- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

Many investors view dividends as the ultimate reward for their financial endeavors. This is easier said than done in the realm of conventional banking due to the considerable effort and cost needed. On the other hand, the cryptocurrency market provides an alternative for achieving passive income goals. These days, staking cryptocurrency is all the rage.

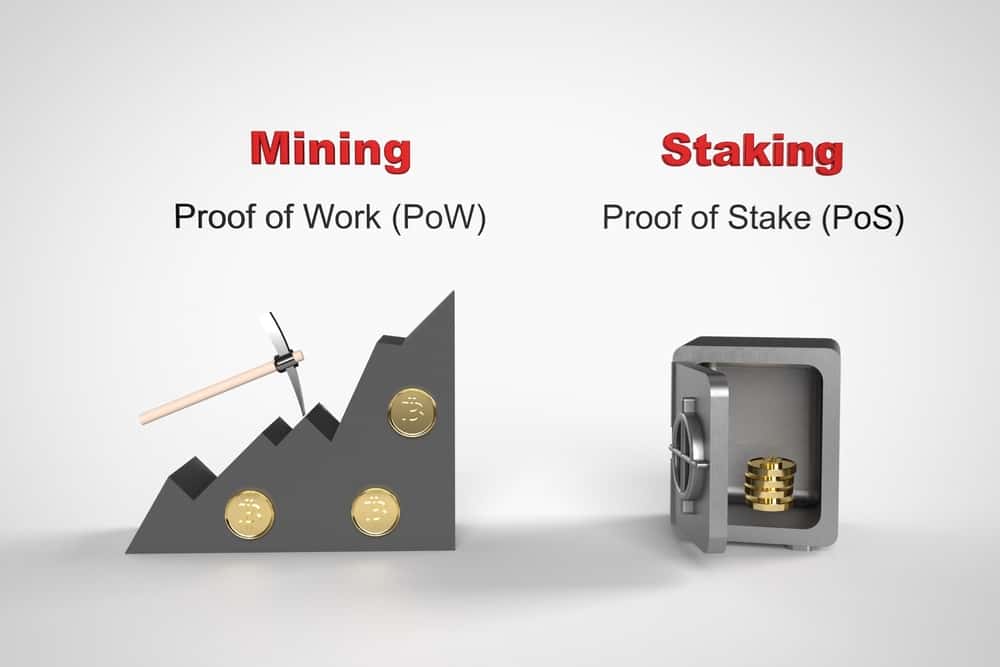

To begin with, the Proof-of-Work (PoW) model now used on the Ethereum network is being replaced with a Proof-of-Stake (PoS) version on the Beacon Chain as part of the Ethereum 2.0 (ETH2) upgrade.

These enhancements are being rolled out in three phases to improve scalability and performance, lessen operational expenses, and fortify blockchain reliability. This development also paves the path for the widespread adoption of staking cryptocurrencies and ETH-based rewards.

If the prospect of such passive income has you feeling a pang of FOMO, then you should visit your go-to crypto platform to purchase and stake ETH and boost your crypto profits.

Let’s first examine the historical context that inspired the novel idea of staking cryptocurrencies and the investment strategy that it supports.

What Is Staking?

Staking in a blockchain that uses Proof-of-Stake (PoS) technology implies taking an important role in the process of authenticating the transactional blocks of data on the network. This is analogous to mining in other blockchain technologies. Anyone with the minimum quantity of a staking-eligible cryptocurrency in their wallet can participate in the validation of transactions and reap staking bonuses.

Specifically, when you stake (or lock) a particular number of coins on a platform, the blockchain will use the PoS consensus to put those coins to function. To validate blocks, the PoS protocol rewards users who have made a financial investment in the blockchain, as opposed to the PoW protocol, which provides incentives to the crypto miners who verify the transaction data blocks by tackling complex cryptographic problems.

When all is said and done, the blockchain will prioritize the transactions (confirmable via the PoS protocol) based on the number of tokens you have locked on the blockchain platform. Additionally, each blockchain transaction approved by a validator allows users to receive a staking reward.

How to Stake ETH?

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

Through a process called staking, cryptocurrency holders can earn dividends just by keeping their holdings in the network. Coin holders can stake their tokens and join the network of validators to help verify transactions and add new transaction data blocks.

Aside from the staking incentive, some blockchains go above and beyond the staking rewards by giving the validators access to voting/control over the blockchain’s evolution.

The requirements to become a validator on the Ethereum 2.0 network are high, despite the fact that they may seem low at first glance. To illustrate, a validator must invest at least 32 ETH to become part of the Ethereum 2.0 network.

For crypto investors with limited capital interested in participating in the staking process, the second most prevalent strategy is to delegate ownership of their funds to another party in exchange for a share of the profits. In essence, delegators can free themselves from the burden of operating a node by outsourcing their staking to others for a reduced initial investment and a cut of the staking earnings.

In the end, the network will reimburse you based on a set of parameters that considers your coin balance, coin maturity, worth, and so forth, regardless of the activity you take.

The Best Places to Stake Your ETH Coins

Because so many cryptocurrency exchanges offer staking incentives on at least some currencies, beginners may discover that using these exchanges is an easy and straightforward way to earn cryptocurrency passively from the convenience of their own homes.

You can also use a platform that offers staking as a service, often known as SaaS, a staking pool, or a DeFi lending platform. All three of these options are available to you.

Solo Home Staking

By operating an online Ethereum node and depositing 32 ETH to activate a validator node, often known as “solo staking,” one can take an active role in the network’s consensus.

Both an EL (execution layer) client and a CL (consensus layer) client make up what is known as an Ethereum node. Clients are software components that, in conjunction with a set of signing keys, can validate blocks and payment operations, check the chain’s master node, collect and verify attestations, and propose new blocks.

Furthermore, it is the responsibility of solo staking participants to maintain the hardware used by these clients. Using a home computer that you only use for this purpose is ideal for the network’s upkeep and security.

In addition, staking as a single entity is rewarded by the protocol itself, with the staker receiving tokens for maintaining a validator’s online presence and proper operation.

Staking as a Service (SaaS)

In the case of opting for staking as a service (“SaaS”), you put up your own 32 ETH for a validator but let a third party handle node operations. When you sign up for a new service, you’ll often be taken through the initial setup, which includes key generation and deposit, before being asked to upload your signing keys to the service provider. With this setup, for a small monthly fee, the provider will manage your validator on your behalf.

Considering that delegation of stake is not integrated into the Ethereum protocol, various services have been developed to meet user needs. Utilizing SaaS services, you can delegate the hard part of staking while earning native block rewards if you have 32 ETH to stake but aren’t skilled in operating with hardware.

Pooled Staking

It takes 32 ETH to activate a set of validator keys, but staking pools make it possible for many people with lower sums of ETH to do so collectively. The protocol does not inherently allow pooling capabilities; hence, third-party solutions were developed to fill this gap.

Smart contracts are used by some pools; once money is put the contract will reliably keep track of your position in the pool and distribute tokens to you in proportion to the value of your stake. On the other hand, certain pools may not use smart contracts at all but instead be mediated off-chain.

As an added bonus, staking in a pool is as simple as exchanging tokens. There is zero responsibility for node configuration and upkeep. Pools let you deposit ETH, which in turn funds validator node operations. After deducting a cost for node operations, rewards are given to contributors.

Centralized Exchanges

If you don’t feel confident storing ETH in your crypto wallet just yet, you can use one of the many centralized exchanges that offer staking services. As a last resort, they can help you get a return on your ETH investments with little to no management.

As a cost, centralized providers pool together substantial amounts of ETH to fund a large number of validators. Unfortunately, this makes the network and its users more susceptible to assault or faults by creating a massive, centralized target and point of failure.

How Much Money Can I Make by Staking Ethereum?

The quantity of ETH you stake and the network on which you stake it both have an impact on how profitable staking will be for you. To put it another way, the APR (annual percentage rate) increases if the amount of ETH being staked goes down, and vice versa.

It’s important to keep in mind, however, that the total quantity of staked ETH won’t change until after The Merge, when ETH will be redeemable. Rewards and bonuses are proportional to the total quantity of ETH staked.

When there are more validators, the reward per validator is divided among fewer people or base reward (B). Those who propose blocks receive 1/8 B, while those who verify them might earn up to 7/8 B, depending on how quickly they do so. These interest rates might range from 6% each year to 15% annually.

If you employ a SaaS or pooled staking model, you can get the same results with fewer resources expended on administration. The benefits of staking Ethereum (ETH) on a centralized exchange might vary from platform to platform but often sit between 4% and 6% APR.

Can I Put My Cryptocurrency at Risk by Staking It?

- 350+ Cryptocurrencies Listed

- <0.10% Transaction Fees

- 120 million Registered Users

- Secure Asset Fund for Users

- Earn On Deposits

- US Based

- Start with as little as $10

- Buy and sell 200+ cryptocurrencies

- Pro Solution for larger traders

- Available in 190+ countries

As with any other type of investment, staking digital currency exposes investors to certain risks. However, these risks are most readily apparent in the form of price fluctuation. For instance, if the price of the digital asset that you are staking declines, the investment income that you earn through staking may not be adequate to offset the financial loss that you have sustained.

There’s also the possibility of losing money if a new DeFi venture that boasts high rates of interest unexpectedly fails. This can be avoided if you research the cryptocurrency’s roadmap and are convinced that its founders have no plans to give up on the crypto project any time soon.

Perhaps most significantly, you should think about the practical applications of the coin you intend to stake. It’s worth noting that several staking-eligible altcoins are now performing poorly on the marketplace, so despite the high yearly interest rate, you may not end up earning as much as you’d like by staking them.

Future Prospects of ETH Staking

Even though consensus protocols have a lot of untapped potential, there is still no way to make them more scalable, which makes it hard for them to be used widely in the financial industry. This is the motivation behind the transition of Ethereum’s blockchain to a Proof-of-Stake platform architecture.

Moreover, sharding the Ethereum network and switching from Proof-of-Work to Proof-of-Stake could potentially increase the throughput by a factor of ten without affecting the decentralized nature of the network.

Since the network will shift its emphasis from computational complexity (which is required for the PoW) to staked assets as a result of this protocol adjustment, ETH’s potential for staking will significantly grow.

Pros and Cons of Staking ETH

Pros

- An instrument for producing passive income;

- Less harmful to the environment than crypto mining;

- Safer than investing in cryptocurrencies on the market.

Cons

- Possibly risky owing to the unpredictability of the cryptocurrency market;

- A 32 ETH deposit and some technical know-how are needed to operate a network node.

Conclusion

My opinion is that you have nothing to be concerned about in terms of staking Ethereum (ETH), except for taxes, obviously. This conclusion is based on the fact that ETH is one of the most widely used and well-established cryptocurrencies, making it quite likely that you will end up with a profit after investing in it. Once again, you should never get too comfortable when dealing with fundamentally unstable financial items like digital assets.

Therefore, to stake safely, securely, and profitably, you must make sure that all additional conditions have been met, including the integrity of the trading platform, the exchange’s commitment to protecting your holdings, and the staking conditions.