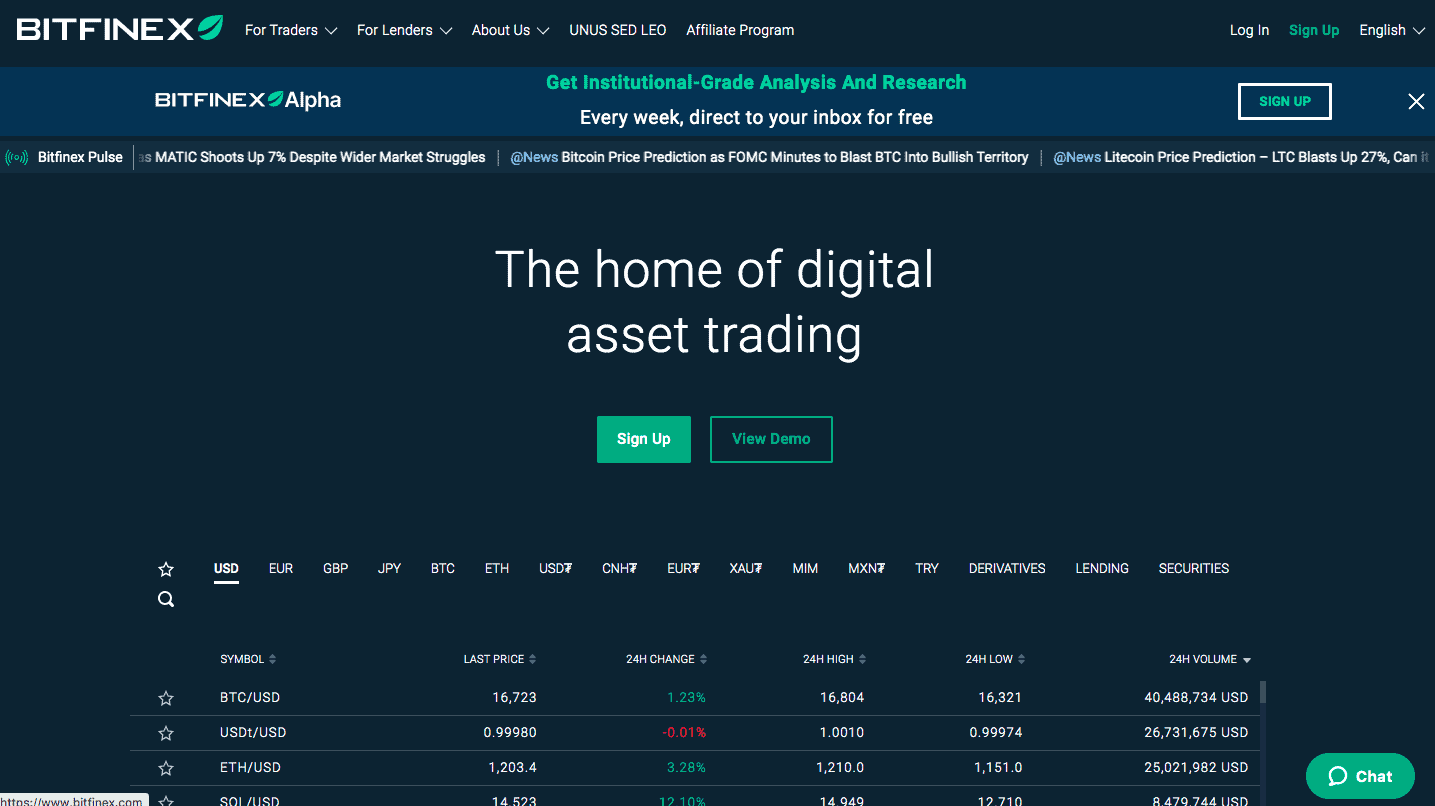

Bitfinex is an unregulated global cryptocurrency exchange based in the British Virgin Islands. The platform is a subsidiary of iFinex.inc, the company that issues Tether (USDT) stablecoin.

Bitfinex has been operating as a Bitcoin and cryptocurrency exchange platform ever since 2012 and is generally considered a popular exchange despite its long history of controversies.

The crypto exchange operates in over 100 countries but isn’t available to the US, Canada, Italy, Austria, and, interestingly, British Virgin Islands-based customers.

The platform is among CoinmarketCap’s top exchanges list and offers access to various trading instruments, cryptocurrencies, and markets.

Bitfinex offers around 170 digital currencies and has a competitive fee schedule. The platform supports margin trading, derivatives trading, lending, borrowing, and staking.

In this Bitfinex review, we’ll take a close look at all aspects of the exchange, such as fees, features, security, and the platform’s various controversies, so you can decide if it’s the right platform for you.

Pros & Cons of Bitfinex Exchange

Pros

- Competitive trading fees start at 0.1% for makers and 0.2% for takers.

- The trading platform offers around 170 digital assets.

- High trading volume and deep liquidity.

- Offers margin and derivatives trading, staking, and lending.

- You can purchase crypto with debit and credit cards.

- You can deposit and withdraw fiat money to the platform.

Cons

- Bitfinex services aren’t available to US and Canada-based customers.

- The company paid government fines for deceptive activities.

- The platform has a complicated user interface.

- Minimum fiat withdrawal limits are very high (10,000 USD) unless you use OpenPayd.

- The exchange has been accused of enabling spoofing and wash-trading.

- The exchange is very opaque regarding its practices and has hidden its involvement with Tether.

About Bitfinex

Bitfinex is one of the more interesting trading platforms out there simply because it has remained a constant over the years despite being the subject of many controversies.

Bitfinex was founded in 2012 as a peer-to-peer (P2P) Bitcoin market. The exchange grew quickly and started offering altcoins and derivatives markets for trading.

In 2018, Paradise papers revealed the company behind the Bitfinex exchange also issued Tether stablecoin. Financial fraud researchers claimed Bitfinex had used Tether to pump up Bitcoin prices in 2017.

In 2019, a New York Attorney General’s Office probe revealed that Bitfinex had been covering its cash losses by withdrawing from Tether’s cash reserves. The company paid 18.5 million dollars as a result of the probe.

In 2021, the company paid 41 million dollars in fines when it became apparent that Tether wasn’t backed 1:1 with fiat currencies, as it previously advertised.

As controversies grew, so did the curiosity regarding Bitfinex and Tether. A pair of crypto sleuths even traveled to Hong Kong to find Bitfinex’s offices, as the company claims it has its headquarters there. Predictably, they didn’t find much.

When reached for an answer, the company claimed they were preparing for Covid-19 and practicing working from home at the time, though the trip happened a year before the pandemic started.

In 2022, a Spanish court ruling connected Bitfinex CEO and CFO to European fraud convict Gennaro Rino Platone. The exchange’s upper management is under strict scrutiny for their ties to various known fraudsters.

Some also suspect recently defunct FTX had close ties to the Tether and Bitfinex. FTX’s parent company Alameda Research received almost one-third of all Tether tokens, and the FTX founder Sam Bankman-Fried defended Tether’s founder from allegations of misconduct.

It’s important to note that Bitfinex doesn’t operate in the US and Canada.

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

Crypto Coins Available on Bitfinex

Bitfinex supports around 170 digital currencies, including popular cryptocurrencies like:

Bitfinex also has its native Unus Sed Leo (LEO) token. Token holders can receive up to 15% trade fee discounts on crypto-to-crypto trading pairs. Other benefits include P2P lending fee reductions and deposit/withdrawal fee discounts.

Fiat Currencies Supported on Bitfinex

Bitfinex supports US Dollars (USD), Pound sterling (GBP), Euros (EUR), offshore Chinese Yuan (CNH), and Japanese Yen.

You can deposit fiat to the platform in two ways: bank wire transfer and third-party payment provider OpenPayd.

Users can deposit fiat to the platform via bank transfer after they complete full KYC verification. OpenPayd users can deposit to the platform after completing intermediate-level verification.

Bank wire via OpenPayd costs a 0.5 EUR fee. Regular bank wires cost a 0.1% fee or $60 minimum.

For deposits, Bitfinex charges a 0.1% fee or a minimum fee of 60 (EUR/USD). Express withdrawals cost 100 EUR/USD.

Please note that the minimum withdrawal limit is 10,000 EUR/USD for bank wire withdrawals. Many users can’t withdraw fiat from the platform because they don’t have the necessary funds to request a withdrawal.

OpenPayd users can withdraw a minimum of 25$ from the platform.

Countries Supported on Bitfinex

Bitfinex is available in many countries but isn’t available to citizens or residents of the US, Canada, Italy, and Austria.

However, Bitfinex isn’t licensed to offer services in certain areas, including the UK. As the exchange offers derivatives products, it may have to restrict its offerings to customers from jurisdictions with regulations against crypto derivatives trading in the future.

Bitfinex Trading Fees

Bitfinex has a maker/take fee schedule. Maker fees start at 0.10%, and taker fees start at 0.20%. LEO token holders receive fee discounts on taker fees.

Bitfinex doesn’t charge a fee for crypto deposits. Crypto withdrawal fees vary and may change depending on the coin and market conditions.

Fiat deposits and withdrawals cost a 0.1% fee or a minimum of 60 USD/EUR fee, whichever is higher. OpenPayd deposits and withdrawals cost only 0.5 EUR, but the payment service may charge separate fees.

Main Features of the Bitfinex Platform

Bitfinex offers several features to advanced traders. Some of the most notable features of Bitfinex include the following:

Margin Trading

With margin trading, traders can increase their investment capital by borrowing funds from other users.

Bitfinex users can borrow funds from the peer-to-peer (P2P) Margin Funding market to trade with up to 10x leverage. You need at least Intermediate level verification to margin trade on the platform.

Users can select the duration and interest rate that suits their strategies best. Alternatively, Bitfinex borrows for you at the best available rate in the market when you open a position without specifying your criteria.

The minimum limit for borrowing is 175 USD.

Derivatives Trading

Derivatives or futures trading allows traders to profit from speculations regarding the future price of an asset. Traders buy and sell contracts for the future price of an asset at a predetermined time.

You must deposit BTC, EURT, or USDT to your derivatives wallet as collateral to qualify for the service. You can open a position at 100x worth of your collateral at maximum. Only intermediate and fully verified users can transact derivatives on the platform.

Lending/Margin Funding

On the Margin Funding platform, you can also lend several currencies, including BTC, ETH, LTC, USDT, XRP, ADA, USD, EUR, and more. You can set the duration and interest rate as you see fit. The minimum limit for lending is 150 USD.

You can also join the Lending Pro program for a fee. Lending Pro is a professional tool for managing your assets and investments.

Bitfinex Staking

Bitfinex offers staking services for around 10 cryptocurrencies, including Cardano (ADA), Solana (SOL), Polkadot (DOT), and Polygon (MATIC). You can earn weekly rewards on your crypto balance.

Advanced Trading Options

The platform supports several advanced order types: market, limit, stop-limit, trailing stop, fill or kill, and immediate or cancel orders.

The company created the Scaled Orders tool to increase productivity. It is a new order type that automatically creates multiple limit orders across a customer-determined price range, enabling traders to use their time to focus more on strategy instead of manually entering orders. Customers maintain control and can configure the level of diversity and distribution.

There are also several order options on the platform, including one cancels other, hidden, and time-in-force order options.

Paper Trading

Paper Trading allows you to test your trading strategies without depositing real funds. A sub-account can be created to trade with simulated data each time.

Bitfinex Honey

The Honey framework allows users who don’t have coding experience to create automated trading strategies. It’s an open-source toolkit to design new order types and trading strategies. You can download the Honey framework to your computer as a standalone program.

How Easy Is It to Open a Bitfinex Account?

Opening a Bitfinex account only takes a few minutes. Visit the official Bitfinex website and register with your email address. The registration process involves setting up a password and entering your email address and country of residence. You’ll receive a verification email to confirm your account. Use the same web browser for registering and confirming your Bitfinex account.

Bitfinex requires you to enable Google two-factor authentication as part of the signup process, as you won’t be able to use your account until you complete it.

There are four levels of KYC verification on the platform. When you sign-up, you automatically become entitled to Basic Access, which is view only. The next level is Basic Plus, which allows you to deposit and trade crypto on the platform and purchase assets with debit and credit cards.

You must provide an official photo ID, a selfie, a phone number, and a residence address to qualify for Basic Plus. You can complete intermediate verification by providing the platform with a secondary official photo ID, proof of address, and a KYC declaration. You’ll also have to complete a financial questionnaire. You can become fully verified by also submitting your bank statements.

How Secure Is Bitfinex?

While Bitfinex employs industry-standard security measures like two-factor authentication, withdrawal protection, and cold storage for assets, the exchange had many difficulties when protecting user funds.

Aside from a few major hacks we’ll discuss in the next section, the platform also had trouble with third-party payment providers and lost user funds due to regulatory issues or problematic deals with payment providers.

Wells Fargo froze all Bitfinex accounts in 2017, and eventually, the platform became unavailable to US customers. In 2019, it became apparent that Bitfinex didn’t have access to banking institutions and had concealed its liquidity issues from customers and the public.

In 2021, Bitfinex was revealed to have sent 850 million USD of customer funds to the payment processor CryptoCapital to solve their banking problems. When the CryptoCapital assets were lost, the company covered the losses by draining $700 million from Tether’s funds. The company paid 18 million USD in fines to cover up the charges resulting from these actions.

Has Bitfinex Ever Been Hacked?

The exchange was for the first time in 2015, resulting in the theft of 1,500 BTC. In 2016, the exchange was hacked again and lost around 120,000 BTC.

Bitfinex divided the losses equally between all users, with each user experiencing a 36% cut in their financial investments. The exchange issued BFX tokens to compensate the users for the loss.

In 2022, law enforcement recovered 94,000 BTC stolen during the 2016 hack.

Is Bitfinex a Regulated Exchange?

No. Bitfinex isn’t a regulated exchange. It’s unavailable to users from Canada and the United States.

How Does Bitfinex Compare to Other Crypto Exchanges?

Bitfinex is a popular global exchange with competitive fees, advanced trading UI, and margin and futures trading options. Let’s see how it stacks up against Binance.

Fees

Bitfinex charges 0.10% for maker fees and 0.20% for taker fees. It’s competitive by market standards, but other platforms offer even better deals, like Binance, which offers 0.10% for both makers and takers with zero-fee trading pairs.

Features

When it comes to advanced features, it’s hard to beat Bitfinex. The platform offers complex order types, APIs, charts, and ways to design and execute new trading strategies.

On the other hand, Binance offers more cryptocurrencies (around 350) and many features like derivatives and margin trading that you can’t find on Bitfinex.

Security

It’s hard to compare crypto exchanges on the security front because we often depend on the platforms’ transparency to evaluate them. Both Binance and Bitfinex have been hacked in the past and had a number of security breaches, irregularities, or problems with regulators.

Bitfinex also has allegations of widespread fraud swinging over the exchange, but that’s mostly on par with crypto exchanges in general. However, at the moment, Binance seems like the safer exchange.

Nonetheless, it might be a good idea to store large crypto assets in a cold wallet of your own instead of using centralized exchanges that are often targeted by hackers.

Does Bitfinex Have an App?

Yes, Bitfinex does have a mobile app. The app is available on both the App Store and Google Play stores. The app allows you to trade, deposit, withdraw funds, and view your positions, account balance, and order history. The app has received mixed reviews, with some users complaining about glitches and crashes.

Final Thoughts

Bitfinex is one of the most popular cryptocurrency exchanges, as well as the most controversial. The platform had various issues regarding regulations and transparency but remained a popular destination for traders in general.

One of the reasons for its enduring popularity can be chalked up to the more relaxed KYC verification requirements the exchange allowed until March 2022. The exchange allowed users who completed the basic verification process (email and password) to deposit, trade, and withdraw crypto on the platform. These days, Bitfiniex enforces more strict identity verification rules for trading crypto.

Bitfinex isn’t a beginner-friendly trading platform, as the sheer number of options and features can confuse newbie traders. It’s definitely more suited to professional traders with in-depth crypto know-how and an understanding of the risks involved with trading on unregulated and controversial exchanges.

Bitfinex User Reviews

Review Summary

Recent Bitfinex Reviews

There are no reviews yet. Be the first one to write one.